- United States

- /

- Consumer Services

- /

- NasdaqCM:MRM

MEDIROM Healthcare Technologies Inc. (NASDAQ:MRM) Stock's 25% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the MEDIROM Healthcare Technologies Inc. (NASDAQ:MRM) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 88% loss during that time.

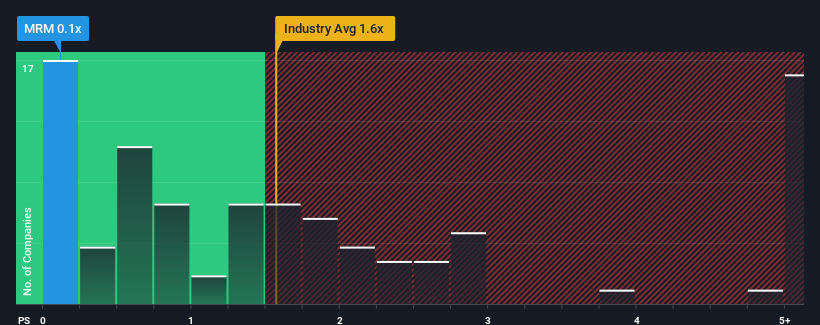

Since its price has dipped substantially, it would be understandable if you think MEDIROM Healthcare Technologies is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the United States' Consumer Services industry have P/S ratios above 1.6x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for MEDIROM Healthcare Technologies

How MEDIROM Healthcare Technologies Has Been Performing

Recent times haven't been great for MEDIROM Healthcare Technologies as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think MEDIROM Healthcare Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For MEDIROM Healthcare Technologies?

There's an inherent assumption that a company should underperform the industry for P/S ratios like MEDIROM Healthcare Technologies' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 2.8%. Pleasingly, revenue has also lifted 74% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 22% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

With this information, we find it odd that MEDIROM Healthcare Technologies is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On MEDIROM Healthcare Technologies' P/S

MEDIROM Healthcare Technologies' P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems MEDIROM Healthcare Technologies currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 4 warning signs for MEDIROM Healthcare Technologies that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MRM

MEDIROM Healthcare Technologies

Provides holistic health services in Japan.

Reasonable growth potential slight.

Market Insights

Community Narratives