- United States

- /

- Hospitality

- /

- NasdaqGS:EXPE

Expedia Group (NasdaqGS:EXPE) Unveils Instagram-Inspired Booking Innovation Despite Increased Q1 Losses

Reviewed by Simply Wall St

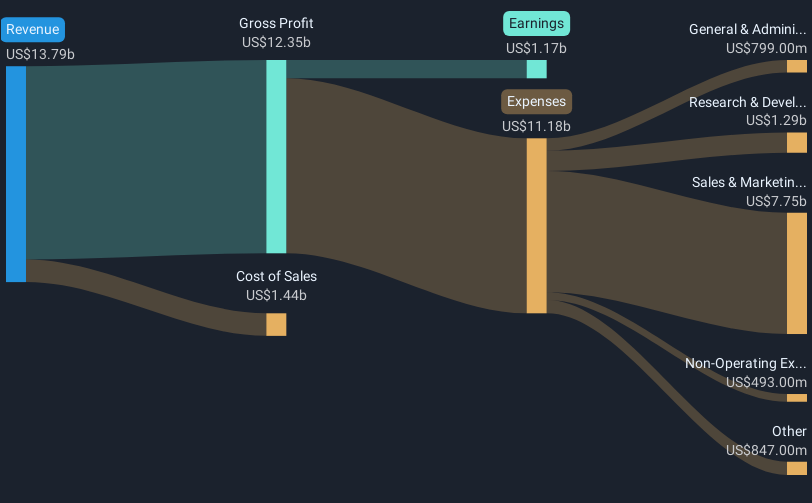

Expedia Group (NasdaqGS:EXPE) recently launched its Trip Matching feature, using Instagram content to tailor travel itineraries. The company's share price experienced a 24% increase over the past month despite facing financial challenges, as reported in its Q1 earnings. The earnings disclosed increased sales but also a widening net loss, likely influencing mixed investor sentiment. Compared to broader market declines influenced by macroeconomic factors like U.S.-China trade talks and soft U.S. travel demand, Expedia's innovations may have helped counter negative pressures, adding weight to its stock's upward movement. This highlight of strategic development amidst financial challenges captures market interest.

Expedia Group has 2 weaknesses we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Expedia Group's introduction of the Trip Matching feature could play an important role in strengthening customer engagement by leveraging social media to create personalized travel plans. This focus on innovation is consistent with the company's narrative of using technological advancements and global expansion to boost market presence and customer loyalty. Over the past five years, Expedia's total shareholder return reached 163.08%, indicating robust performance despite recent financial challenges. This long-term gain contrasts with its one-year return, which outpaced the US Hospitality industry by a notable margin.

The strategic use of AI as highlighted in recent developments may positively influence the company's revenue and earnings forecasts. As the firm bolsters its core brands and expands internationally, analysts have provided a price target of US$199.33, approximately 17.4% higher than the current share price of US$164.73. This price movement suggests that investors might anticipate financial improvements driven by future earnings growth and enhanced profit margins, although challenges persist, such as competitive pressures and platform issues. The Trip Matching feature may enhance consumer engagement, which could potentially support this optimistic outlook and align with anticipated revenue of US$16.5 billion and earnings of US$2 billion by 2028.

Explore historical data to track Expedia Group's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expedia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPE

Expedia Group

Operates as an online travel company in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives