- United States

- /

- Hospitality

- /

- NasdaqGS:PBPB

Potbelly's (NASDAQ:PBPB) Shareholders Are Down 55% On Their Shares

It is doubtless a positive to see that the Potbelly Corporation (NASDAQ:PBPB) share price has gained some 57% in the last three months. But that doesn't change the fact that the returns over the last three years have been disappointing. In that time, the share price dropped 55%. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

See our latest analysis for Potbelly

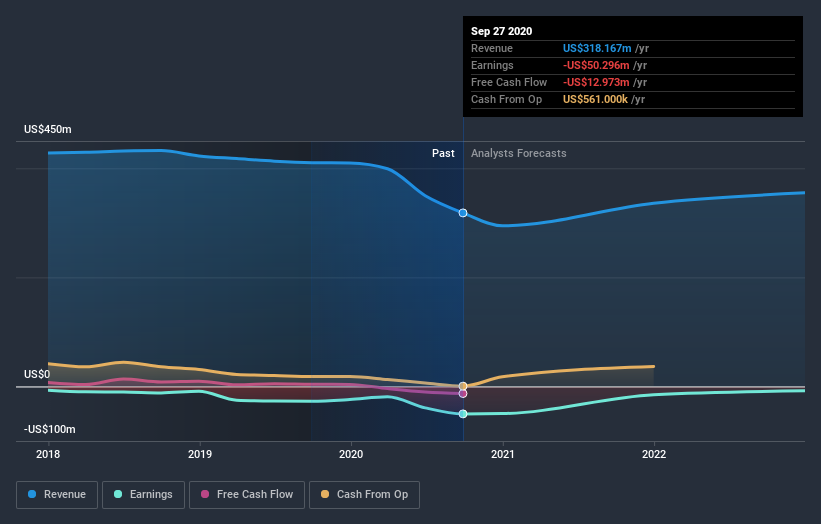

Given that Potbelly didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Potbelly's revenue dropped 6.7% per year. That's not what investors generally want to see. The share price decline of 16% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Potbelly stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Potbelly provided a TSR of 25% over the year. That's fairly close to the broader market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 8% over the last five years. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Potbelly (at least 1 which is significant) , and understanding them should be part of your investment process.

Potbelly is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Potbelly, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PBPB

Potbelly

Owns, operates, and franchises Potbelly sandwich shops in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives