- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

Fresh Lows are Potentially Reversing the Insider Selling Trend at DraftKings (NASDAQ:DKNG)

Recent weeks have not been kind to DraftKings Inc. (NasdaqGS: DKNG), as the stock suffered through missed earnings and a broad market sell-off that saw the correction of over 30%.

Yet, some analysts would argue for 2 cues that predicted this outcome – first, the stock failed to make a new high during the summer and then repeatedly struggled to recapture a critical level of US$50.

View our latest analysis for DraftKings

Latest Developments

Although DraftKings bounced from the lows, it remains down almost 25% YTD. Recently it drew attention from a high-profile short-seller, Jim Chanos, who revealed a position in the company. He criticized the business model, arguing it is unsustainable given the current marketing costs.

On the contrary CEO, Jason Robins disputed those numbers, stating that the company operates profitably in gambling-legal states within 2-3 years of entry into the market. It is worth noting that the current DKNG short interest stands at 11.34% of the float.

When it comes to profitability, DKNG usually drives comparisons with Amazon, which focused on growth over profitability over a long time. However, it is worth noting that the environment in which DKNG operates is vastly different, as the competition is pushing similar strategies in the same market.

On the positive side, one segment where DKNG shines is the quickly emerging NFT market, as the company announced a deal with NFL Players Association. This deal will see NFTs for active NFL players debuting on DraftKings Marketplace in the 2022-2023 NFL season.

DraftKings Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Director, Shalom Meckenzie, for US$27m worth of shares, at about US$49.56 per share. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$33.38. So it may not shed much light on insider confidence at current levels.

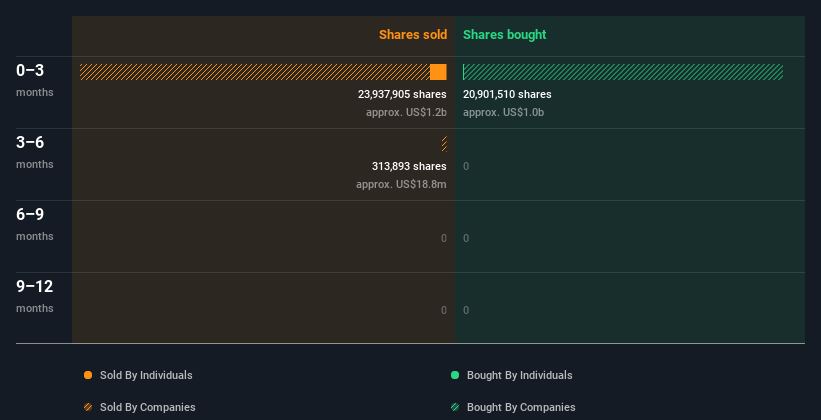

Happily, we note that in the last year, insiders paid US$2.6m for 67.00k shares. But insiders sold 1.06m shares worth US$53m. Over the last year, we saw more insider selling of DraftKings shares than buying. You can see the insider transactions (companies and individuals) over the last year depicted in the chart below.

If you click on the chart, you can see all the individual transactions, including the share price, individual, and date.

For those interested, check out this free list of growing companies with considerable, recent, insider buying.

Insiders at DraftKings Have Sold Stock Recently

There was substantially more insider selling than buying DraftKings shares over the last three months. We note insiders cashed in US$53m worth of shares. On the other hand, we note insiders bought US$2.6m worth of shares, as previously mentioned. We don't view these transactions as a positive sign.

Insider Ownership of DraftKings

It is worth checking how many shares are held by company insiders for a common shareholder. We usually like to see fairly high levels of insider ownership. DraftKings insiders own about US$1.1b worth of shares (7.9% of the company).

Most shareholders would be happy to see this sort of insider ownership since it suggests that management incentives are well aligned with other shareholders.

So What Do The DraftKings Insider Transactions Indicate?

In the last three months, the insider sales have outweighed the insider buying at DraftKings. However, it is worth noting that, as the stock turned to fresh lows, the trend has been reversing - with multiple independent directors buying in the recent weeks. This does give some optimism from now on.

While it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks a particular company faces. You'd be interested to know, that we found 4 warning signs for DraftKings and we suggest you have a look.

Furthermore, take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives