- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Duolingo (NasdaqGS:DUOL) Launches Duo's Treehouse For Bilingual Learning Growth (9% Gain)

Reviewed by Simply Wall St

Duolingo (NasdaqGS:DUOL) recently experienced a 9% share price increase over the past week, coinciding with the launch of Duo's Treehouse, a bilingual community initiative in Pittsburgh. This development highlights the company's commitment to social impact and potentially attracted positive investor sentiment. Concurrently, broader market movements showed the Nasdaq and S&P 500 ending a four-week decline, likely bolstered by big tech stocks such as Apple and Microsoft, which posted gains. The steady interest rates by the Federal Reserve also seem to have supported the broader market, potentially influencing Duolingo's upward movement.

Buy, Hold or Sell Duolingo? View our complete analysis and fair value estimate and you decide.

Over the past three years, Duolingo’s total shareholder returns reached 232.40%, highlighting a substantial period of growth. Crucial to this performance was the company's focus on leveraging AI-driven content to enhance user engagement and monetization, with an expansion of AI features like the Video Call tool. Further boosting this trajectory, Duolingo's strategic focus on international markets and AI-driven content likely contributed to a larger user base and higher subscription rates.

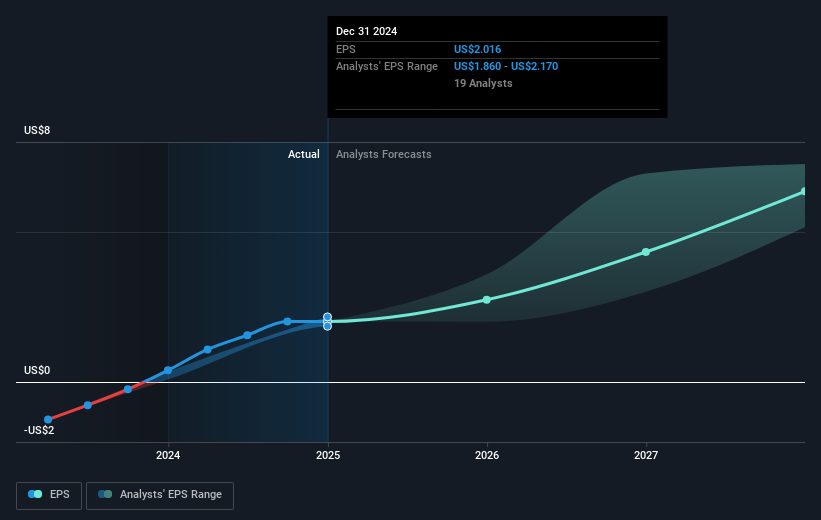

Key factors in Duolingo's success include impressive earnings growth, with net income rising from US$16.07 million to US$88.57 million over the past year. Collaborative ventures, including partnerships with Chess.com and Sony Music to enrich learning experiences, likely aided user retention and reactivation. Within the past year, Duolingo outperformed its industry and the broader U.S. market in total return, cementing its position as a leading innovator in the mobile learning space.

Our valuation report unveils the possibility Duolingo's shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives