- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

DoorDash (DASH) Valuation Check After Director Alfred Lin’s $100 Million Insider Share Purchase

Reviewed by Simply Wall St

DoorDash (DASH) just got a serious vote of confidence from the inside, with longtime director Alfred Lin reportedly buying more than $100 million of stock, a move that immediately sharpened investor focus on valuation.

See our latest analysis for DoorDash.

The timing matters, because even after a 29 percent year to date share price return, DoorDash has recently cooled off, with a 90 day share price decline of 15 percent and near term weakness that contrasts with its powerful three year total shareholder return of 277 percent. This suggests that longer term momentum is still very much intact.

If Lin’s conviction has you rethinking your own watchlist, this could be a good moment to explore other high growth tech and AI names via high growth tech and AI stocks.

With revenue still growing near 20 percent annually and analysts seeing more than 25 percent upside to fair value, is Lin leaning into an underappreciated growth story, or is the market already baking in years of expansion?

Most Popular Narrative Narrative: 20.2% Undervalued

Based on the most followed narrative, DoorDash’s fair value of $276.17 sits notably above the recent $220.30 close, framing Lin’s buy against a still supportive valuation backdrop.

Rapid expansion into new verticals (grocery, retail, convenience, pharmacy) and international markets is yielding faster growth rates and improving unit economics, which should diversify and accelerate topline revenue while supporting net margin expansion.

Want to see the math behind that confidence gap? The narrative leans on aggressive revenue compounding, rising margins, and a future earnings multiple usually reserved for elite growth leaders. Curious which precise profit leap and valuation reset need to click into place to reach that fair value? Dive in to see the assumptions doing the heavy lifting.

Result: Fair Value of $276.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in new markets or tighter gig worker regulations could quickly compress margins and undercut the growth assumptions behind that bullish valuation.

Find out about the key risks to this DoorDash narrative.

Another Lens on Valuation

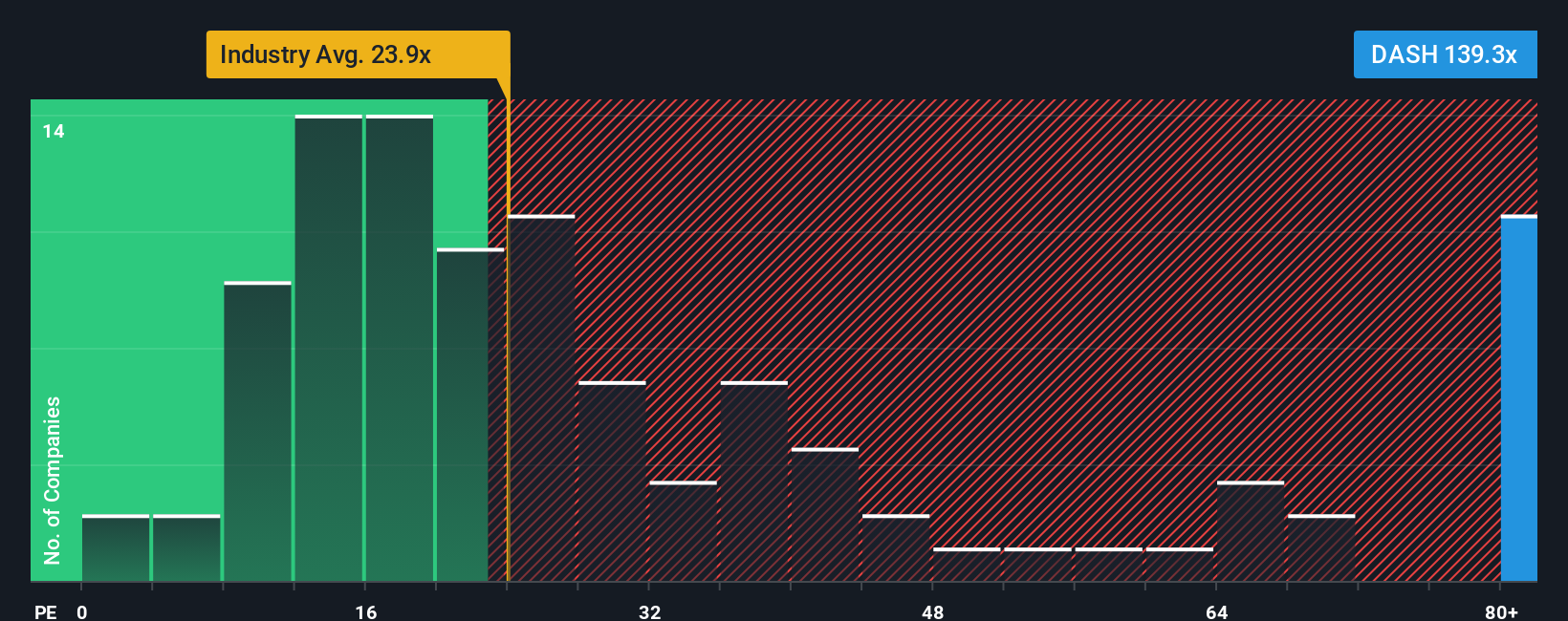

On simple price to earnings math, the story looks very different. DoorDash trades around 110 times earnings, versus a fair ratio of 50.4 times, 23.6 times for the wider US hospitality space, and 33.6 times for peers, implying investors are paying a steep premium for future growth.

That premium might prove justified if forecasts land, but if sentiment cools and the market drifts closer to the fair ratio, the downside could be painful. How much multiple risk are you really comfortable holding here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoorDash Narrative

If you see things differently or want to stress test the numbers yourself, you can spin up a custom narrative in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding DoorDash.

Ready to Find Your Next Big Idea?

Do not stop at one opportunity; use the Simply Wall Street Screener now to uncover fresh, data driven ideas before the crowd catches on.

- Capitalize on potential mispricings by scanning these 907 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations.

- Ride powerful technology tailwinds by targeting these 26 AI penny stocks positioned at the forefront of artificial intelligence adoption.

- Lock in income potential by focusing on these 12 dividend stocks with yields > 3% that offer reliable yields above 3 percent and room for long term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026