- United States

- /

- Hospitality

- /

- NasdaqGS:MAR

Marriott International (MAR): Evaluating Valuation as Global Expansion and Q3 2025 Results Drive Investor Focus

Reviewed by Kshitija Bhandaru

Marriott International (MAR) has kept investors watching closely as anticipation builds for its upcoming Q3 2025 results. The company is rolling out strategic moves, including the opening of The Red Sea Edition in Saudi Arabia and a planned Atlanta property rebranding.

See our latest analysis for Marriott International.

After robust expansion headlines and anticipation for the upcoming Q3 results, Marriott International shares are still trading around $260.85, with the stock seeing a slight pullback year-to-date. However, when you zoom out, Marriott’s long-term track record stands out. The company has delivered an impressive 165% total shareholder return over five years, reflecting momentum in its global growth story.

If you’re looking to find other companies with a strong track record of outperformance, now is the perfect moment to broaden your perspective and explore fast growing stocks with high insider ownership

With analysts predicting modest earnings growth and the stock hovering below consensus price targets, investors are left to wonder if Marriott is momentarily undervalued or if the market has already accounted for its future ambitions.

Most Popular Narrative: 8.6% Undervalued

With Marriott International's fair value now estimated at $285.29 and a last close of $260.85, consensus thinking places the stock below where analysts see its long-term intrinsic value. This sets up a clear case for readers wanting to understand the ambitious projections driving Marriott’s valuation.

Global expansion continues to accelerate, with net rooms growth approaching 5% and a record pipeline (over 590,000 rooms, 40% under construction), reflecting strong demand for Marriott's brands in international markets, particularly APAC and EMEA. A rising middle class in these regions is driving double-digit RevPAR increases and provides a foundation for multi-year revenue growth.

What is the secret ingredient powering this bullish narrative? Analysts are betting on aggressive international growth, transformative loyalty engagement, and a bold margin outlook that could disrupt industry expectations. Want to uncover the real assumptions that justify this premium? The answer is tucked inside the numbers. Dig in to see why the fair value may be higher than you expect.

Result: Fair Value of $285.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and heavy technology investment could quickly reshape this outlook and pose real risks to Marriott's multi-year expansion story.

Find out about the key risks to this Marriott International narrative.

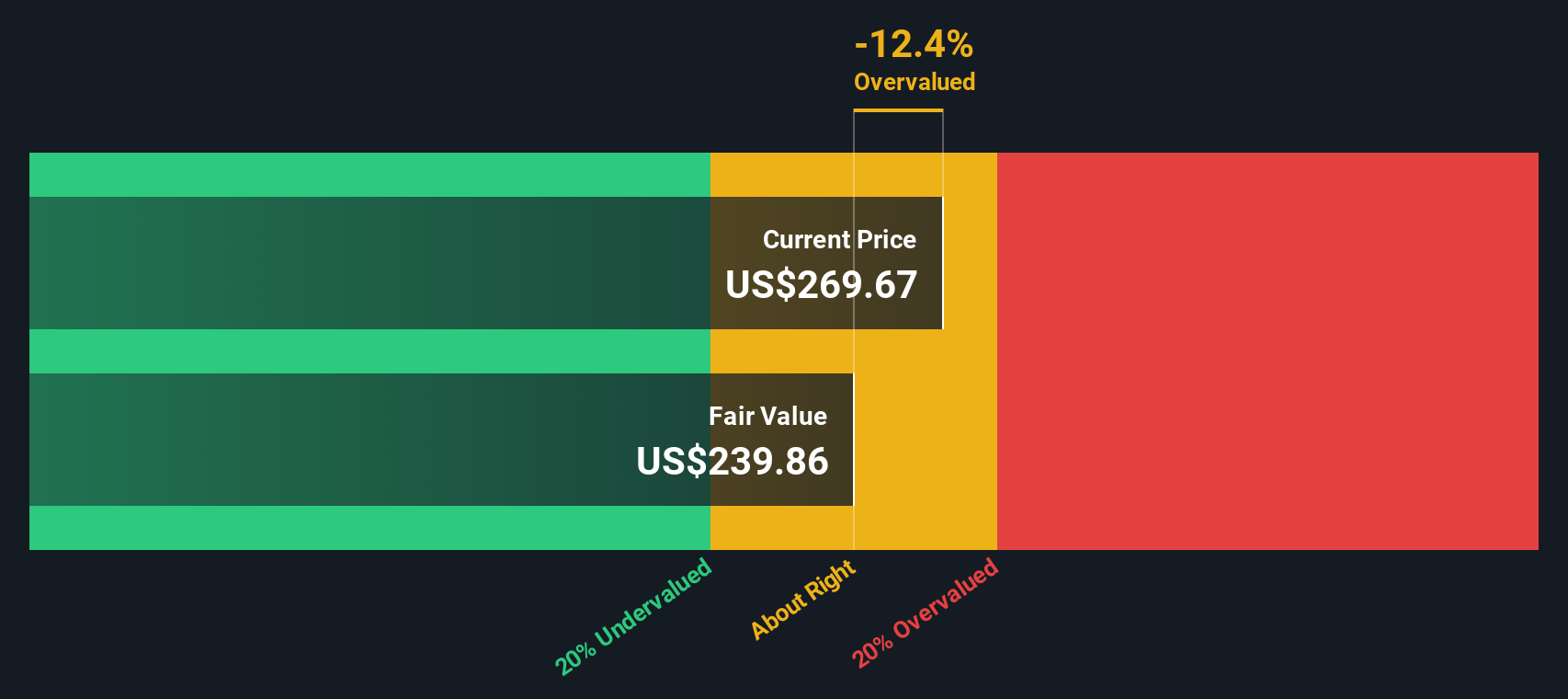

Another View: SWS DCF Model

While the analyst consensus builds its fair value on future earnings growth and target price multiples, a different picture emerges when we use the SWS DCF model. This approach, based on forecasted cash flows, now suggests Marriott could be trading slightly above its intrinsic fair value. This raises fresh questions about upside potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marriott International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marriott International Narrative

If you want to dig deeper or think the story could turn out differently, you can assemble your own interpretation using the data in just a few minutes. Do it your way

A great starting point for your Marriott International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Waiting could mean missing out on standout opportunities in today’s market. Use the tools pros rely on to spot unique, fast-growing stocks before they catch fire.

- Capture potential high yield by checking out these 18 dividend stocks with yields > 3% delivering impressive payouts and steady performance, ideal for income-focused investors seeking stability.

- Spot early-stage disruptors making headlines in tech and innovation. Explore these 24 AI penny stocks for a chance to find tomorrow’s game-changers before the crowd notices.

- Join the hunt for value by targeting these 877 undervalued stocks based on cash flows that present strong upside, helping you invest smartly without overpaying.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAR

Marriott International

Engages in operation, franchising, and licensing of hotel, residential, timeshare, and other lodging properties worldwide.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives