- United States

- /

- Hospitality

- /

- NasdaqGS:PZZA

Papa John's (PZZA): Revisiting Valuation After Papa Dippa Launch and Uber Eats Partnership Announcement

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 9.8% Undervalued

The prevailing narrative sees Papa John’s International as modestly undervalued, given analyst expectations for future profit margins and ongoing strategic investments.

Papa John's strategic focus on product innovation and enhancing the menu with new offerings is expected to boost revenue growth by increasing customer engagement and driving higher ticket sales. The investment of up to $25 million in marketing, including CRM capabilities and the Papa Rewards loyalty program, aims to drive greater customer loyalty and frequency. This is anticipated to positively impact revenue.

What is really behind this potential upside? The narrative is powered by a surprising mix of cautious growth, major marketing bets, and a future profit multiple that could rival some of the leading names in hospitality. If you are curious about how analysts expect Papa John’s to deliver on this ambitious fair value, the full story reveals the key figures at the heart of this call.

Result: Fair Value of $52.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in sales or increased spending on marketing could put pressure on profit margins and challenge the current case for undervaluation.

Find out about the key risks to this Papa John's International narrative.Another View: What Does the SWS DCF Model Say?

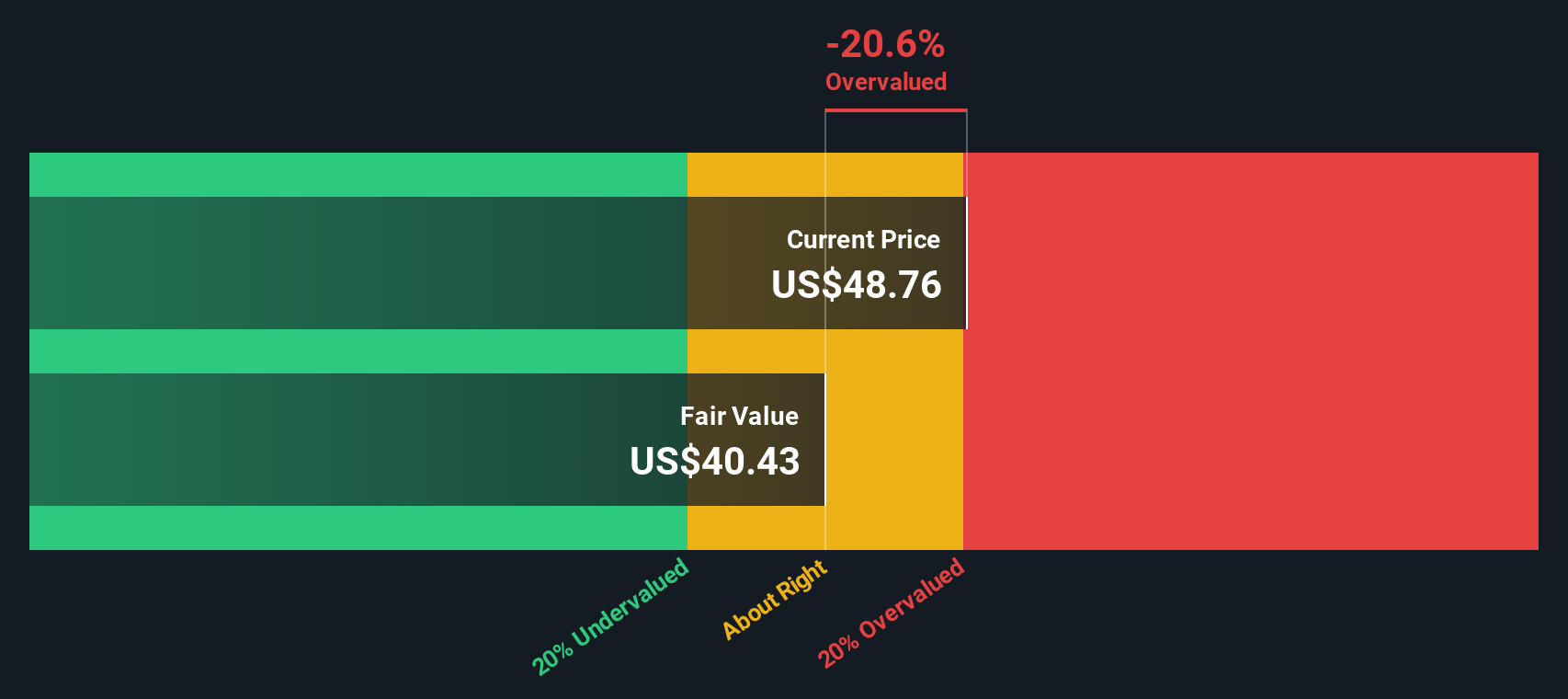

Looking at Papa John’s International through the SWS DCF model, the outcome suggests a different story. This approach currently points to the stock being above fair value and paints a more cautious picture. Which perspective will prove more accurate as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Papa John's International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Papa John's International Narrative

If the current perspectives don't align with your own thinking, or you want to dig into the numbers yourself, you can easily shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Papa John's International research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Stay ahead of the crowd by tapping into investment opportunities that others might overlook. Pick your next move and unlock fresh ideas right now:

- Boost your portfolio’s income stream and see which companies stand out for reliable yields by checking out dividend stocks with yields > 3%.

- Uncover the best growth stories in AI innovation before the spotlight hits by using AI penny stocks.

- Spot high-potential stocks trading below their true value and gain an edge with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PZZA

Papa John's International

Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives