- United States

- /

- Hospitality

- /

- NasdaqGS:CHDN

Why We're Not Concerned About Churchill Downs Incorporated's (NASDAQ:CHDN) Share Price

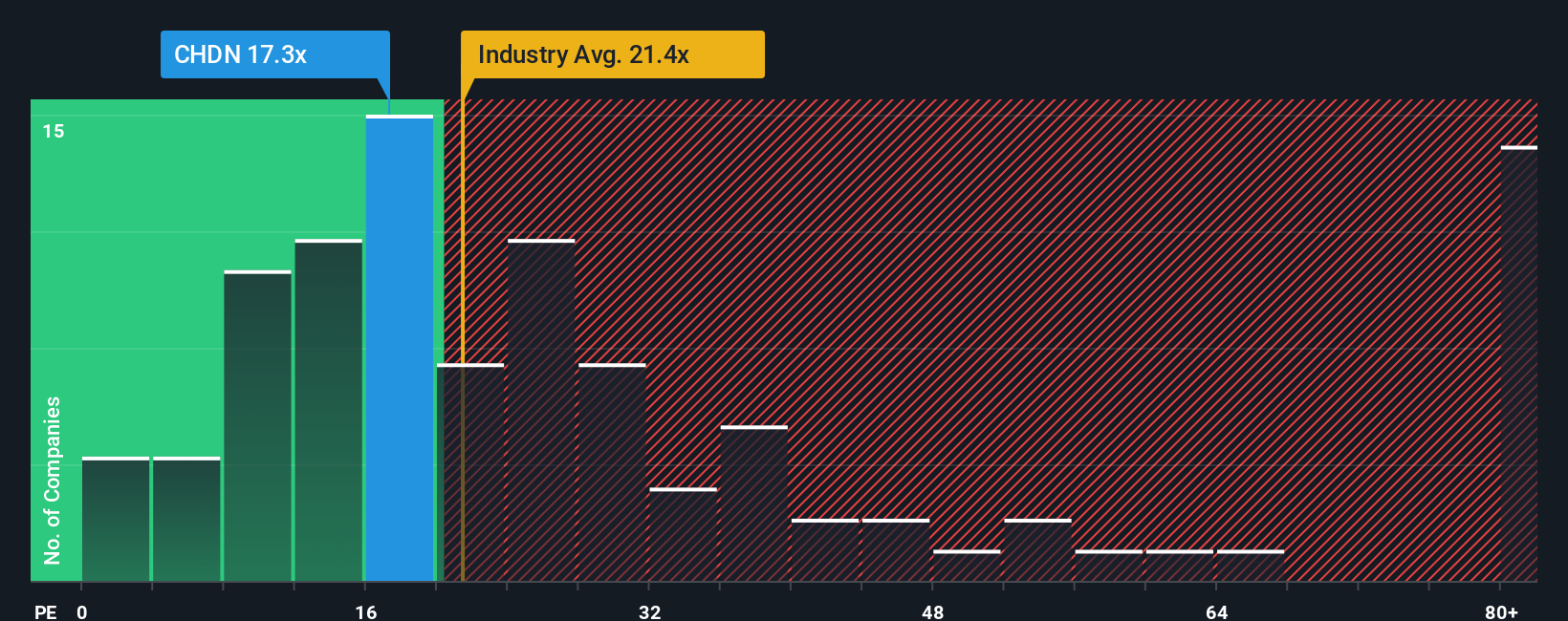

With a median price-to-earnings (or "P/E") ratio of close to 18x in the United States, you could be forgiven for feeling indifferent about Churchill Downs Incorporated's (NASDAQ:CHDN) P/E ratio of 17.3x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Churchill Downs' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Churchill Downs

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Churchill Downs' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 8.5% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 16% as estimated by the ten analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 16%, which is not materially different.

In light of this, it's understandable that Churchill Downs' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Churchill Downs' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Churchill Downs maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 1 warning sign for Churchill Downs that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CHDN

Churchill Downs

Operates live and historical racing entertainment venues, online wagering businesses, and regional casino gaming properties in the United States.

Very undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives