- United States

- /

- Hospitality

- /

- NasdaqGS:HTHT

Is H World Group’s Recent 4.2% Jump a Sign of Fair Value in 2025?

Reviewed by Bailey Pemberton

If you are weighing whether to buy, hold, or move on from H World Group stock, you are not alone. You are asking the right questions at the right time. After a modest 0.6% dip over the past 30 days, the stock just staged a 4.2% bounce this week, continuing an overall upward trajectory with an 18.3% gain so far this year. Over the last three years, H World Group shares have surged by 40.2%, but the longer five-year view shows the growth is a more modest 6.9%. This reflects the company’s evolving story and the changing dynamics in the hospitality sector.

Behind these numbers, a swirl of recent news adds context to the stock’s performance. H World Group has responded to changing travel trends, while also expanding its hotel footprint in key markets such as China and Southeast Asia. These strategic moves have caught the attention of investors, supporting improved sentiment even as global economic headlines spark uncertainty in the sector.

If you are wondering whether the market is properly valuing H World at its current closing price of $38.53, you are in good company. Evaluating six core valuation checks, the company registers an overall score of 3, meaning it appears undervalued in three of the six key measures we track. But does that mean H World Group is truly a bargain right now? Let’s dig into the most common valuation methods and see how the numbers stack up before we talk about a smarter way to think about value that could change your perspective entirely.

Why H World Group is lagging behind its peers

Approach 1: H World Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach aims to capture the true worth of a business based on its expected ability to generate cash for shareholders over time.

For H World Group, recent figures show a last twelve months (LTM) Free Cash Flow (FCF) of approximately CN¥6.6 billion. Looking ahead, analyst estimates suggest that annual FCF will fluctuate only slightly, with projections of around CN¥5.8 billion by 2027. Although analyst forecasts become less reliable beyond five years, Simply Wall St has extrapolated the numbers out ten years. This indicates FCF is expected to rise modestly to about CN¥6.7 billion by 2035. These long-term projections are key inputs in the DCF model's estimate.

Based on these cash flow assumptions and using the 2 Stage Free Cash Flow to Equity methodology, H World Group's estimated intrinsic value comes in at $32.62 per share. Compared to the current market price of $38.53, this suggests the stock is trading about 18.1% higher than its projected value according to DCF. This may indicate it is overvalued at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests H World Group may be overvalued by 18.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: H World Group Price vs Earnings

The price-to-earnings (PE) ratio is widely recognized as a go-to metric for valuing established, profitable companies like H World Group. It helps investors gauge how much the market is willing to pay today for each dollar of earnings, making it a practical measure for comparing companies within the same sector.

What defines a “fair” PE ratio can vary. Companies with higher growth prospects or lower risks typically command higher multiples, while those with uncertain outlooks or heightened risk tend to trade at a discount. This is why context is essential, and why investors should consider more than just a company's headline PE number in isolation.

H World Group currently trades at a PE ratio of 22.46x. This is lower than the industry average for hospitality companies, which sits at 24.29x, and significantly below its peer average of 37.94x. However, Simply Wall St’s proprietary Fair Ratio for H World Group is 24.85x. The Fair Ratio is designed to reflect a more complete picture by accounting for aspects such as the company’s earnings growth potential, risk profile, profit margins, industry classification, and market cap. Unlike a simple comparison against industry or peers, the Fair Ratio aims to be more tailored and forward looking.

With H World Group’s actual PE ratio just below its Fair Ratio, the stock appears to be about fairly valued based on this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your H World Group Narrative

Earlier we mentioned a smarter way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, personal story investors create about a company, combining their perspective on the company's future with numbers such as projected revenues, earnings, margins, and an estimate of fair value. Narratives link a company's journey to a forecast and then to the price you might be willing to pay, letting you see the "why" behind any valuation. On Simply Wall St, anyone can use Narratives within the Community page, making them an easy and accessible tool trusted by millions of investors.

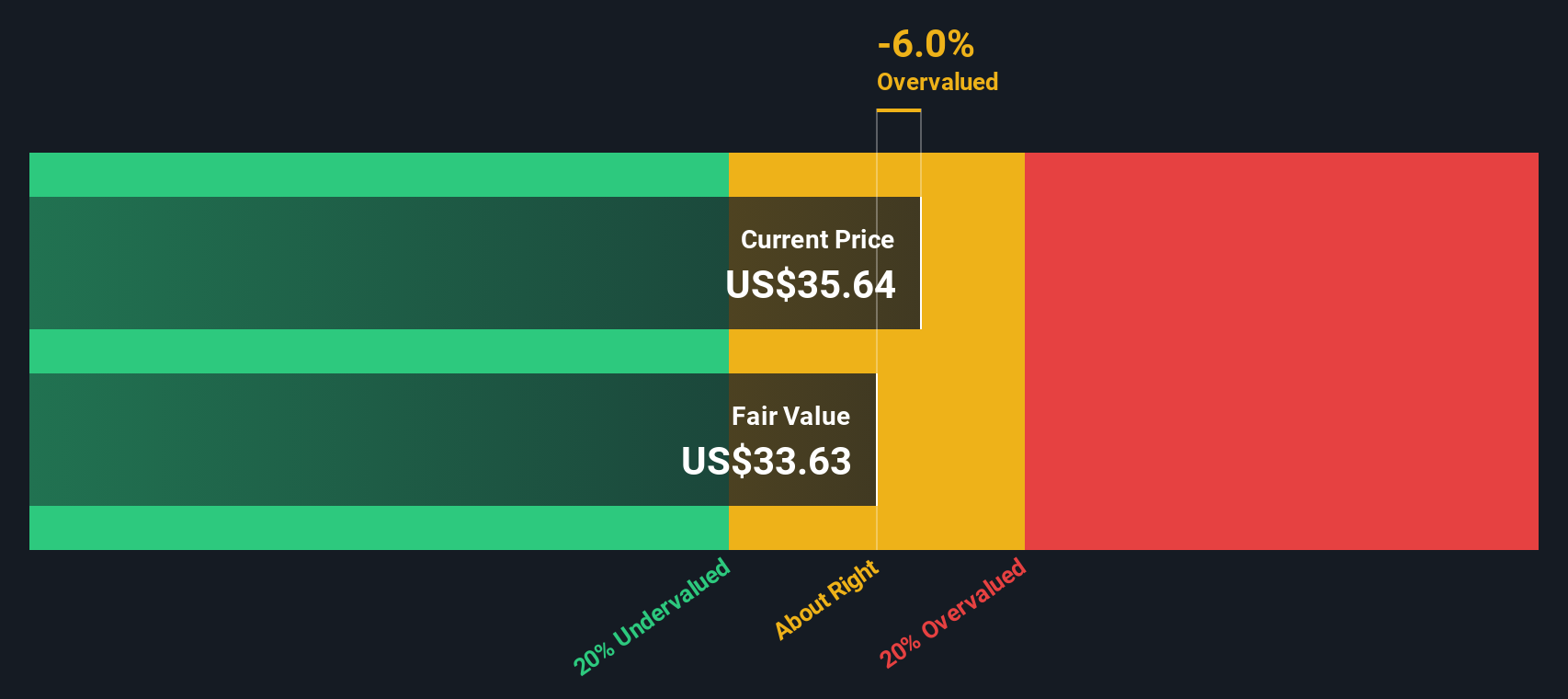

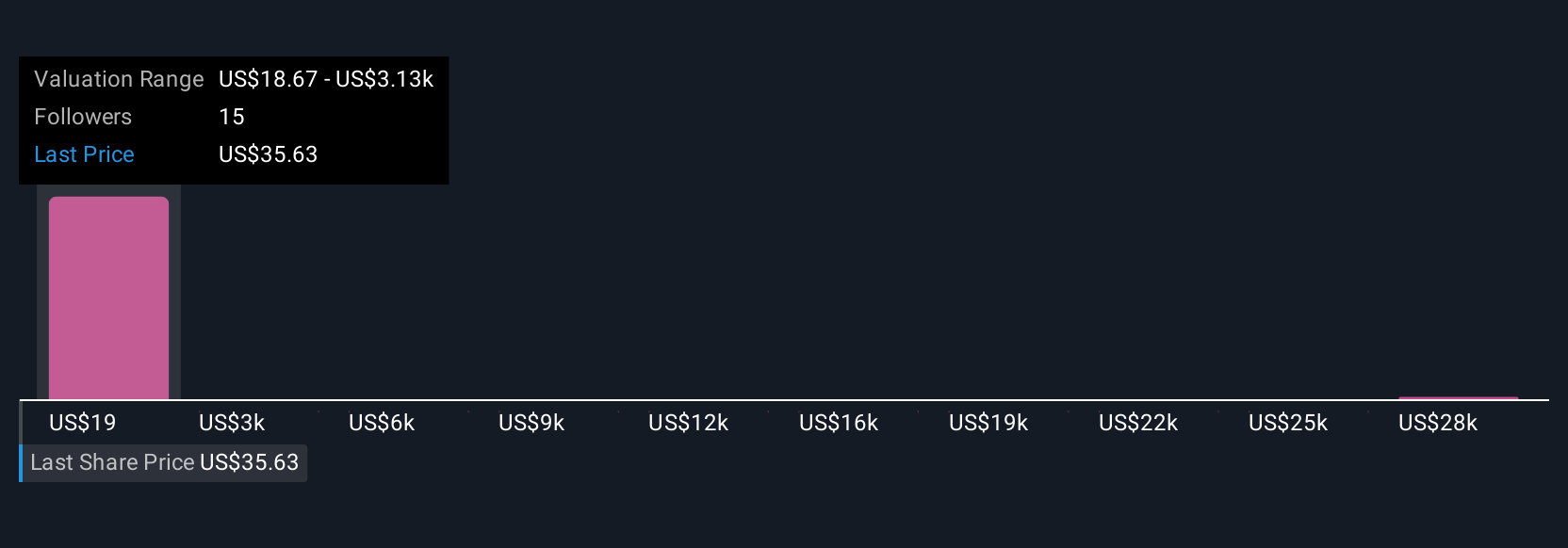

Narratives help you decide when to buy or sell by comparing the fair value in your story to the current market price, and since they are dynamic, they update automatically as news breaks or earnings reports arrive. For example, one investor tracking H World Group might believe its rapid domestic expansion and digital upgrades will boost future growth and value the company at $55.30 per share, while another might highlight risks from aggressive expansion and cautious travel demand, landing at just $35.79. Narratives empower you to apply your own logic and see exactly how shifts in the business can influence the right price for you.

Do you think there's more to the story for H World Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if H World Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTHT

H World Group

Develops leased and owned, manachised, and franchised hotels in the People’s Republic of China.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion