- United States

- /

- Hospitality

- /

- NasdaqGS:EXPE

Is Now the Right Time for Expedia After Its 46% Share Price Surge?

Reviewed by Bailey Pemberton

If you have Expedia Group stock in your portfolio or you are thinking about jumping in, you are probably wondering whether now is the moment to act. After all, Expedia is sitting at a closing price of $219.23, and it has notched some eye-catching gains over time. In just the past year, the stock is up 46.4%, and it has soared 134.9% over three years. Even in the past five years, Expedia has delivered an impressive 129.1% return. But while the longer-term story is strong, you might have noticed some bumps recently. The seven-day change is down -1.6%, while the last month has been more positive, rising 3.2%.

This kind of movement suggests investors are weighing fresh opportunities against new risks as the travel industry continues evolving. Market developments, such as the reshaping of online travel and bookings, have sparked optimism that Expedia is well-positioned for growth. However, these changes also mean that the bar for future performance keeps moving.

So is Expedia stock undervalued right now? Looking at valuation, Expedia Group scores a 4 out of 6 according to our checklist, signaling that it meets four major checks for being undervalued. That is a compelling starting point. Of course, not all valuation methods are created equal. Let’s break down exactly what goes into that score and explore whether traditional indicators tell the full story or if there is an even smarter approach to understanding Expedia’s real worth.

Approach 1: Expedia Group Discounted Cash Flow (DCF) Analysis

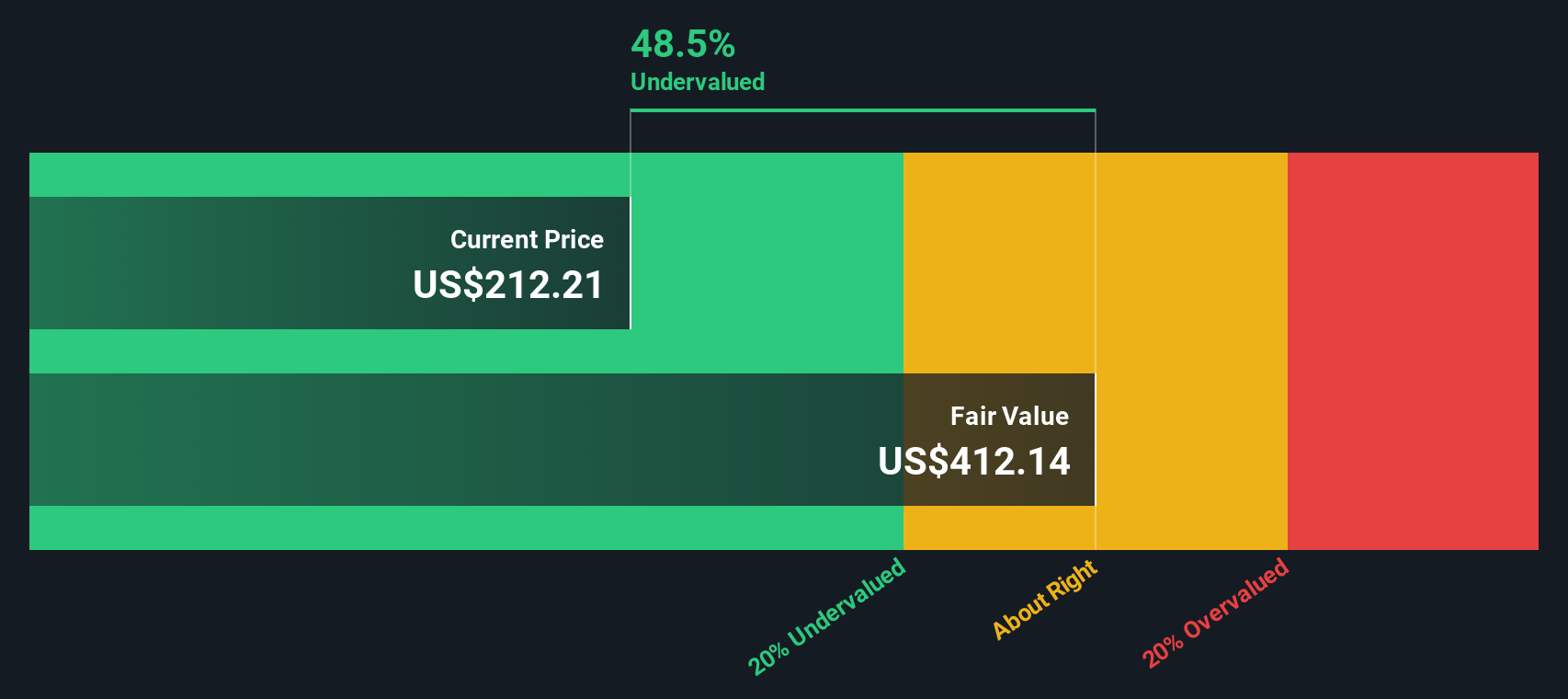

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. For Expedia Group, this approach is based on a 2 Stage Free Cash Flow to Equity model, which first uses direct analyst estimates and then extrapolates further growth trends.

Expedia’s most recent reported Free Cash Flow (FCF) was $1.95 billion. According to analyst projections and extended estimates, the company’s FCF is expected to steadily grow over the coming decade, reaching approximately $4.16 billion by 2035. It's important to note that analyst coverage is robust for the next five years, while longer-term numbers are extrapolated from current growth rates.

This analysis results in an estimated intrinsic value per share of $421.95 using the DCF model. Comparing this to Expedia’s current share price of $219.23, the model indicates that the stock is trading at a 48.0% discount to its fair value, suggesting that Expedia Group is undervalued by any traditional standard.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Expedia Group is undervalued by 48.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Expedia Group Price vs Earnings

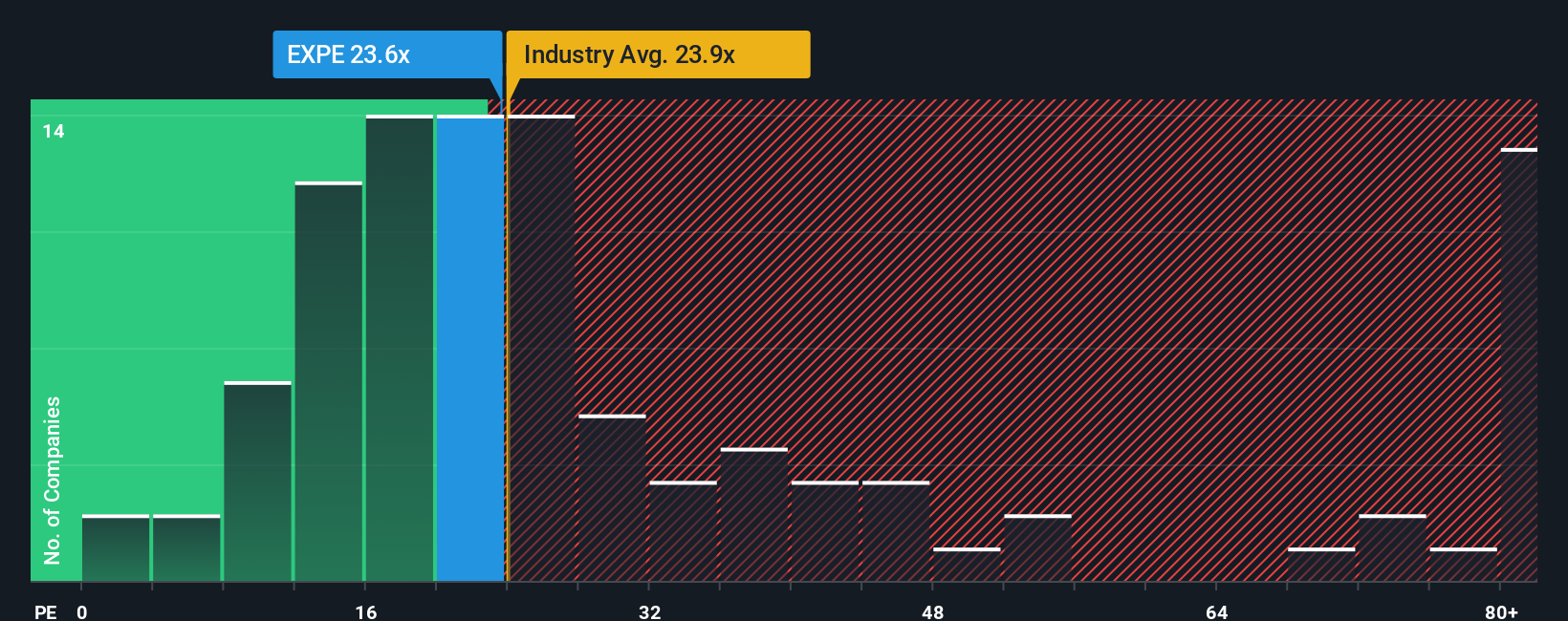

The Price-to-Earnings (PE) ratio is often the go-to valuation measure for profitable companies because it shows how much investors are willing to pay for each dollar of earnings. Generally, companies with higher growth prospects and lower risk profiles command higher PE ratios, as investors are willing to pay a premium for future profitability. Conversely, if a business carries more uncertainty or limited growth potential, its PE ratio tends to fall below market averages.

Expedia Group currently trades at a PE ratio of 24.4x, which is in line with the wider hospitality industry average of 24.4x but below the peer group average of 30.9x. At first glance, this may indicate Expedia is trading at a discount versus direct competitors. However, these benchmarks can sometimes miss the nuances of a company’s unique outlook and circumstances.

This is where Simply Wall St’s Fair Ratio comes into play. Unlike simple industry or peer comparisons, the Fair Ratio incorporates factors such as Expedia’s earnings growth, profit margins, risk profile, industry trends, and market cap. For Expedia Group, the Fair Ratio is calculated at 31.4x. Comparing this to the current PE of 24.4x, the stock trades noticeably below what would be considered fair value given its business profile and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

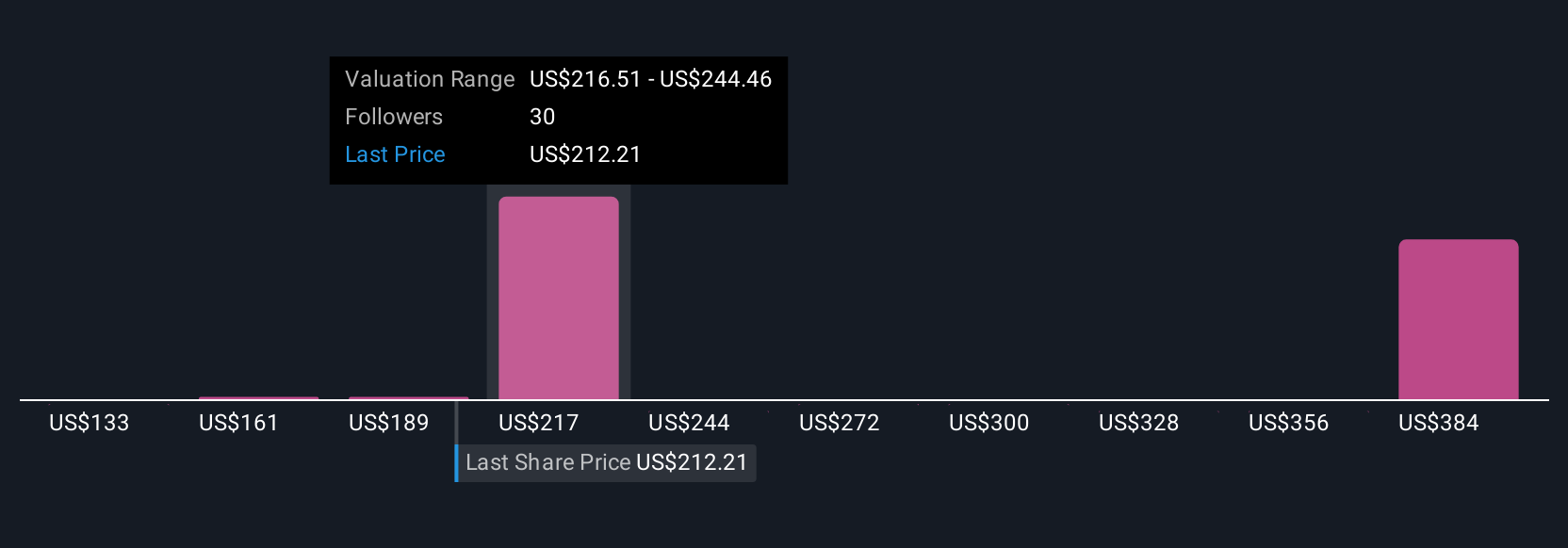

Upgrade Your Decision Making: Choose your Expedia Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a unique feature on Simply Wall St’s platform that empower you to tell the story behind your assumptions. This gives you a chance to connect your perspective about Expedia Group with financial forecasts and a calculated fair value. Instead of just relying on numbers, a Narrative lets you explain what you believe will shape Expedia’s future, such as expansion in Asian markets, the impact of AI, or changes in consumer demand, and then see how your views translate into revenue, earnings, and margin estimates.

This approach makes investment decisions more dynamic and personal. On Simply Wall St’s Community page, millions of investors use Narratives to clarify when and why to buy or sell by comparing their own fair value estimate with the current share price. Narratives automatically update as new information like earnings, news, or industry shifts comes in, helping you stay on top of evolving opportunities and risks. For example, one investor might believe Expedia will outperform thanks to AI and global growth, setting a bullish $290 price target, while another anticipates competitive headwinds and picks a cautious $168 fair value. These are two stories and two actionable strategies.

Do you think there's more to the story for Expedia Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expedia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPE

Expedia Group

Operates as an online travel company in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives