- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Is Starbucks' Valuation Justified After Record-Breaking Fall Sales Surge?

Reviewed by Simply Wall St

Thinking about what to do with your Starbucks shares? You are not alone. The stock has seen its share of swings lately, and investors are weighing whether these moves point to an opportunity or a warning. If you have watched Starbucks climb 1.6% in the past week only to remember it is still down 3.0% over the last month and off 7.0% year-to-date, you know the feeling of uncertainty. The last year has been rough, with the stock shedding 7.0%, though the longer-term picture is brighter, showing solid gains of 9.2% over three years and 12.8% over five.

Some of that up-and-down can be traced to changes under Starbucks’ new CEO, including a revamp focused on fast service for those Instagrammable drinks, and a fall product launch that reportedly sparked a record sales week. Cost controls and new pay policies have also made headlines. While those moves hint at big growth ambitions, they add a layer of risk perception, so it is no wonder the market has been cautious.

But what about Starbucks’ valuation? On our 6-point checklist for undervaluation, the company only ticks one box, giving it a value score of 1 out of 6. Some readers see a low score and worry it means the shares are expensive, while others recognize it might signal long-term potential if Starbucks is set to execute on its new strategies.

Let’s break down how the key valuation methods measure up for Starbucks today. Stick with us, because by the end of this article, we will look at an even more insightful way to think about valuation overall.

Starbucks scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Starbucks Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them to today’s dollars. In simple terms, it tries to calculate what all of Starbucks’ future profits are worth in the present, accounting for the time value of money.

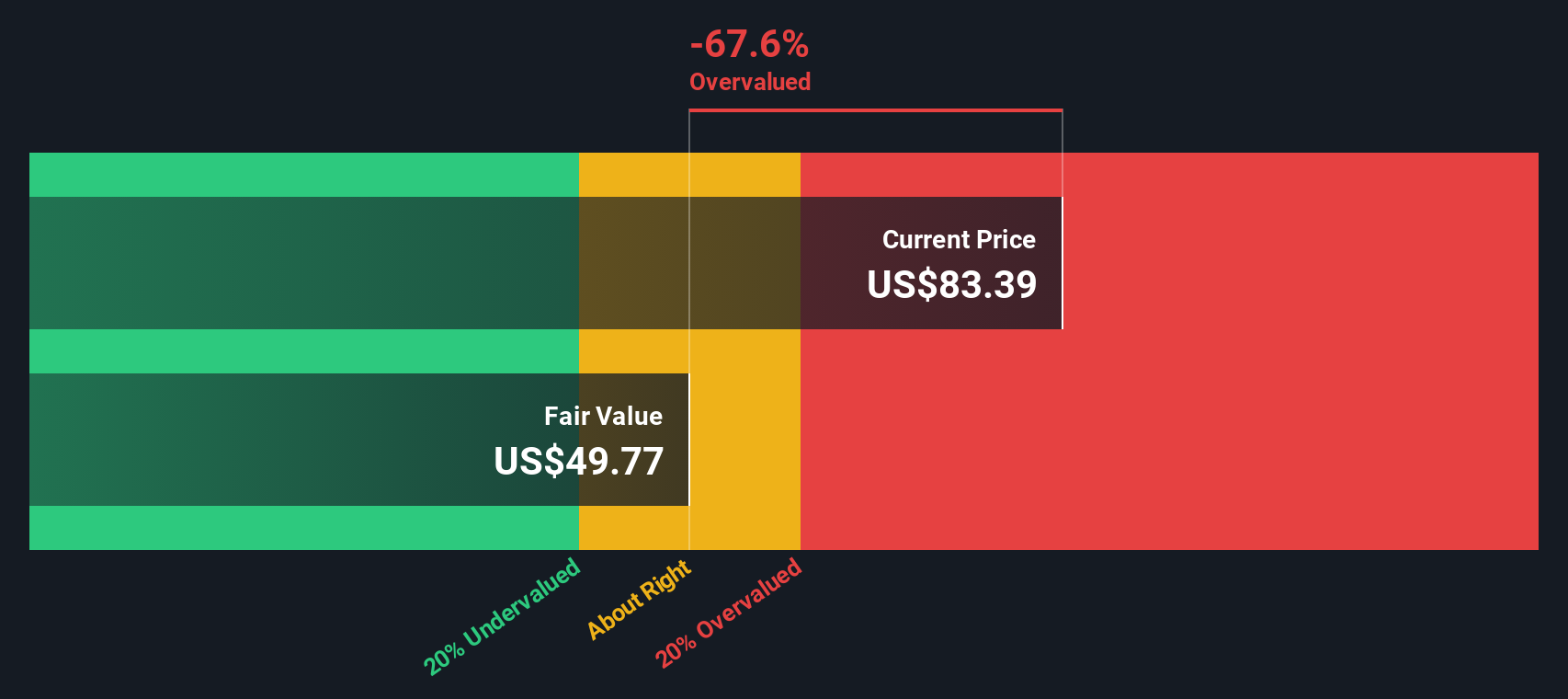

For Starbucks, the current Free Cash Flow stands at $2.36 Billion. Analysts project steady growth, with cash flows expected to reach about $4.49 Billion by 2035, driven by factors like operational changes and new products. While analysts directly forecast up to five years out, further growth estimates through 2035 are based on trend extrapolations and industry insights.

Based on this 2 Stage Free Cash Flow to Equity model, Starbucks’ intrinsic value is estimated at $49.72 per share. Given the present share price, this represents a discount of 72.3%, indicating that the stock is trading far above what the DCF model sees as its fair value.

In this light, from a pure cash flow perspective, Starbucks appears significantly overvalued today compared to its long-term fundamentals.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Starbucks.

Approach 2: Starbucks Price vs Earnings

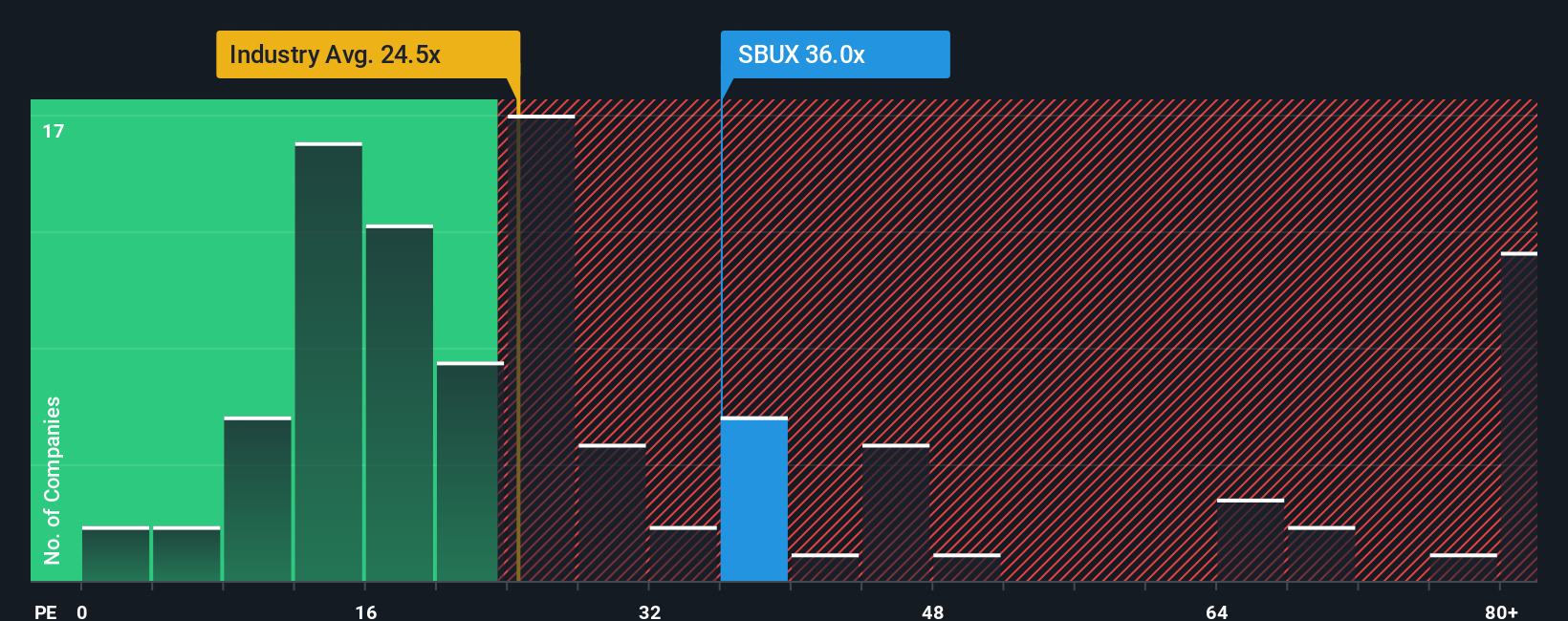

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it relates a company’s share price to its earnings, helping investors understand how much they are paying for each dollar of profit. For established businesses like Starbucks, with consistent earnings and visibility into future growth, the PE ratio offers a practical sense-check on valuation.

It is worth noting that what constitutes a “normal” or “fair” PE ratio depends on factors like expected future growth, overall market sentiment, and the perceived risks facing the company. Companies with strong growth potential or lower risks tend to command higher PE multiples, while more uncertainty or slower growth can justify lower ratios.

Currently, Starbucks trades on a PE ratio of 37x. This is well above the Hospitality industry average of 24x. It is also higher than its peer group average of 59x. Simply Wall St’s Fair Ratio for Starbucks, which incorporates aspects like its growth, profit margins, size, and risk profile, comes in at 35.5x. The Fair Ratio is particularly useful as it adjusts for factors that simple industry or peer comparisons overlook, offering a more nuanced and tailored benchmark.

Comparing Starbucks’ actual PE ratio of 37x to its Fair Ratio of 35.5x, the difference is less than 0.10. This suggests that the stock is priced about right on this metric.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Starbucks Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simple, flexible tools that allow you to assign your own story to a company, turning your views on its future revenue, margins, and risks into a clear, transparent fair value.

With Narratives, you move beyond just numbers by connecting your outlook for Starbucks, whether that means believing its store expansion in China will power rapid growth or that rising labor and coffee costs will hold it back, to an actual forecast and estimated fair value. This makes your reasoning visible and actionable.

Narratives are accessible right within Simply Wall St's Community page, used by millions of investors to compare their own assumptions with others’, check their fair value against the latest share price, and quickly spot if the market aligns or disagrees with their view.

Unlike static models, Narratives update dynamically whenever Starbucks releases new results or news, letting your fair value and forecasts evolve in real time so you stay in control of your investment decisions.

For instance, right now, the most optimistic Narrative values Starbucks shares at $115, assuming accelerating growth from global expansion, while the most cautious Narrative comes in at $73, reflecting concerns over profit pressure and competition.

Do you think there's more to the story for Starbucks? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee internationally.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.