- United States

- /

- Hospitality

- /

- NasdaqGM:GDEN

Benign Growth For Golden Entertainment, Inc. (NASDAQ:GDEN) Underpins Its Share Price

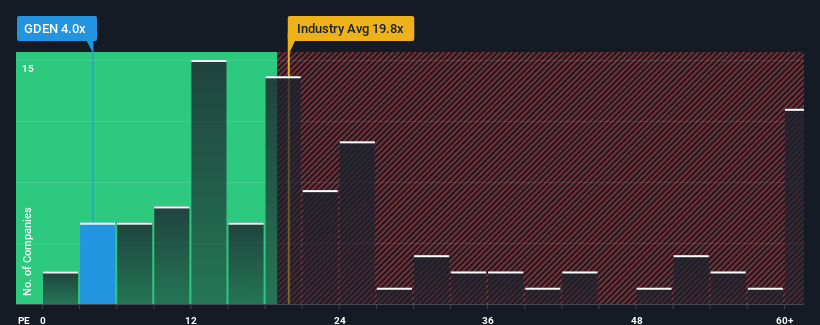

Golden Entertainment, Inc.'s (NASDAQ:GDEN) price-to-earnings (or "P/E") ratio of 4x might make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 32x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Golden Entertainment certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Golden Entertainment

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Golden Entertainment's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 208% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 67% as estimated by the five analysts watching the company. Meanwhile, the broader market is forecast to expand by 10%, which paints a poor picture.

In light of this, it's understandable that Golden Entertainment's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Golden Entertainment's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Golden Entertainment maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 4 warning signs for Golden Entertainment (3 can't be ignored!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:GDEN

Golden Entertainment

Owns and operates a diversified entertainment platform in the United States.

Moderate and good value.

Similar Companies

Market Insights

Community Narratives