- United States

- /

- Hospitality

- /

- NasdaqGS:EXPE

Expedia Group (NasdaqGS:EXPE) Expands B2B Tech Platform With AI-Powered Innovations

Reviewed by Simply Wall St

Expedia Group (NasdaqGS:EXPE) recently announced significant advancements in its B2B technology platform, focusing on AI and API innovations to enhance travel experiences. During the past month, the company's share price moved 13% higher, aligning with broader market gains driven by positive economic data and easing global trade tensions. Although specific catalysts related to Expedia's technology announcements likely added positive weight, the company's overall share movement also mirrored the upward trends seen across various market indexes, such as the S&P 500 and Nasdaq Composite, which are extending their winning streaks.

Buy, Hold or Sell Expedia Group? View our complete analysis and fair value estimate and you decide.

Expedia Group's recent advancements in B2B technology, focusing on AI and API innovations, could bolster its growth prospects by enhancing customer engagement and operational productivity. Such innovations might stimulate revenue growth and encourage investor confidence, fitting with the company's narrative of strengthening its market presence. However, competitive pressures and platform issues remain challenges.

Over a five-year period, Expedia's total shareholder return, including share price and dividends, was 113.09%. This significant long-term performance illustrates the company's resilience and steady growth. In the past year, Expedia outperformed both the US market, which returned 11.5%, and the US Hospitality industry, which returned 13%. This indicates a positive trend, at least in the short term.

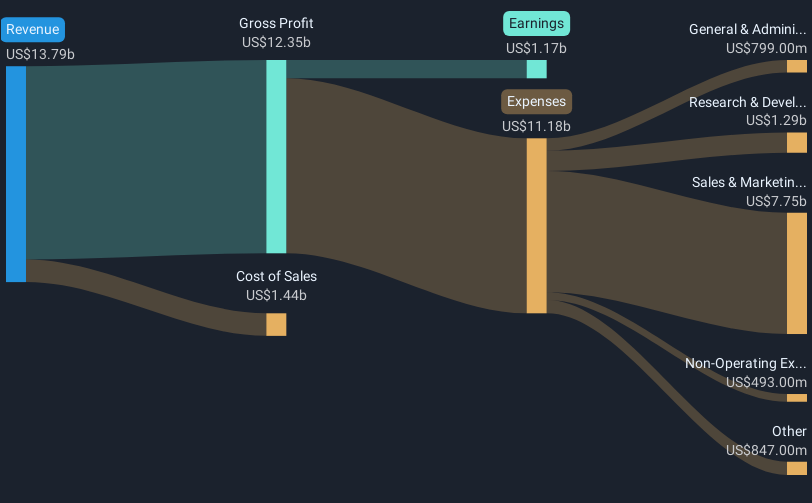

Expedia Group's share price has been performing well in the shorter term, rising 13% recently. With current innovations and strategic investments, forecasts of revenue and earnings may see upward revisions, potentially aligning with consensus expectations of a revenue increase to $16.5 billion and earnings reaching $2 billion by 2028. Given the current share price of US$164.73, and a consensus analyst price target of US$199.33, the company's shares offer a potential 17.4% upside. Investors are advised to evaluate whether their views align with such projections and consider the associated risks.

Learn about Expedia Group's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expedia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPE

Expedia Group

Operates as an online travel company in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives