- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

DoorDash (NasdaqGS:DASH) Reports Q1 Revenue of US$3 Billion and Net Income of US$193 Million

Reviewed by Simply Wall St

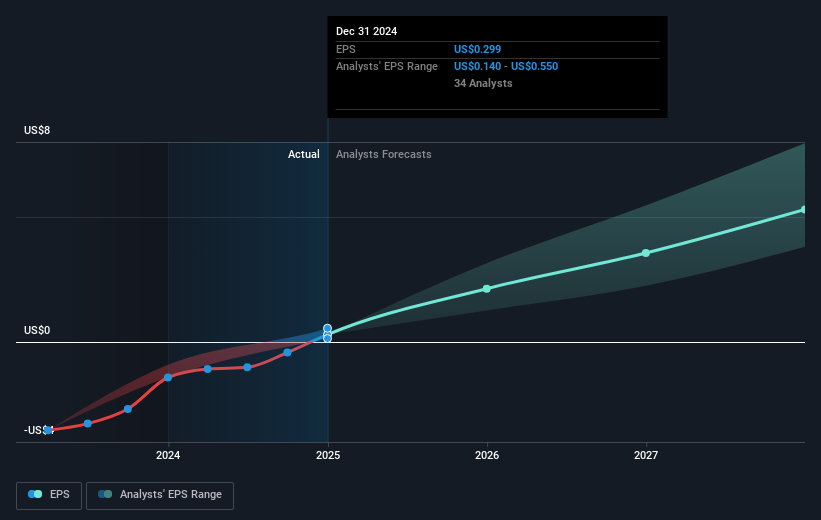

DoorDash (NasdaqGS:DASH) recently reported impressive financial results, with a notable rise in sales from $2,513 million to $3,032 million, and a shift from a net loss to a net income of $193 million for Q1 2025. These figures are likely to have bolstered investor confidence, as reflected by the company’s 25% price increase last month. Additionally, the company's extension of partnerships in Canada and the U.S. likely supported this rally. Meanwhile, broader market movements showed mixed signals amidst concerns regarding tariff negotiations, but DoorDash's positive earnings report seems to have significantly influenced its outperformance.

The recent surge in DoorDash's share price, following its transition from a net loss to a US$193 million net income in Q1 2025, underscores the positive investor sentiment buoyed by its robust earnings announcement and strategic partnerships in North America. This momentum has potential implications for the broader company narrative, emphasizing optimism around future revenue streams and profitability. Over the longer term, DoorDash's total return, including share price appreciation and dividends, has increased by a very large 220.04% over the past three years, showcasing substantial investor returns.

When compared to the U.S. Hospitality industry, which returned 6.8% over the past year, DoorDash's recent price performance has been impressive, demonstrating its outperformance against industry peers. Looking ahead, the company's growth initiatives in grocery and technology integration may further bolster revenue and earnings forecasts, with analysts projecting significant annual growth. With a current share price of US$191.23, the movement towards the consensus price target of approximately US$217.65 suggests that investors might still perceive additional upside potential, though it is always essential for investors to conduct their own analysis.

Evaluate DoorDash's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives