- United States

- /

- Hospitality

- /

- NasdaqGS:CHDN

Did New Middle East Races Just Shift Churchill Downs' (CHDN) Global Growth Narrative?

Reviewed by Sasha Jovanovic

- In the past week, Churchill Downs Incorporated announced the addition of three new international races, the UAE 2000 Guineas, the Saudi Derby, and the Dubai Road to the Kentucky Derby Stakes, to its Road to the Kentucky Derby points system.

- This move aims to broaden global engagement with the Kentucky Derby by providing new qualifying pathways for international horses and strengthening the event's presence in emerging racing markets.

- We'll examine how the inclusion of Middle East qualifying races could influence Churchill Downs' worldwide brand appeal and long-term growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Churchill Downs Investment Narrative Recap

To be a shareholder in Churchill Downs, you need to believe the company can sustain growth by expanding the Kentucky Derby’s brand reach and by evolving its gaming and media assets. While the announcement of new Middle East qualifying races broadens international participation, it does not appear to be a material catalyst for Churchill Downs’ short-term financial results or address the company’s biggest current risk: its reliance on horse racing and venue-specific performance, which continues to expose revenue to volatility.

Among recent announcements, the approval of a new US$500 million share repurchase program stands out. This development is particularly relevant as it reflects management’s commitment to returning capital to shareholders, which could help counterbalance near-term operational risks and provide support during periods of market uncertainty.

However, investors should also consider that, despite new growth efforts, Churchill Downs’ concentration in live and historical racing venues means revenue can still be vulnerable if...

Read the full narrative on Churchill Downs (it's free!)

Churchill Downs' narrative projects $3.2 billion in revenue and $541.1 million in earnings by 2028. This requires a 4.2% yearly revenue growth and a $111.2 million earnings increase from $429.9 million currently.

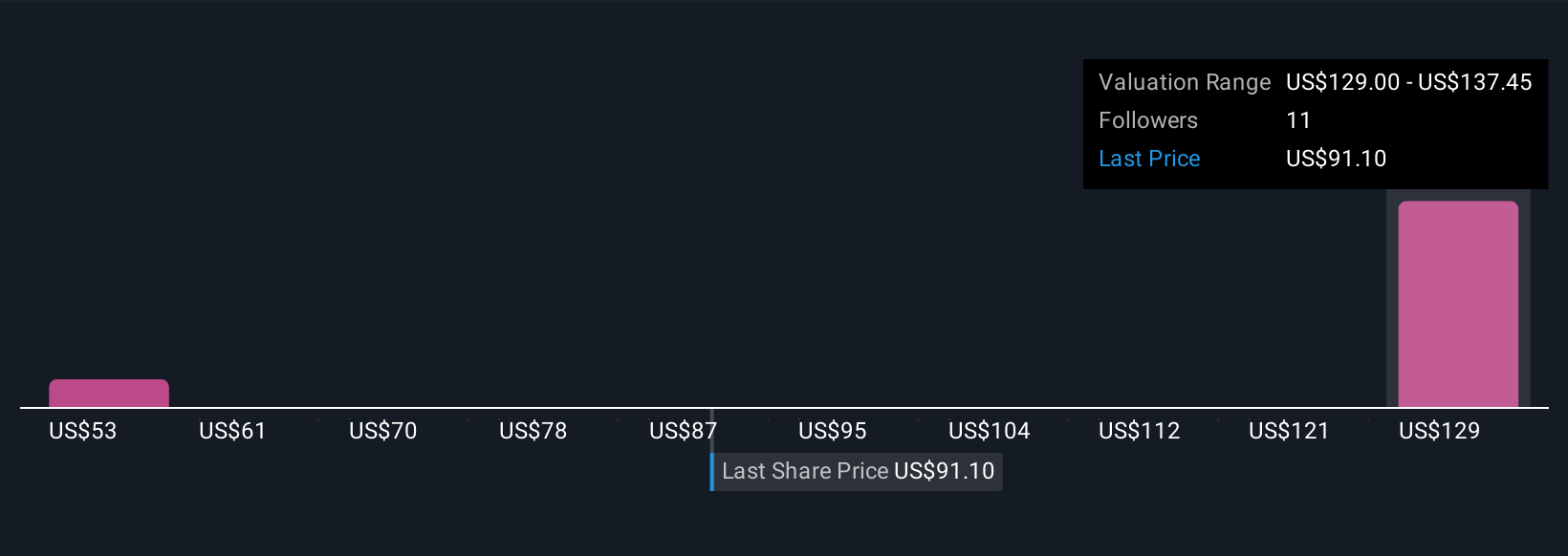

Uncover how Churchill Downs' forecasts yield a $137.45 fair value, a 52% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community estimates Churchill Downs’ fair value across a wide range, from US$52.87 to US$137.45, based on three distinct perspectives. Given this diversity, and the company’s exposure to shifts in demand for traditional racing, you may want to compare multiple viewpoints before making decisions.

Explore 3 other fair value estimates on Churchill Downs - why the stock might be worth as much as 52% more than the current price!

Build Your Own Churchill Downs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Churchill Downs research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Churchill Downs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Churchill Downs' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHDN

Churchill Downs

Operates live and historical racing entertainment venues, online wagering businesses, and regional casino gaming properties in the United States.

Very undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives