- United States

- /

- Hospitality

- /

- NasdaqGS:MLCO

Macau Casino Closures and Asset Shifts Might Change the Case for Investing in Melco Resorts (MLCO)

Reviewed by Simply Wall St

- Melco Resorts & Entertainment recently announced the closure of its Grand Dragon Casino and several Mocha Club slot machine venues in Macau by the end of 2025, reallocating gaming assets and employees across its other Macau properties to align with changing regulations.

- This consolidation reflects the company's broader effort to adjust its Macau operations amid evolving government requirements, while aiming to maintain operational efficiency within a shifting regulatory landscape.

- To understand the implications for Melco's investment narrative, we’ll explore how this consolidation and regulatory response impacts the company’s Macau-focused business model.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Melco Resorts & Entertainment's Investment Narrative?

To be a shareholder in Melco Resorts & Entertainment, you have to believe in the company's ability to adapt to shifting regulatory conditions in Macau while sustaining its core gaming and hospitality business. The recent decision to close the Grand Dragon Casino and several Mocha Club venues, followed by asset and staff reallocations, looks like a direct response to evolving government demands rather than a fundamental change in Melco’s growth catalysts. For most short-term drivers, such as earnings recovery and capital allocation discipline, this reshuffling does not appear material, especially as recent results already reflected a mix of improving sales with still-volatile profits. However, this move could influence ongoing conversations about operational efficiency and debt management, particularly following the new $500 million senior note refinancing. While risks tied to government policy and sector regulation remain key, these closures mainly affirm that regulatory adaptation is now at the forefront of Melco’s Macau strategy.

However, regulatory unpredictability remains an important point for investors to keep in mind.

Exploring Other Perspectives

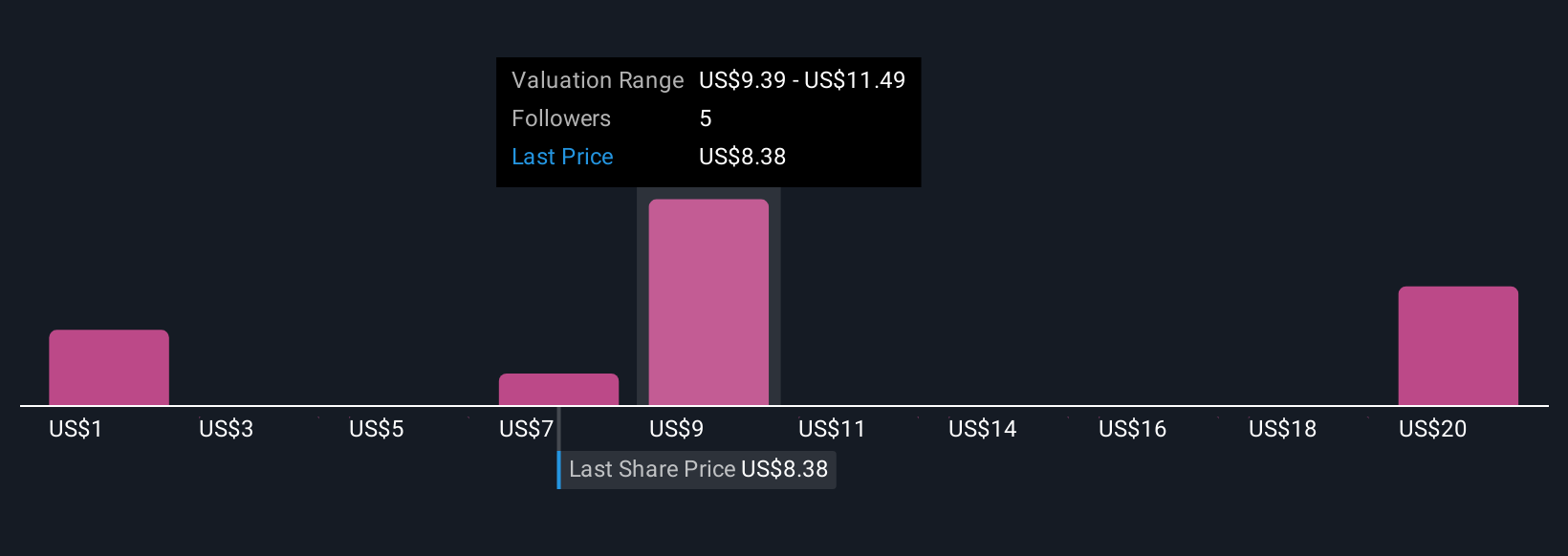

Explore 3 other fair value estimates on Melco Resorts & Entertainment - why the stock might be worth over 2x more than the current price!

Build Your Own Melco Resorts & Entertainment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Melco Resorts & Entertainment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Melco Resorts & Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Melco Resorts & Entertainment's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLCO

Melco Resorts & Entertainment

Develops, owns, and operates casino gaming and resort facilities in Asia and Europe.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026