- United States

- /

- Metals and Mining

- /

- NYSEAM:IDR

Discovering US Undiscovered Gems November 2025

Reviewed by Simply Wall St

As the U.S. market navigates the aftermath of a prolonged government shutdown, major indices like the Dow Jones Industrial Average have reached new heights, while others like the Nasdaq show mixed results amid shifting economic sentiments. In this dynamic environment, identifying promising small-cap stocks requires a keen understanding of market trends and economic indicators that can reveal potential growth opportunities often overlooked in broader analyses.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Leifras (LFS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Leifras Co., Ltd. operates as a sports and social business company in Japan with a market cap of $297.45 million.

Operations: LFS generates revenue primarily from its educational services segment, amounting to ¥11.05 billion. The company's financial performance is reflected in its market capitalization of $297.45 million.

Leifras, a promising player recently added to the NASDAQ Composite Index, has shown impressive earnings growth of 75.1% over the past year, outpacing its industry significantly. The company's financial health is robust with interest payments well-covered by EBIT at 36.8 times and more cash than total debt on hand. Despite shares being highly illiquid, Leifras remains free cash flow positive. Recently completing a $5 million IPO and securing a contract for facility management in Nagoya highlights its strategic expansion efforts. For 2025, revenue is expected to rise between $80.2 million and $82.6 million from last year's $71.6 million.

Caledonia Mining (CMCL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caledonia Mining Corporation Plc primarily operates a gold mine in Jersey and has a market cap of $546.71 million.

Operations: Caledonia generates revenue primarily from gold mining operations. The company reported a market cap of $546.71 million.

Caledonia Mining, a notable player in the mining sector, has shown impressive financial performance with earnings skyrocketing by 917.5% over the past year, significantly outpacing the industry's 3.5%. The company's net income for Q3 2025 reached US$15.12 million compared to US$2.26 million a year ago, while sales rose to US$71.44 million from US$46.87 million in the same period last year. Despite an increased debt-to-equity ratio from 0.3% to 8.2% over five years, Caledonia's interest payments remain well-covered by EBIT at a robust 46x coverage, reflecting strong operational efficiency and financial health amidst industry challenges.

Idaho Strategic Resources (IDR)

Simply Wall St Value Rating: ★★★★★★

Overview: Idaho Strategic Resources, Inc. is a resource-based company focused on the exploration, development, and extraction of gold, silver, and base metal mineral resources in North Idaho with a market cap of $498.83 million.

Operations: With a revenue of $30.50 million from its primary segment, Idaho Strategic Resources focuses on exploring and developing gold, silver, and base metal mineral resources. The company's financial performance can be further analyzed by examining its net profit margin trends over time.

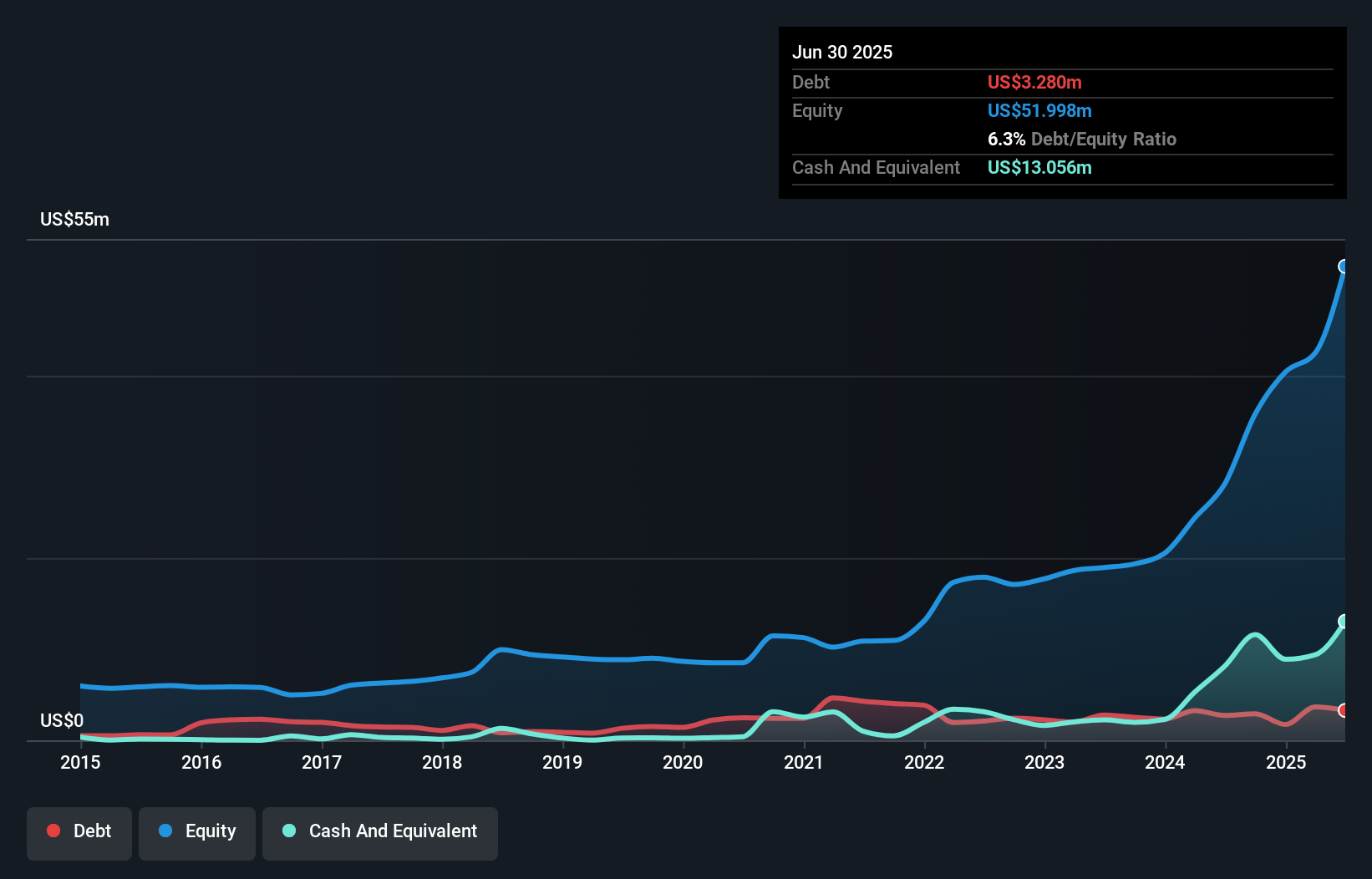

Idaho Strategic Resources, a nimble player in the mining sector, has shown impressive growth with earnings surging 74.3% over the past year, outpacing its industry peers significantly. The recent third-quarter revenue of US$11.08 million marks a substantial increase from US$6.15 million last year, reflecting robust operational performance and strategic expansions like those at the Golden Chest Mine's Paymaster shoot. Despite significant insider selling recently and highly volatile share prices over three months, IDR maintains a healthy balance sheet with more cash than debt and forecasts earnings to grow by 9.1% annually, indicating potential for continued progress in its operations and market standing.

Make It Happen

- Discover the full array of 295 US Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:IDR

Idaho Strategic Resources

A resource-based company, engages in the exploration, development, and extraction of gold, silver, and base metal mineral resources in the North Idaho.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives