- United States

- /

- Hospitality

- /

- NasdaqGM:KRUS

Kura Sushi USA, Inc. (NASDAQ:KRUS) Stocks Pounded By 27% But Not Lagging Industry On Growth Or Pricing

Kura Sushi USA, Inc. (NASDAQ:KRUS) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 24% in that time.

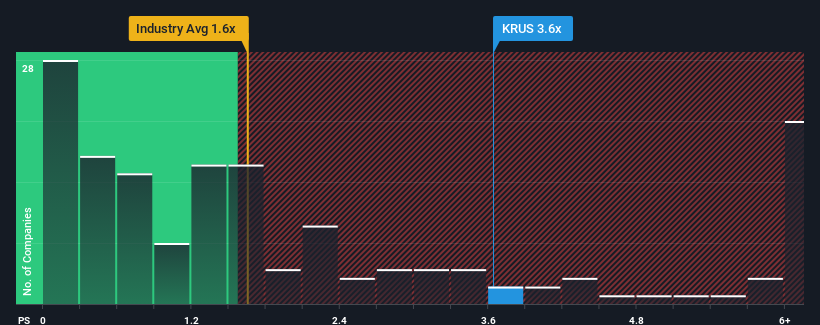

In spite of the heavy fall in price, given close to half the companies operating in the United States' Hospitality industry have price-to-sales ratios (or "P/S") below 1.6x, you may still consider Kura Sushi USA as a stock to potentially avoid with its 3.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Kura Sushi USA

What Does Kura Sushi USA's Recent Performance Look Like?

Recent times have been advantageous for Kura Sushi USA as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kura Sushi USA.Is There Enough Revenue Growth Forecasted For Kura Sushi USA?

Kura Sushi USA's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 194% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 18% as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

In light of this, it's understandable that Kura Sushi USA's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Kura Sushi USA's P/S Mean For Investors?

Kura Sushi USA's P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Kura Sushi USA's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Kura Sushi USA with six simple checks.

If you're unsure about the strength of Kura Sushi USA's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kura Sushi USA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:KRUS

Kura Sushi USA

Operates technology-enabled Japanese restaurants in the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives