- United States

- /

- Hospitality

- /

- NasdaqGS:CZR

Caesars Entertainment (CZR): Assessing Valuation After Times Square Casino Setback and Mounting Investor Concerns

Reviewed by Kshitija Bhandaru

If you’re watching Caesars Entertainment (CZR) right now, you’re not alone. The recent rejection of its proposed $5.4 billion Times Square casino project by New York’s Community Advisory Committee has thrown the stock into the spotlight, with volatility spiking in the aftermath. Local concerns over crime and traffic proved too much for the project to move forward, putting one of Caesars’ most ambitious growth bets on ice and stirring up new conversations about the company’s next move.

This setback comes as the company grapples with flatlining revenue expansion and shrinking earnings. Over the past year, Caesars Entertainment’s share price has shed 38%. Long-term investors have seen a 56% decline over five years. Momentum remains challenged given investor concerns around the company’s high debt load and softer recent performance, even as it rolls out new products and announces additions or removals from major indices.

After such a tough stretch and a high-profile project setback, is Caesars Entertainment now trading at a discount? Or is the market bracing for even tougher times ahead? Let’s dig into the current valuation.

Most Popular Narrative: 37.7% Undervalued

According to the most widely followed narrative, Caesars Entertainment is deeply undervalued. Analysts view the stock as trading at a significant discount to its fair value based on medium-term growth catalysts and digital expansion.

Strategic capital allocation into property renovations, new amenity rollouts (such as room remodels and high-return upgrades like Flamingo's pool experience), and slot machine enhancements are already showing positive returns and are set to unlock additional property-level revenue and margin expansion over coming years.

What is fueling this bullish outlook? Analysts point to a bold blend of growth investments and a digital transformation that could reshape margins. Want to know the assumptions that justify such a sharp disconnect between current price and fair value? There is one especially surprising forecast helping shape this narrative. Curious yet?

Result: Fair Value of $41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Caesars' heavy debt burden and shifting customer preferences could derail growth if digital adoption or Las Vegas demand softens unexpectedly.

Find out about the key risks to this Caesars Entertainment narrative.Another View: What Does Our DCF Model Say?

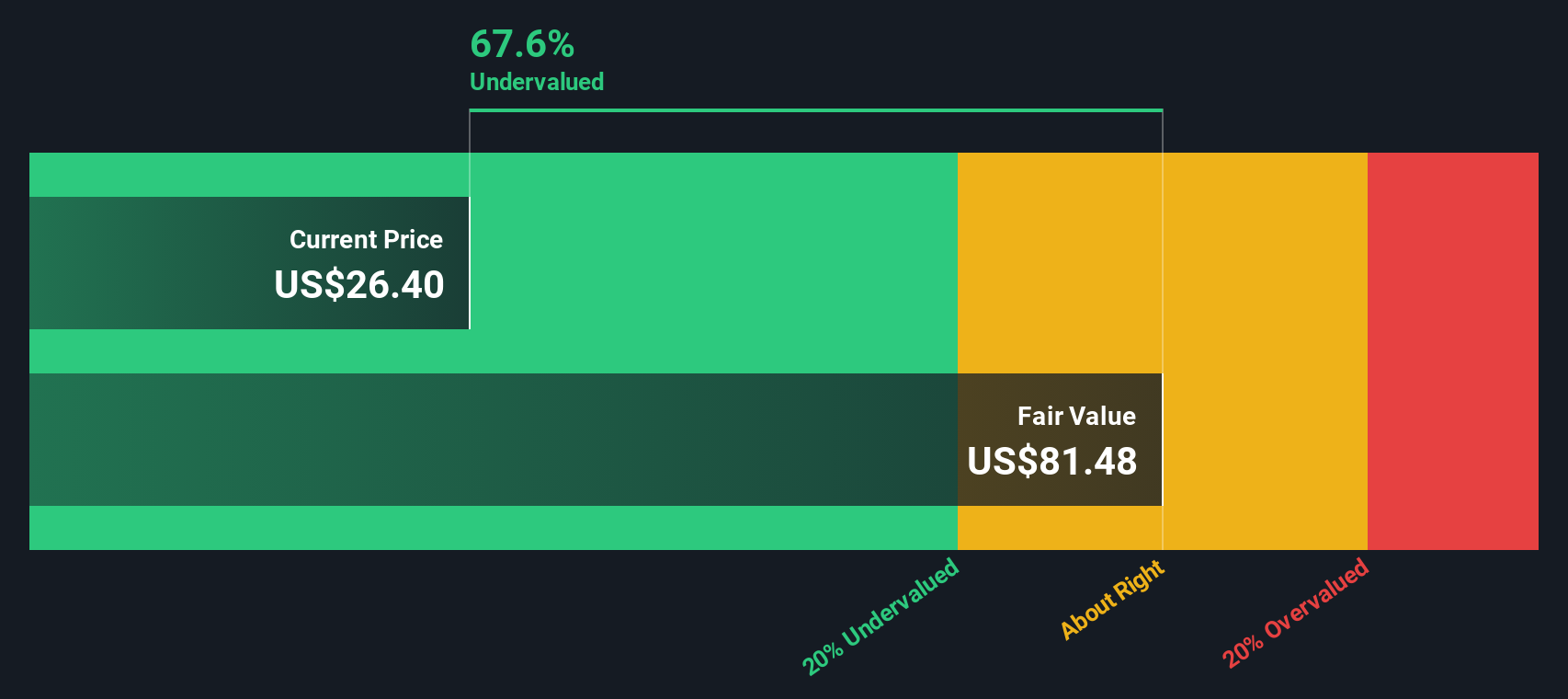

Turning to our DCF model for an in-depth cross-check, the analysis also points to Caesars being undervalued. This approach digs into cash flows and long-term fundamentals. Could this method reveal hidden value, or are the risks being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Caesars Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Caesars Entertainment Narrative

If the latest results have you thinking differently, or you want to check the numbers for yourself, you can quickly create your own narrative from scratch. Do it your way with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Caesars Entertainment.

Looking for More Standout Investment Ideas?

There’s a whole world of opportunities beyond Caesars. Don’t let them pass you by. Take the next step and put your portfolio ahead of the curve with handpicked stock ideas from our powerful tools below.

- Boost your income potential as you target reliable returns with dividend stocks with yields > 3%, built to highlight stocks that consistently deliver strong yields.

- Spot the innovators riding the unstoppable artificial intelligence wave using AI penny stocks, ideal for finding companies shaping tomorrow’s digital landscape.

- Jump on tomorrow’s value leaders by uncovering hidden gems trading well below their intrinsic worth through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CZR

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives