When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. Long term Denny's Corporation (NASDAQ:DENN) shareholders would be well aware of this, since the stock is up 166% in five years. The last week saw the share price soften some 1.7%.

See our latest analysis for Denny's

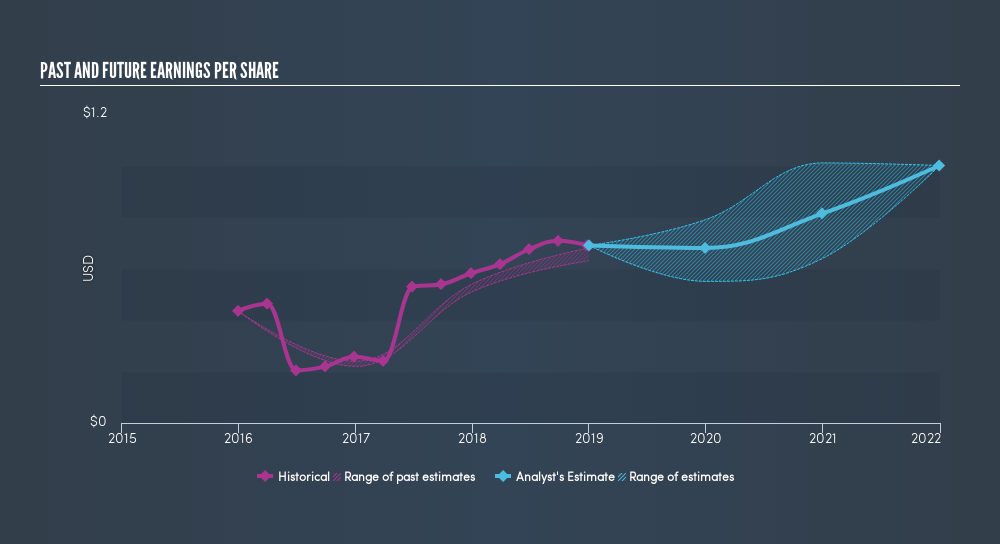

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over half a decade, Denny's managed to grow its earnings per share at 21% a year. This EPS growth is remarkably close to the 22% average annual increase in the share price. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Indeed, it would appear the share price is reacting to the EPS.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Denny's has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this freereport showing consensus revenue forecasts.

A Different Perspective

It's nice to see that Denny's shareholders have received a total shareholder return of 16% over the last year. However, the TSR over five years, coming in at 22% per year, is even more impressive. If you would like to research Denny's in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Denny's may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:DENN

Denny's

Through its subsidiaries, owns and operates franchised full-service restaurant chains under the Denny's and Keke’s Breakfast Cafe brand names in the United States and internationally.

Good value low.

Market Insights

Community Narratives