Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Potbelly Corporation (NASDAQ:PBPB) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Potbelly

What Is Potbelly's Net Debt?

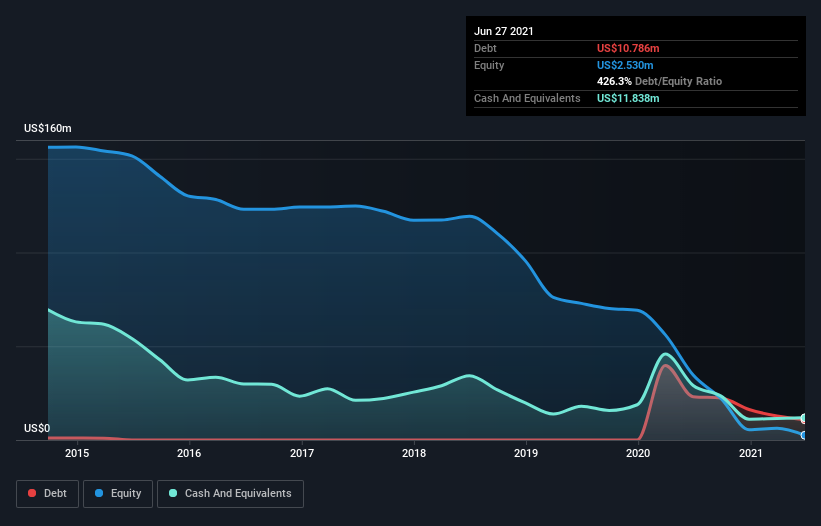

You can click the graphic below for the historical numbers, but it shows that Potbelly had US$10.8m of debt in June 2021, down from US$23.1m, one year before. But on the other hand it also has US$11.8m in cash, leading to a US$1.05m net cash position.

A Look At Potbelly's Liabilities

Zooming in on the latest balance sheet data, we can see that Potbelly had liabilities of US$73.1m due within 12 months and liabilities of US$189.5m due beyond that. Offsetting these obligations, it had cash of US$11.8m as well as receivables valued at US$6.56m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$244.2m.

Given this deficit is actually higher than the company's market capitalization of US$180.6m, we think shareholders really should watch Potbelly's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. Given that Potbelly has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Potbelly can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Potbelly made a loss at the EBIT level, and saw its revenue drop to US$323m, which is a fall of 7.8%. That's not what we would hope to see.

So How Risky Is Potbelly?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Potbelly had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$19m of cash and made a loss of US$48m. While this does make the company a bit risky, it's important to remember it has net cash of US$1.05m. That kitty means the company can keep spending for growth for at least two years, at current rates. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Potbelly (of which 2 are a bit unpleasant!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Potbelly, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PBPB

Potbelly

Through its subsidiaries, owns, operates, and franchises Potbelly sandwich shops in the United States.

Solid track record and fair value.