- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

Can DoorDash’s Drone Delivery Ambitions Justify the Recent Surge in Stock Price?

Reviewed by Bailey Pemberton

Thinking about what to do with DoorDash stock right now? You are not alone. After a blockbuster year that has seen shares rally an incredible 98.3% over the past 12 months and over 65% year-to-date, investors are both excited and a little nervous. Just in the last month, the price popped another 14.1%, and even this last week delivered a respectable gain of 3.4%. There is clearly momentum behind this stock, but every jump brings new questions about whether the valuation is keeping up with reality or outpacing it.

Recent news has kept things interesting. DoorDash is stepping up innovation with plans to test autonomous flying drone deliveries out of San Francisco, adding yet another potential growth driver to their already ambitious roadmap. The company also recently recruited the head of Spotify’s ad business as their Chief Revenue Officer, signaling a serious push into new revenue streams. Analysts are taking note, too. UBS recently hiked its price target for DoorDash to $260, reflecting shifting sentiment and raised expectations across the board.

Of course, beneath the headlines and fast-moving share price, serious investors always circle back to valuation. On our six-point undervaluation checklist, DoorDash scores a two. That is, two out of six methods suggest the stock is undervalued right now. Before you make your next move, let’s walk through exactly how those valuation methods stack up, and why a more nuanced view might matter even more than number crunching alone.

DoorDash scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: DoorDash Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model forecasts a company’s future free cash flows and then discounts those projected numbers back to today’s dollars, aiming to estimate what the business is truly worth right now. For DoorDash, this approach hinges on cash flow projections that factor in both current performance and future growth expectations.

Currently, DoorDash generates free cash flow of $1.72 Billion. Analyst estimates suggest strong growth in the coming years, with projections up to 2029 indicating free cash flow could reach $7.46 Billion. Beyond these analyst estimates, later years are extrapolated to show continued momentum, with cash flows still rising by 2035 according to Simply Wall St's calculations. All these projections are in US dollars.

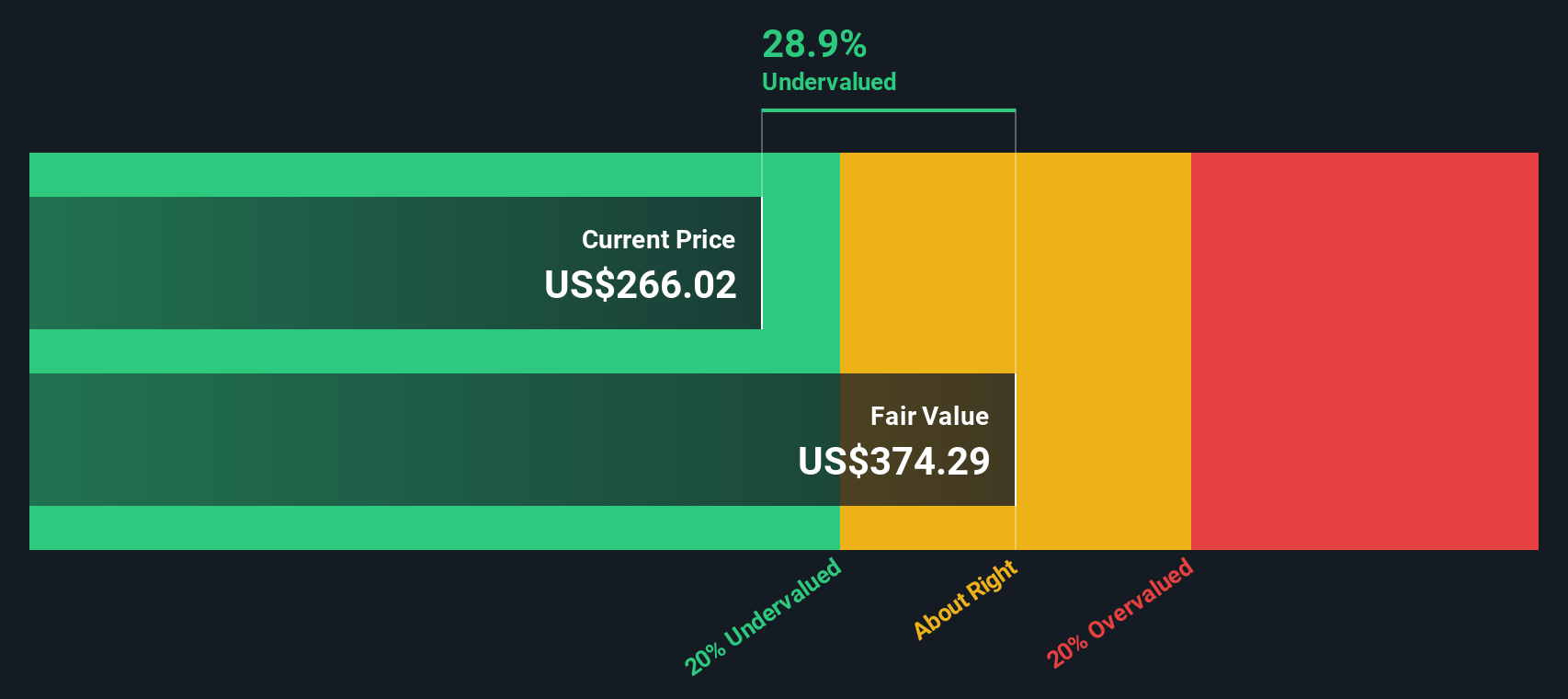

Crunching the numbers, the DCF model arrives at an estimated intrinsic value for DoorDash of $373.25 per share. Compared to the current prevailing share price, this represents a sizable intrinsic discount of 24.5%. In other words, the stock is considered 24.5% undervalued by this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DoorDash is undervalued by 24.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: DoorDash Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is a popular metric for valuing growth companies like DoorDash, especially when earnings are volatile or reinvested back into expanding the business. This ratio compares a company’s stock price with its revenue, making it handy for evaluating high-growth businesses that may not yet be consistently profitable but are rapidly scaling their top-line sales.

In general, a “normal” or “fair” P/S ratio is shaped by growth expectations and perceived risks. Companies expected to grow sales quickly often command higher multiples, while those with sluggish revenue growth typically trade at lower ones. However, too high of a ratio can signal the market is overly optimistic, or that risks are being overlooked.

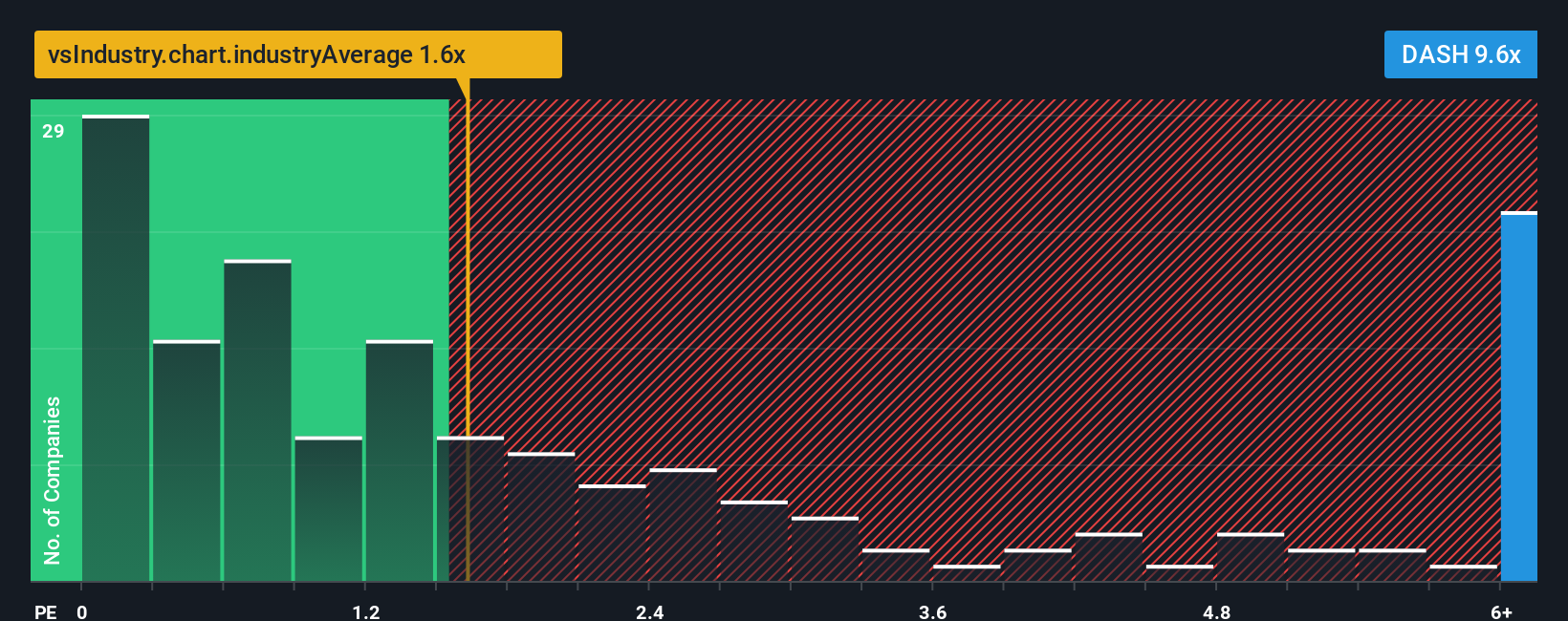

Currently, DoorDash trades at a P/S ratio of 10.1x. This is considerably higher than both the Hospitality industry average of 1.7x and the peer group average of 5.2x. But raw comparisons can be misleading, as they do not factor in DoorDash's unique mix of growth, margins, scale, and risk profile. The Simply Wall St “Fair Ratio” is designed to estimate what multiple is justified for DoorDash given its specific fundamentals and outlook. For DoorDash, the Fair Ratio is 6.8x, which sits well above the industry and peer averages but below the stock’s current P/S.

The advantage of the Fair Ratio is that it adjusts for more than just industry trends. It reflects DoorDash’s actual potential and business quality, incorporating factors like projected sales growth, profitability, and market capitalization. When comparing the current P/S (10.1x) to the Fair Ratio (6.8x), the gap suggests DoorDash is trading above where fundamentals alone would put it.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DoorDash Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, accessible way for you to tell the story behind your assumptions about a company, such as how you believe DoorDash will grow its revenues, expand margins, and overcome challenges.

Narratives link together your personal view of DoorDash’s business story, a financial forecast built on those beliefs, and an estimate of what the stock is really worth, all in one place. Unlike static analysis, Narratives make valuation dynamic, letting you adjust your outlook as new information (like earnings or news) comes in.

On Simply Wall St's platform, millions of investors are already using Narratives on the Community page to compare fair value to the current share price and decide when the odds favor buying or selling. This tool gives you full visibility into how different assumptions drive different outcomes. It is designed so anyone can use it, whether you are a beginner or a professional.

For example, some investors see DoorDash expanding successfully into new international markets and automation, projecting a fair value as high as $360, while others are more cautious due to competitive and regulatory pressures, with estimates as low as $205.

Narratives empower you to make smarter, more personalized decisions by connecting your reasoning directly to the numbers.

Do you think there's more to the story for DoorDash? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion