- United States

- /

- Hospitality

- /

- NasdaqGS:MAR

Marriott International (NasdaqGS:MAR) Reports Revenue Growth And Raises 2025 Earnings Guidance

Reviewed by Simply Wall St

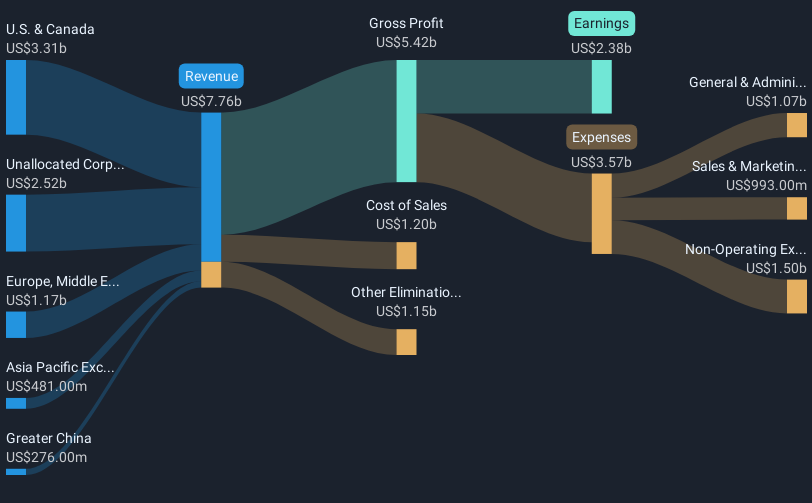

Marriott International (NasdaqGS:MAR) recently announced robust earnings for the first quarter of 2025, reporting increased revenue and net income compared to the previous year, alongside providing optimistic guidance for future revenues. These positive financial results coincide with the company's stock experiencing a notable 15% increase in the past month. Despite mixed movements in broader markets, influenced by concerns over tariffs and Federal Reserve decisions, Marriott's strong quarterly performance and forward-looking guidance appear to have buoyed investor confidence, supporting its share price momentum amid these broader economic discussions.

Marriott International's recent earnings announcement, highlighting increased revenues and net income, aligns with the company's strategic push into digital transformation and expansion in mid-scale brands. This financial performance may further solidify investor confidence in Marriott's growth trajectory, particularly through enhanced customer engagement and diversified offerings. With a robust pipeline of room growth and new ventures into non-traditional lodging, Marriott's future revenue, projected to grow significantly, underpins its optimistic guidance despite challenges such as uncertain demand in China and financing hurdles.

Over the past five years, Marriott's total shareholder return, inclusive of share price appreciation and dividends, reached approximately 209.18%, showcasing substantial long-term growth. When placed in a recent context, Marriott's shares have underperformed the US Hospitality industry, which grew by 7.8% in the past year. This contrasts with a more impressive five-year window, suggesting that while short-term fluctuations exist, the company has delivered considerable value over the long term.

The 15% share price rise following the earnings report, while setting a positive short-term tone, falls under the consensus price target of $269.88, suggesting further room for growth. This price target considers both current revenue figures, US$6.62 billion, and expected earnings of US$2.38 billion, along with anticipated market conditions. However, the risks related to growth in key markets and operational costs continue to call for careful evaluation. Investors should weigh these forecasts against potential headwinds such as regulatory challenges and potential declines in RevPAR in international regions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAR

Marriott International

Engages in operation, franchising, and licensing of hotel, residential, timeshare, and other lodging properties worldwide.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives