- United States

- /

- Consumer Services

- /

- NasdaqGS:FTDR

Frontdoor (FTDR): Exploring Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Frontdoor.

Frontdoor’s momentum has been gaining, as shown by its year-to-date share price return of 20.2% and an impressive 25.5% total shareholder return over the past year. Investors appear to be warming to the company’s underlying growth story once again, with recent price strength suggesting sentiment could be shifting in its favor.

If Frontdoor’s steady performance has you curious, now is the time to broaden your view and discover fast growing stocks with high insider ownership

With shares climbing yet still trading below some analyst targets, investors may be wondering if Frontdoor remains undervalued or if future growth is already fully priced in. This could leave little room for upside from here.

Most Popular Narrative: 9.4% Overvalued

Frontdoor's narrative valuation stands below the last close price, highlighting a disconnect between market optimism and the assumptions behind analysts' fair value. Now let's look at one key premise shaping this perspective.

Ongoing technology investments, including the integration of AI in marketing, sales, and operations, are already showing improvements in campaign performance and process efficiencies. These developments could help further drive down service costs and support higher net margins over time.

Curious what future financial projections gave rise to that price target? There is a twist: analyst models hinge on a bold combination of recurring revenue momentum and margin assumptions that most investors would not expect. The full narrative reveals the crucial quantitative levers behind these forecasts. Will the underlying growth logic surprise you?

Result: Fair Value of $60.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in home warranty membership and rising customer acquisition costs could challenge Frontdoor’s growth narrative and put pressure on future profitability.

Find out about the key risks to this Frontdoor narrative.

Another View: What Does the DCF Model Say?

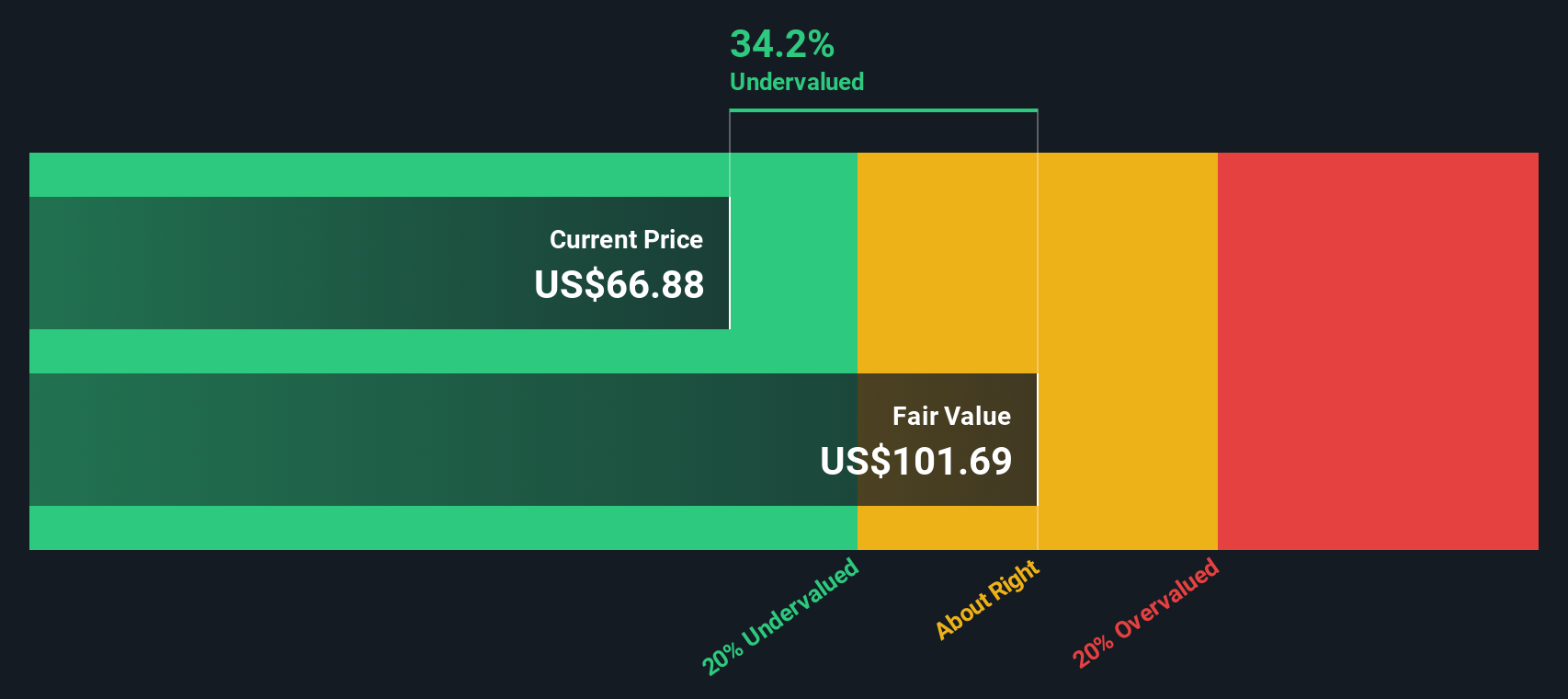

While analysts’ price targets suggest Frontdoor is a bit overvalued, our SWS DCF model presents a different perspective. The model indicates the stock trades about 34% below its fair value. This valuation method suggests potential upside the market may be overlooking. Could the real opportunity be hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Frontdoor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Frontdoor Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own story in just a few minutes, Do it your way

A great starting point for your Frontdoor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your portfolio to just one opportunity. With the right research tools, you can uncover standout stocks across emerging and resilient themes, giving yourself the edge others might miss.

- Unlock income potential by checking out these 18 dividend stocks with yields > 3% offering yields above 3%, so your investments can work harder for you.

- Spot tomorrow’s tech leaders and get a front-row seat to innovation by browsing these 24 AI penny stocks shaping the future of artificial intelligence.

- Capture significant value-upsides by finding these 871 undervalued stocks based on cash flows trading below their intrinsic worth, so you never overpay for strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTDR

Frontdoor

Provides home and new home structural warranties in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives