- United States

- /

- Hospitality

- /

- NasdaqGS:CHDN

Is There Opportunity in Churchill Downs After 30% Slide and Gaming Regulatory Uncertainty?

Reviewed by Bailey Pemberton

If you are holding, watching, or simply wondering what is next for Churchill Downs, you are not alone. With shares now at $95.98 and the stock off 30% over the past year, investors are right to ask if this is a bargain or a sign to stay away. Despite a rocky year, this is not just a story about declines. Over the past five years Churchill Downs has actually posted a 14.3% gain, and while recent one-month and year-to-date numbers are negative, the long-term backdrop still holds some promise for patient hands.

What really matters now is valuation, especially after the sharp drops we have seen. There is plenty of talk around market sentiment shifting following regulatory rumblings across the gaming industry, but that turbulence could be creating real opportunities. Our current valuation score for Churchill Downs comes in at a perfect 6 out of 6, meaning the company ticks off every single box for being undervalued by our criteria. In other words, there may be more substance behind the recent pullback than just nerves.

So how exactly are we evaluating Churchill Downs and what do these numbers really mean for investors? Let’s break down the valuation approaches. After that, we will explore an even more insightful way to look at value for this storied name.

Why Churchill Downs is lagging behind its peers

Approach 1: Churchill Downs Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s value. This approach helps investors understand what a business is really worth based on its expected ability to generate cash in the years ahead.

In the case of Churchill Downs, the company’s latest twelve months free cash flow stands at $176.6 million. Analyst estimates see this free cash flow increasing steadily, with projections reaching $645.9 million by 2026 and $954.5 million by 2035. These longer-term forecasts are based on analyst estimates for the next five years and then extrapolated out, highlighting an expected continuation of growth in cash generation capabilities.

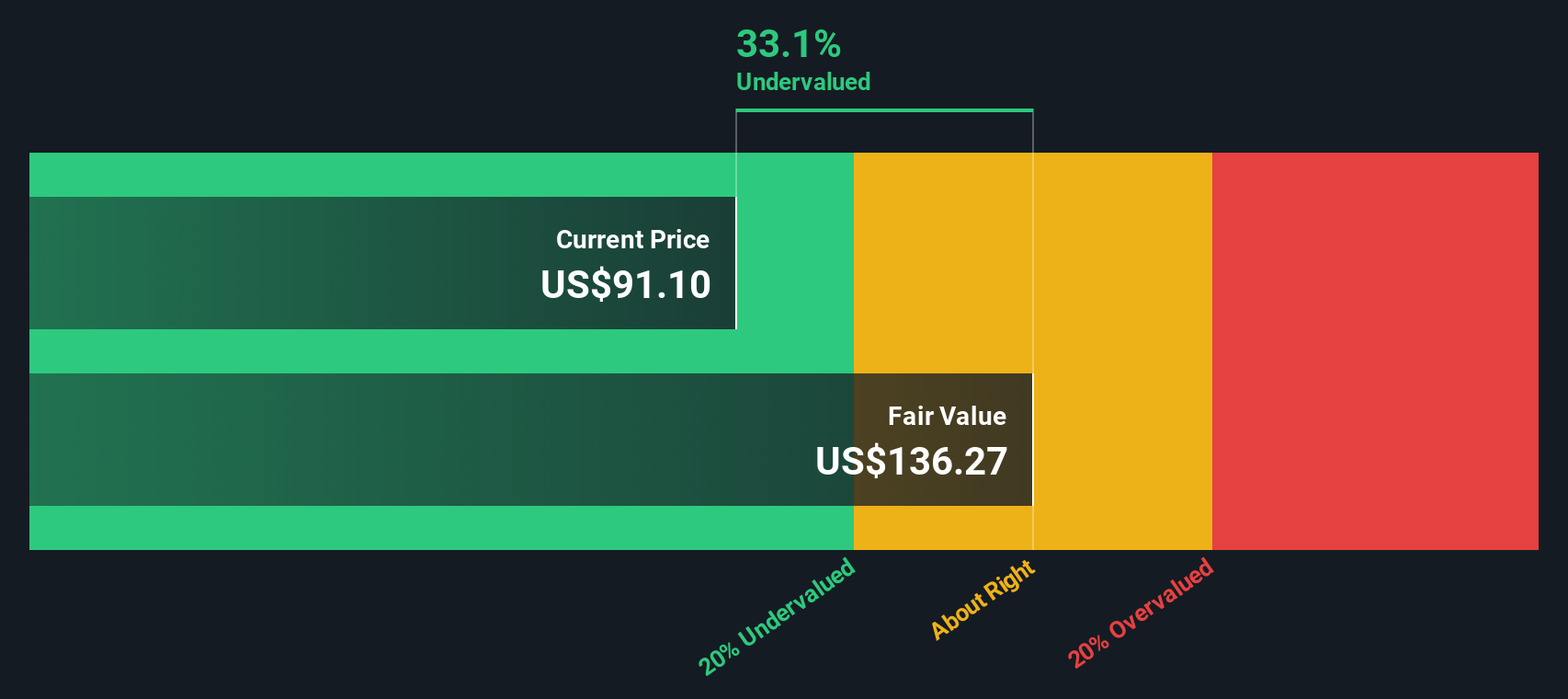

Taking all these numbers into account, the DCF model produces an intrinsic value of $137.61 per share using the 2 Stage Free Cash Flow to Equity method. Compared to the current share price of $95.98, this suggests the stock is 30.3% undervalued.

This sizable discount points to a potential bargain for investors willing to look past recent volatility, as the cash flow outlook remains robust based on these projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Churchill Downs is undervalued by 30.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Churchill Downs Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is widely recognized as an effective way to value profitable companies because it links a company’s share price directly to its underlying earnings. For businesses steadily generating profits like Churchill Downs, the PE ratio gives investors a quick lens on what they’re paying relative to actual earnings, helping them gauge whether the stock offers good value at current levels.

However, what constitutes a “fair” PE ratio can vary significantly based on growth prospects, profitability, risk profile, and the broader market landscape. Generally, faster-growing or lower-risk companies command higher PE multiples, while slower or riskier businesses tend to trade at lower values. Comparing Churchill Downs’ current PE ratio to its industry and peers helps provide context, but these benchmarks do not always capture a company’s unique strengths and circumstances.

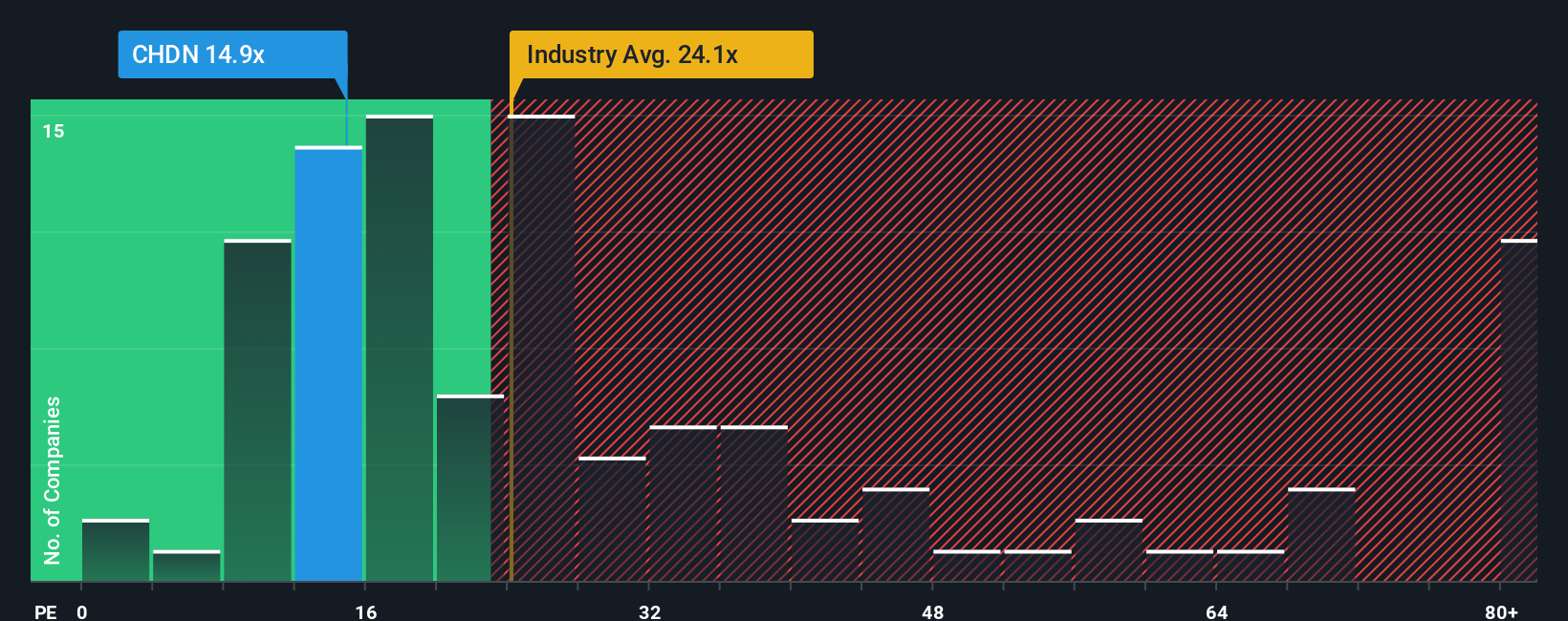

At present, Churchill Downs trades at a PE ratio of 15.66x. This is well below the industry average of 24.37x and the average of its peers at 35.80x, suggesting a potential discount relative to the sector. Simply Wall St’s Fair Ratio, however, goes further by tailoring the benchmark multiple to reflect the company’s specific earnings growth, margins, risks, and market cap. For Churchill Downs, the Fair Ratio stands at 21.09x, which more accurately adjusts for all these relevant factors than standard industry or peer comparisons.

Comparing Churchill Downs’ current 15.66x PE to its Fair Ratio of 21.09x, the stock appears undervalued by PE standards. This more holistic view indicates that investors may be underappreciating its future potential at current prices.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Churchill Downs Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives, a smart, approachable tool that goes beyond the numbers to capture the why behind an investment decision.

A Narrative is your personal investment story about Churchill Downs. You connect key business drivers and market outlook with your beliefs about future revenue, earnings, and margins, ultimately arriving at your own fair value for the stock.

Narratives work by linking the company’s story to a financial forecast and then to a price that makes sense for you, all within a structure that makes complex analysis accessible to everyone.

Available on Simply Wall St’s Community page, Narratives are used by millions of investors to weigh the evidence, adjust forecasts, and decide whether Churchill Downs’ potential upside matches their convictions. Because these Narratives are kept fresh as news or results come in, your fair value stays relevant.

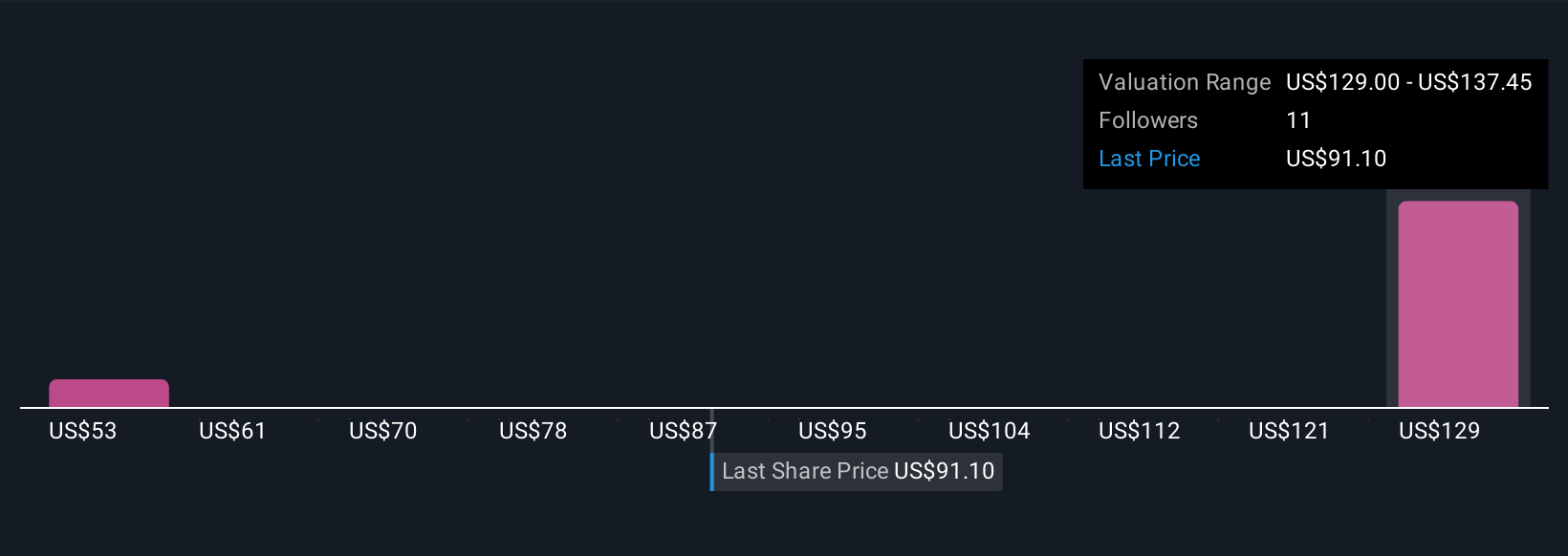

For example, one Narrative might see strong growth in premium Derby experiences and digital wagering, leading to a target price of $155. Another focused on regulatory risks and declining interest, estimates a fair value closer to $125.

With Narratives, you get a dynamic, transparent framework to compare your fair value to the current market price and strengthen your decision to buy, sell, or hold.

Do you think there's more to the story for Churchill Downs? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHDN

Churchill Downs

Operates live and historical racing entertainment venues, online wagering businesses, and regional casino gaming properties in the United States.

Very undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives