- United States

- /

- Consumer Services

- /

- NasdaqCM:OSW

Investors in OneSpaWorld Holdings (NASDAQ:OSW) have seen decent returns of 96% over the past three years

One simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at OneSpaWorld Holdings Limited (NASDAQ:OSW), which is up 95%, over three years, soundly beating the market return of 16% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 40%, including dividends.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

Check out our latest analysis for OneSpaWorld Holdings

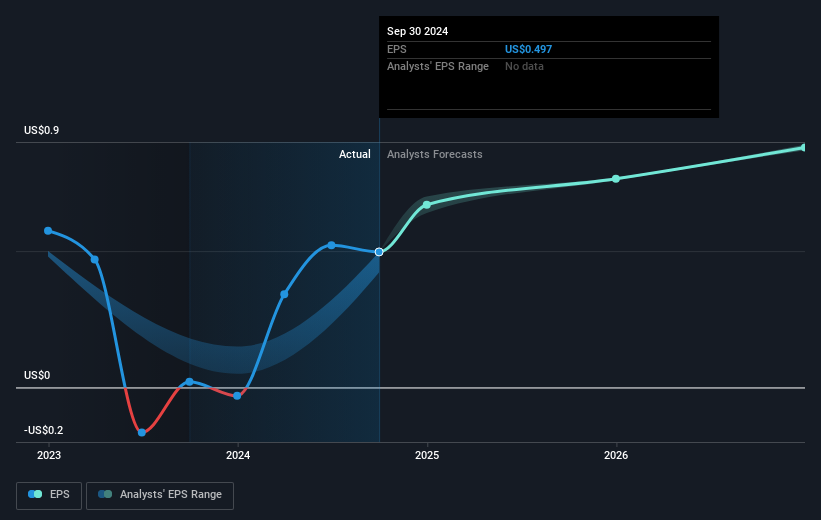

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

OneSpaWorld Holdings became profitable within the last three years. That would generally be considered a positive, so we'd expect the share price to be up.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that OneSpaWorld Holdings has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling OneSpaWorld Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that OneSpaWorld Holdings shareholders have received a total shareholder return of 40% over one year. That's including the dividend. That gain is better than the annual TSR over five years, which is 3%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for OneSpaWorld Holdings that you should be aware of before investing here.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade OneSpaWorld Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:OSW

OneSpaWorld Holdings

Operates health and wellness centers onboard cruise ships and at destination resorts in the United States and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives