- Australia

- /

- Capital Markets

- /

- ASX:IFL

Exploring 3 Undervalued Small Caps With Insider Action In None

Reviewed by Simply Wall St

In the current global market landscape, rising U.S. Treasury yields have exerted pressure on equities, with small-cap stocks underperforming their large-cap counterparts as seen in the recent decline of indices like the Russell 2000. Despite this challenging environment, opportunities can still be found within small-cap stocks that are trading below their intrinsic value and exhibit solid fundamentals. Identifying such stocks requires a keen understanding of market dynamics and economic indicators to uncover potential investments that may thrive despite broader market headwinds.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 17.9x | 0.6x | 38.23% | ★★★★★★ |

| Bytes Technology Group | 22.0x | 5.6x | 12.45% | ★★★★★☆ |

| Lion Rock Group | 5.6x | 0.4x | 48.79% | ★★★★☆☆ |

| Avia Avian | 17.9x | 4.1x | 3.32% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 19.57% | ★★★★☆☆ |

| Freehold Royalties | 14.0x | 6.5x | 49.48% | ★★★★☆☆ |

| Cheerwin Group | 11.8x | 1.5x | 44.01% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 16.4x | 0.8x | 18.65% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -54.39% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

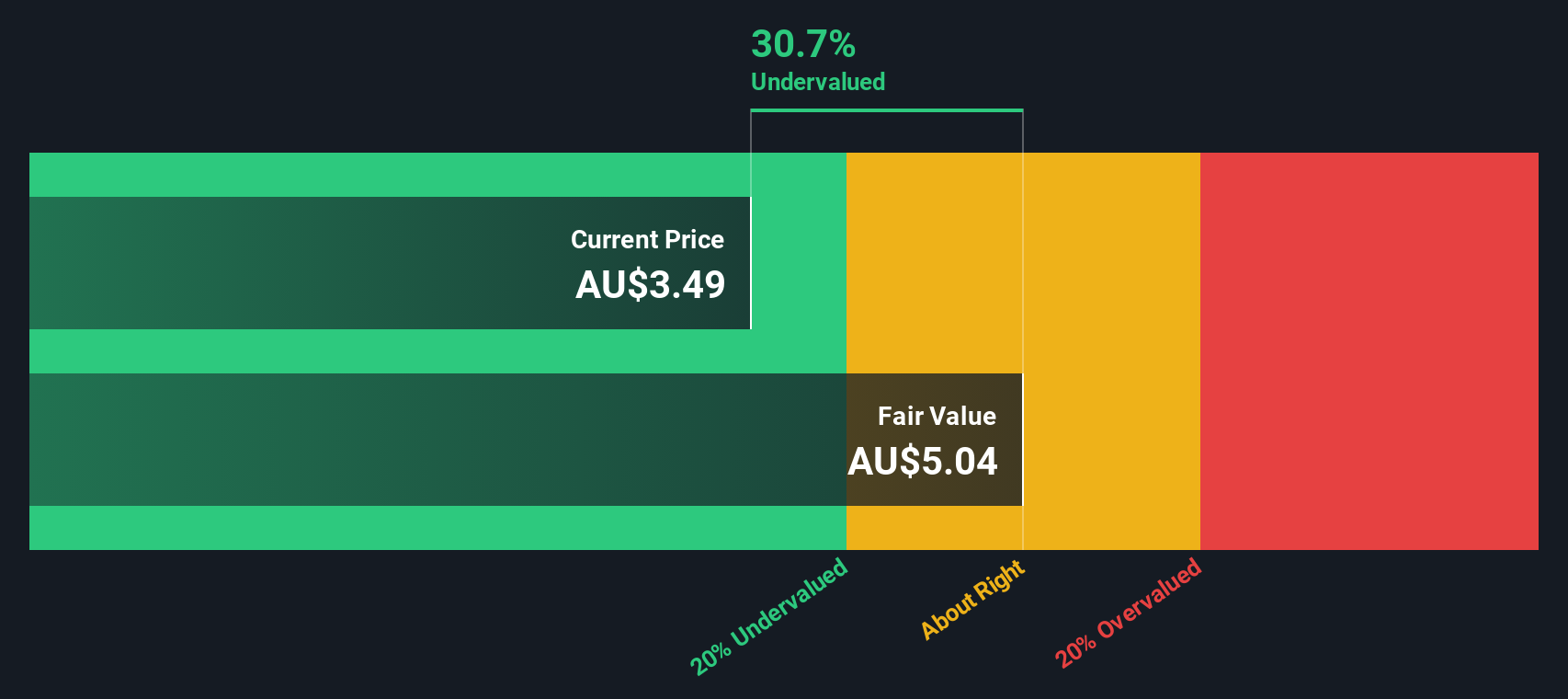

Insignia Financial (ASX:IFL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Insignia Financial operates in the financial services sector, offering advice, platforms, and asset management solutions, with a market capitalization of A$2.5 billion.

Operations: The company's revenue streams are primarily derived from Platforms (A$1.16 billion), followed by Advice (A$527.90 million) and Asset Management (A$222.80 million). Over recent periods, the gross profit margin has shown a notable increase, reaching 36.72% as of October 2024, indicating an improvement in cost management relative to revenue generation.

PE: -12.0x

Insignia Financial, operating within the smaller company segment, has faced a challenging year with reported sales of A$1.94 billion and a net loss of A$185.3 million for the year ending June 2024. Despite these financial setbacks, insider confidence is evident as executives have shown commitment through share purchases over recent months. The company's reliance on external borrowing adds risk to its funding structure; however, earnings are projected to grow annually by 55%.

- Dive into the specifics of Insignia Financial here with our thorough valuation report.

Understand Insignia Financial's track record by examining our Past report.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre operates as a technology solutions provider to the global travel and tourism industry, with a focus on travel and hospitality solutions, and has a market capitalization of approximately $2.21 billion.

Operations: Sabre generates revenue primarily from its Travel Solutions and Hospitality Solutions segments, with the former contributing significantly more. The company's cost of goods sold (COGS) is a major expense, impacting its gross profit margin, which has shown variability over time but recently recorded at 59.47%. Operating expenses are also substantial, including significant research and development costs.

PE: -3.4x

Sabre's recent distribution agreements, including partnerships with Premier Inn and World Travel, highlight its strategic growth in travel content distribution. The integration of advanced AI-powered solutions like Lodging AI enhances its service offerings, potentially boosting hotel attachment rates. Despite a net loss of US$69.76 million in Q2 2024, the company shows insider confidence with share purchases throughout the year. Sabre's evolving tech partnerships and executive board changes suggest a forward-thinking approach to industry challenges and opportunities.

- Click here to discover the nuances of Sabre with our detailed analytical valuation report.

Review our historical performance report to gain insights into Sabre's's past performance.

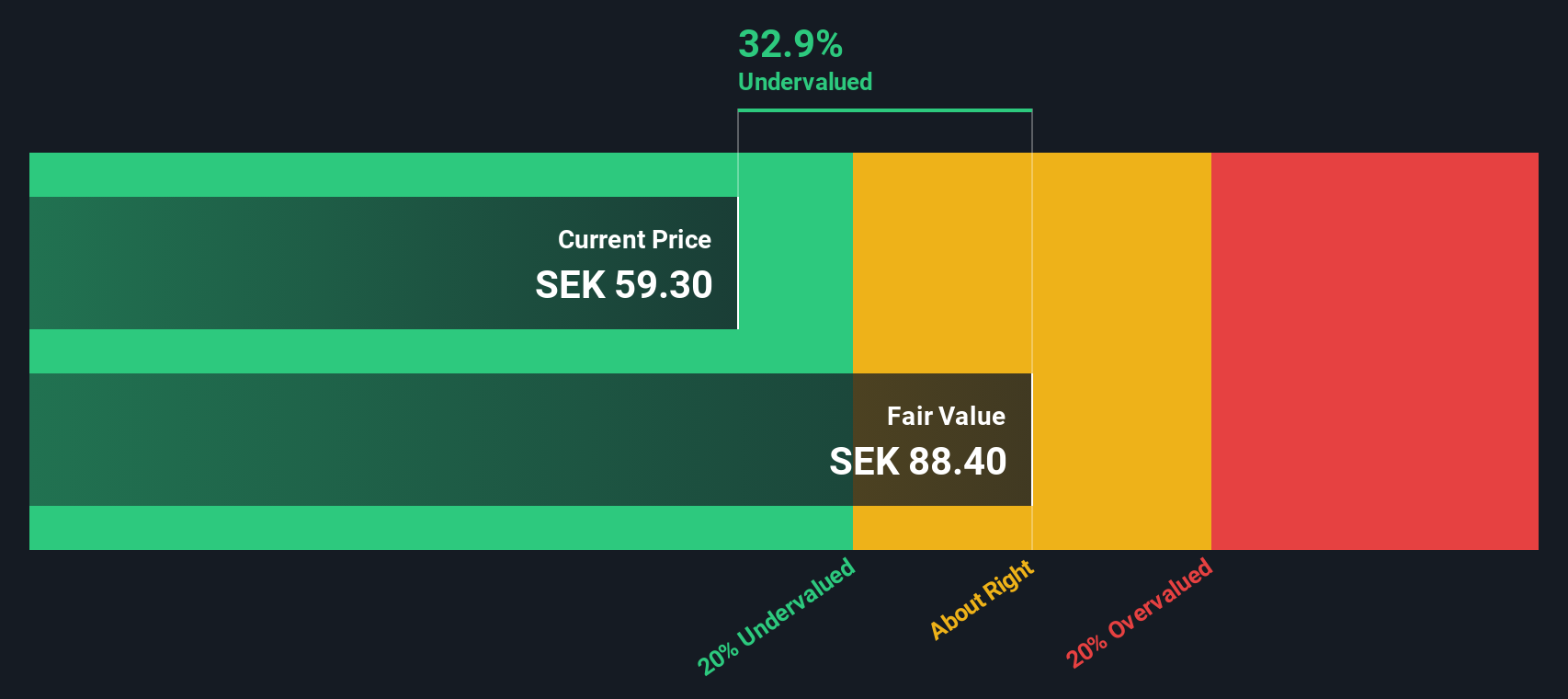

Nolato (OM:NOLA B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nolato is a Swedish company that specializes in developing and manufacturing polymer product systems for customers in medical technology, pharmaceuticals, consumer electronics, telecom, automotive, and other industrial sectors with a market cap of SEK 13.15 billion.

Operations: The company's revenue streams are primarily driven by its Medical Solutions segment, with total revenues reaching SEK 9.53 billion as of the latest reporting period. The gross profit margin has shown variability, with a recent figure of 16.36%. Operating expenses and non-operating expenses have impacted net income margins, which stood at 5.98% in the most recent quarter.

PE: 26.4x

Nolato, a company in the smaller stock category, recently reported strong earnings for Q3 2024 with sales of SEK 2,401 million and net income of SEK 164 million, up from SEK 69 million the previous year. This performance highlights potential growth despite relying solely on external borrowing for funding. Insider confidence is evident as insiders purchased shares within the last quarter. The company's earnings are projected to grow by over 22% annually, suggesting promising prospects ahead.

- Navigate through the intricacies of Nolato with our comprehensive valuation report here.

Assess Nolato's past performance with our detailed historical performance reports.

Next Steps

- Click through to start exploring the rest of the 186 Undervalued Small Caps With Insider Buying now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFL

Insignia Financial

Provides financial advice, platforms, and asset management services in Australia.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives