- United States

- /

- Hospitality

- /

- NasdaqCM:CNTY

Market Cool On Century Casinos, Inc.'s (NASDAQ:CNTY) Revenues Pushing Shares 29% Lower

Century Casinos, Inc. (NASDAQ:CNTY) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

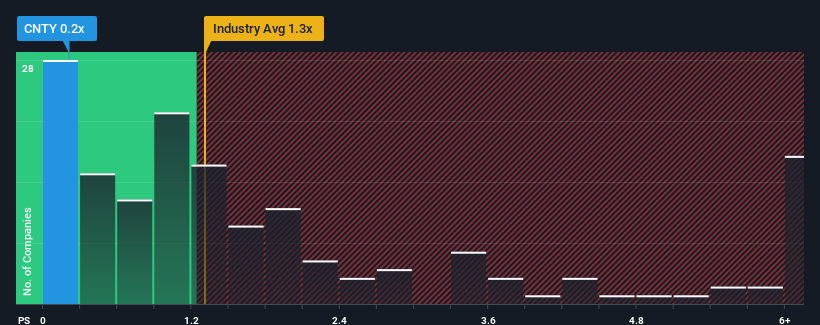

Since its price has dipped substantially, considering around half the companies operating in the United States' Hospitality industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider Century Casinos as an solid investment opportunity with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Century Casinos

What Does Century Casinos' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Century Casinos has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Century Casinos' future stacks up against the industry? In that case, our free report is a great place to start.How Is Century Casinos' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Century Casinos' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The strong recent performance means it was also able to grow revenue by 78% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 20% over the next year. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Century Casinos' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Century Casinos' P/S

The southerly movements of Century Casinos' shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Century Casinos' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for Century Casinos that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CNTY

Century Casinos

Operates as a casino entertainment company in the United States, Canada, and Poland.

Very undervalued with imperfect balance sheet.

Market Insights

Community Narratives