- United States

- /

- Hospitality

- /

- NasdaqGS:FWRG

Evaluating First Watch (FWRG) After Advent’s 9.4 Million-Share Selloff and Shifting Ownership Dynamics

Reviewed by Simply Wall St

First Watch Restaurant Group (FWRG) just saw private equity backer Advent International unload 9.4 million shares, a big portfolio shift that puts fresh attention on who is owning this breakfast focused growth story now.

See our latest analysis for First Watch Restaurant Group.

With the stock now around $17.70, the recent block sale has added some short term pressure, and the negative year to date share price return contrasts with a still positive three year total shareholder return. This suggests longer term momentum has not fully broken.

If this reshuffling of ownership has you rethinking your watchlist, it could be worth scouting other consumer facing names through auto manufacturers as a fresh hunting ground for opportunity.

So with earnings still growing briskly and Wall Street targets sitting comfortably above today’s price, is First Watch quietly trading at a discount, or is the market already baking in every bit of future growth?

Most Popular Narrative: 20% Undervalued

Against a last close of $17.70, the most popular narrative pegs First Watch Restaurant Group’s fair value meaningfully higher, framing today’s price as a potential discount.

The analysts have a consensus price target of $22.0 for First Watch Restaurant Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $17.0.

Curious how a daytime dining chain earns a premium style earnings multiple and richer margin profile, all while growing faster than the wider market, and still screens as undervalued on this framework?

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained cost inflation and the natural cap from daytime-only hours could compress margins, undermining the growth assumptions behind today’s undervaluation case.

Find out about the key risks to this First Watch Restaurant Group narrative.

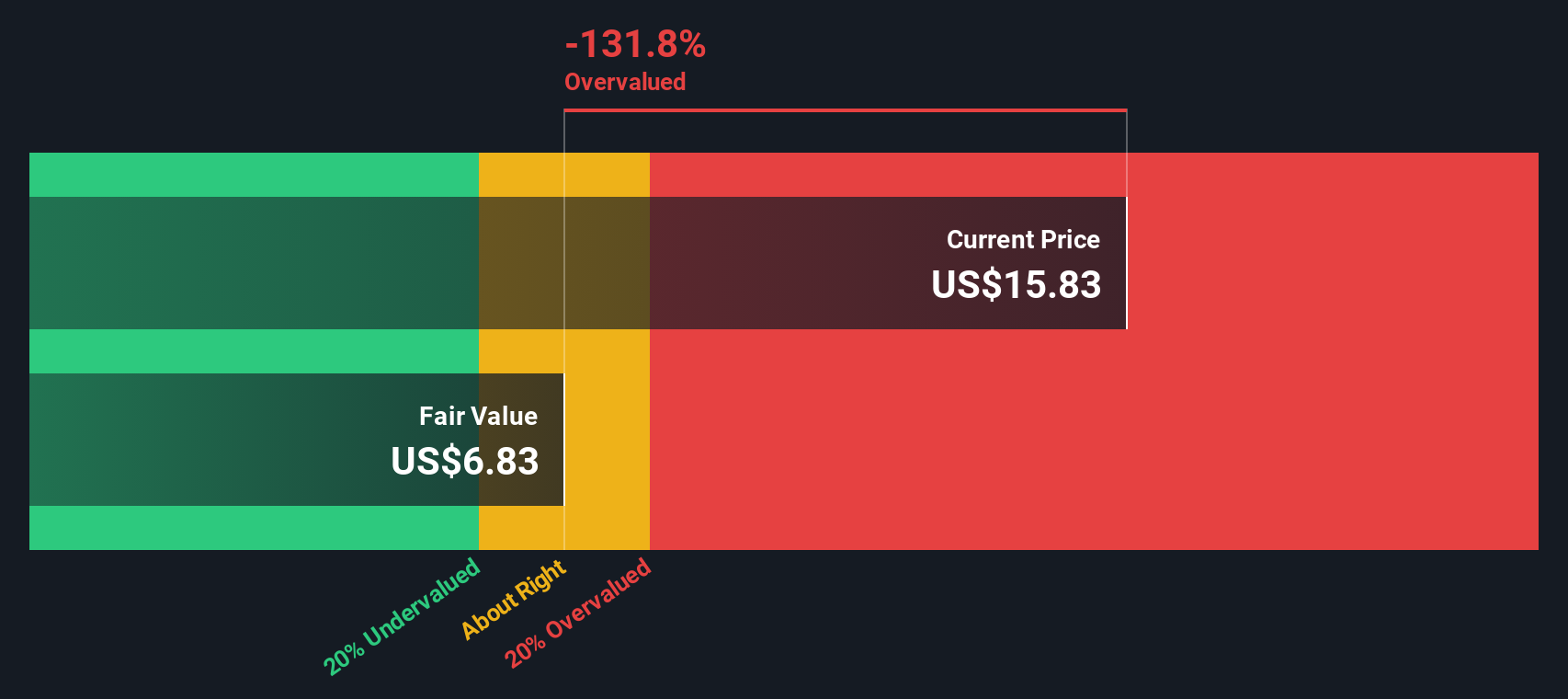

Another View: Cash Flows Flash a Warning

While analyst targets suggest upside, our DCF model points the other way, implying fair value closer to $8.12 versus the current $17.70 share price. On this basis, the stock screens as meaningfully overvalued, raising the question of which story investors should trust.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Watch Restaurant Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Watch Restaurant Group Narrative

If you see the story differently or want to stress test the numbers yourself, you can spin up a custom narrative in under three minutes: Do it your way.

A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single stock when you can build a stronger, future ready watchlist in minutes using these targeted Simply Wall St screeners.

- Capitalize on mispriced opportunities by targeting companies that look cheap on cash flows with these 903 undervalued stocks based on cash flows before the market catches up.

- Ride the next wave of innovation by zeroing in on early stage tech leaders through these 26 AI penny stocks while they are still under the radar.

- Identify potential income streams by filtering for reliable payers using these 15 dividend stocks with yields > 3% and avoid missing out on attractive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FWRG

First Watch Restaurant Group

Through its subsidiaries, operates and franchises restaurants under the First Watch trade name in the United States.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026