- United States

- /

- Pharma

- /

- NasdaqGS:ANTX

Golden Sun Health Technology Group Leads 3 US Penny Stocks Worth Monitoring

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite continue to experience declines, investor sentiment is being tested by economic uncertainties and fluctuating market conditions. Despite these challenges, penny stocks remain a notable segment for investors seeking opportunities in smaller or newer companies. While the term "penny stocks" may seem outdated, it still encapsulates firms that have the potential for growth when backed by strong financials. In this context, certain penny stocks are emerging as intriguing options for those interested in exploring under-the-radar investments with promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.54M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86379 | $6.28M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.76 | $392.77M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.47 | $42.83M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.60 | $82.81M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $47.52M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $4.00 | $155.17M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.36 | $24.65M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8491 | $77.35M | ★★★★★☆ |

Click here to see the full list of 728 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Golden Sun Health Technology Group (NasdaqCM:GSUN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golden Sun Health Technology Group Limited operates in China, offering education services related to medical health, e-commerce live broadcasting, and cultural and tourism services, with a market cap of $5.25 million.

Operations: The company generates revenue from two main segments: Education, contributing $6.30 million, and E-commerce, accounting for $3.86 million.

Market Cap: $5.25M

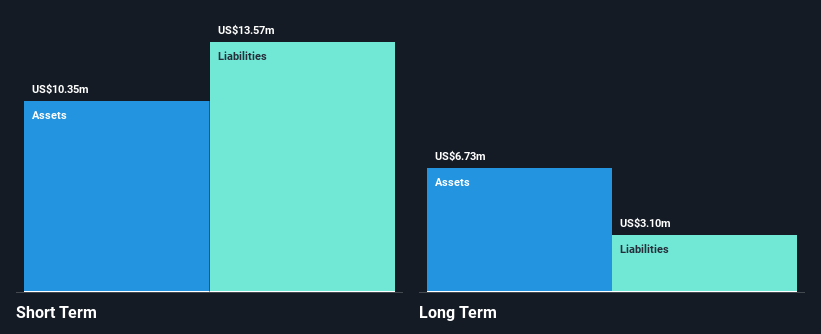

Golden Sun Health Technology Group, with a market cap of US$5.25 million, operates in China offering education and e-commerce services. Despite revenue growth to US$10.16 million for the year ending September 2024, the company remains unprofitable with a net loss of US$3.71 million. The company's financial health is concerning; short-term liabilities exceed assets by US$3.2 million, and its net debt to equity ratio is very high at 939.6%. Recent auditor reports express doubts about its ability to continue as a going concern, compounded by delayed SEC filings and limited cash runway despite recent capital raises.

- Get an in-depth perspective on Golden Sun Health Technology Group's performance by reading our balance sheet health report here.

- Evaluate Golden Sun Health Technology Group's historical performance by accessing our past performance report.

NetSol Technologies (NasdaqCM:NTWK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NetSol Technologies, Inc. specializes in creating and distributing enterprise software solutions for the automobile financing and leasing, banking, and financial services sectors across the United States, North America, Europe, and Asia Pacific with a market cap of $29.18 million.

Operations: NetSol Technologies generates its revenue from three primary regions: $13.09 million from Europe, $9.14 million from North America, and $54.27 million from Asia-Pacific.

Market Cap: $29.18M

NetSol Technologies, with a market cap of US$29.18 million, reported second-quarter revenue of US$15.54 million but experienced a net loss of US$1.15 million, highlighting ongoing profitability challenges despite stable revenue from key regions like Asia-Pacific and Europe. The company’s short-term assets significantly exceed its liabilities, providing some financial stability alongside more cash than debt and an adequate cash runway exceeding three years at current free cash flow levels. Recent developments include the successful implementation of its Transcend Finance Platform for a Japanese client in Australia, showcasing potential growth avenues through strategic partnerships despite declining earnings over five years.

- Take a closer look at NetSol Technologies' potential here in our financial health report.

- Gain insights into NetSol Technologies' past trends and performance with our report on the company's historical track record.

AN2 Therapeutics (NasdaqGS:ANTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AN2 Therapeutics, Inc. is a clinical-stage biopharmaceutical company dedicated to developing treatments for rare, chronic, and serious infectious diseases, with a market cap of $33.76 million.

Operations: AN2 Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $33.76M

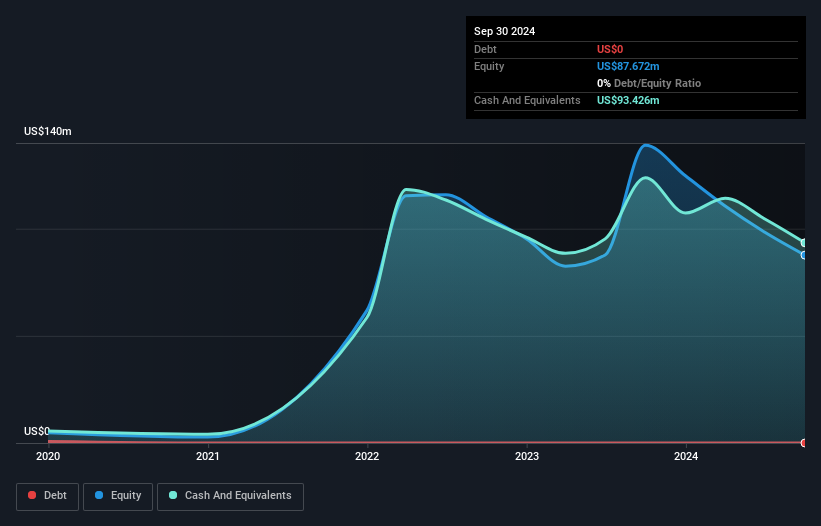

AN2 Therapeutics, Inc., with a market cap of US$33.76 million, is a pre-revenue biopharmaceutical company focused on developing treatments for serious infectious diseases. Despite being unprofitable and lacking significant revenue streams, the company maintains financial stability with no debt and short-term assets of US$97.7 million exceeding liabilities by a wide margin. AN2 has sufficient cash runway for over a year under current conditions. Recent developments include an amended statistical analysis plan submitted to the FDA for its Phase 3 EBO-301 trial, aligning with FDA guidance and following precedents in similar studies; results are expected in Q2 2025.

- Click to explore a detailed breakdown of our findings in AN2 Therapeutics' financial health report.

- Gain insights into AN2 Therapeutics' future direction by reviewing our growth report.

Taking Advantage

- Unlock our comprehensive list of 728 US Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ANTX

AN2 Therapeutics

A clinical-stage biopharmaceutical company, focuses on developing treatments for rare, chronic, and serious infectious diseases.

Flawless balance sheet low.

Market Insights

Community Narratives