- United States

- /

- Hospitality

- /

- NasdaqGS:MAR

Marriott International (NasdaqGS:MAR) Declares US$0.67 Dividend Reflecting Strong Earnings

Reviewed by Simply Wall St

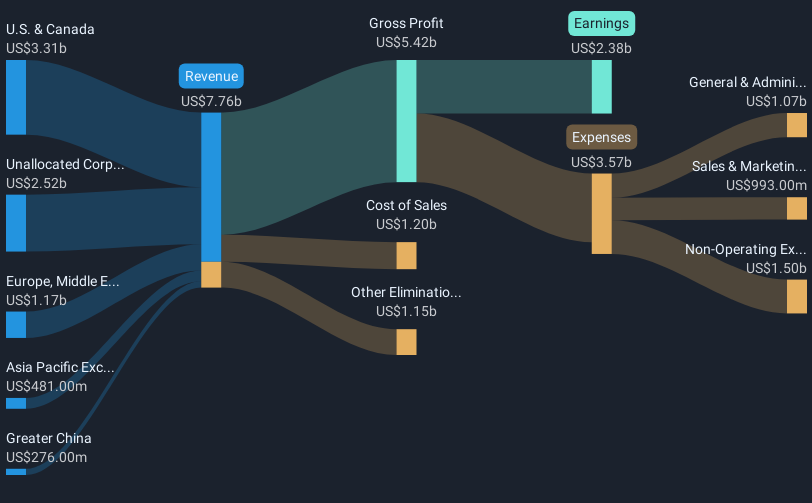

Marriott International (NasdaqGS:MAR) recently declared a quarterly cash dividend increase to 67 cents per share, highlighting its strong earnings growth and cash generation, which aligns with its reported Q1 growth. The company's stock rose 11% over the past month, mirroring the market's broader upward trend of 8% over the past year and a flat recent week. Alongside an earnings increase and new business expansions, such as the opening of the Udaipur Marriott Hotel and The Vanguard Hotel, these developments arguably support investor confidence amid stable market conditions.

The announcement of Marriott International's dividend increase, coupled with its recent strategic expansions, plays a crucial role in enhancing investor confidence, as reflected in recently enhanced shareholder value. Over a five-year trajectory, the company's total return, including share price and dividends, climbed to a very large 232.87%, illustrating a significant gain and investor approval over the long-term. This period contrasts with the one-year performance where Marriott's stock matched the broader market's 8.2% return, revealing a stable yet less dynamic movement.

The dividend increase underscores Marriott's robust earnings and cash flow generation, which is vital as the company forecasts earnings to reach US$3.4 billion by 2028. The company's earnings growth, though forecasted at 10.1% per year, remains below broader market expectations of 13.9%. Additionally, Marriott's revenue growth prospects are favorable, projected at 23.6% annually, suggesting a substantial boost from strategic brand expansions like citizenM hotels. However, the current share price of US$251.96, although close, trades slightly below the consensus price target of US$271.87. This indicates limited headroom for growth unless earnings and revenue projections materialize as anticipated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAR

Marriott International

Engages in operation, franchising, and licensing of hotel, residential, timeshare, and other lodging properties worldwide.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives