- United States

- /

- Hospitality

- /

- NasdaqGS:CHDN

Churchill Downs (CHDN): Margin Decline Challenges Narrative of Consistent High-Quality Growth

Reviewed by Simply Wall St

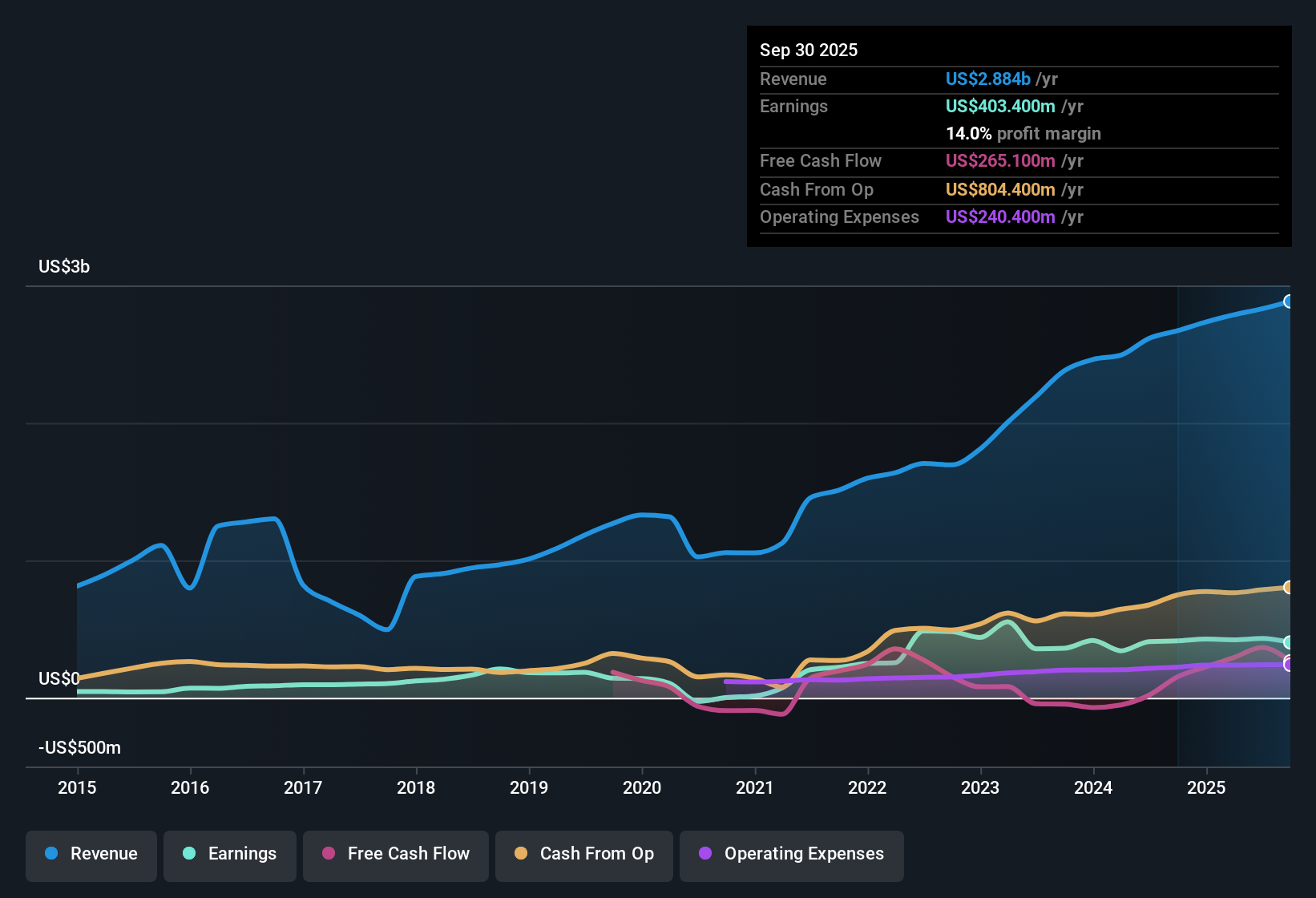

Churchill Downs (CHDN) posted a net profit margin of 14%, down from 15.4% the previous year, as earnings growth reversed from the previous trajectory of 21.7% growth per year to a decline over the latest period. The stock is currently trading at $103.68, significantly below the estimated fair value of $148.07. The forward outlook shows earnings expected to grow 7.2% per year and revenue to rise 3.7% annually. With a price-to-earnings ratio of 17.9x that undercuts peers and the broader US hospitality industry, investors will note that, despite recent margin pressure, Churchill Downs remains attractively valued and supported by forecasts for moderate ongoing growth.

See our full analysis for Churchill Downs.Now, let’s see how these fresh earnings numbers compare to the narratives that shape market expectations. Where do the numbers reinforce the consensus, and where do they present a challenge?

See what the community is saying about Churchill Downs

DCF Fair Value Sits 43% Above Share Price

- At $103.68 per share, Churchill Downs trades well below its DCF fair value of $148.07. This represents a market discount of about 43% versus modeled intrinsic value.

- Analysts' consensus view is that this discount is supported by expectations for profit margins to increase from 15.2% to 16.9% within three years. However, they caution that ongoing capital spending on new venues and venue enhancements could limit upside if investments do not drive the forecast revenue and margin gains.

- Consensus expects annual revenue growth at 4.2% and earnings to reach $541.1 million by September 2028. Outcomes are expected to depend heavily on the company’s ability to convert expansions and digital growth into lasting operating leverage.

- The required price/earnings multiple implied by consensus targets for 2028 (20.6x) remains below current industry levels, which adds some upside leeway. This is only the case if Churchill Downs delivers on those improved fundamentals.

Curious what drives the consensus outlook for Churchill Downs? See the full input behind analysts’ expectations and where the risks may outweigh the upside: 📊 Read the full Churchill Downs Consensus Narrative.

Share Count Set to Drop by 4.59% Each Year

- Consensus expects Churchill Downs to reduce its number of shares outstanding by about 4.59% annually for the next three years, primarily through buybacks and disciplined capital return.

- Consensus narrative emphasizes that shrinking share count could amplify earnings per share growth relative to headline profit figures, assuming the business achieves its targeted expansion in premium Derby offerings, experiential gaming, and recurring digital revenue streams.

- Long-term media rights agreements and digital expansion are positioned to support these shareholder returns. Analysts note that successful execution is required to offset competitive and regulatory headwinds in core gaming markets.

- The reduction in share count augments free cash flow per share, which is a key factor underpinning valuations even if total profit rises more modestly than in recent years.

Valuation Still Under Peers Despite Recent Hurdles

- The company’s price-to-earnings ratio stands at 17.9x, well below its peer group’s 36.2x and the US hospitality industry average of 24.3x. This marks Churchill Downs as comparatively undervalued despite last year’s slip in net profit margin from 15.4% to 14%.

- Consensus narrative argues this discount strongly supports the investment case, pointing to five-year historical annualized earnings growth of 21.7% as evidence that Churchill Downs, even amid near-term margin pressure, offers better relative value and earnings stability than most listed competitors.

- Continued investment in Derby experiences and HRM venues is credited for bolstering growth durability. Analysts remain cautious, however, that the business’s reliance on horse racing and regulatory-sensitive markets could pressure multiples if competitive pressures intensify.

- Recent moderation in margin and growth trajectories is flagged as a balancing factor for valuation optimism, indicating the market is cautious but not pricing in business model deterioration.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Churchill Downs on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different angle on the latest results? You can quickly shape your own perspective and contribute your narrative: Do it your way.

A great starting point for your Churchill Downs research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Churchill Downs trades at a discount and has a history of strong growth, recent margin pressure and slowing earnings highlight concerns about steady future expansion.

If you want companies that consistently deliver reliable gains through market ups and downs, use stable growth stocks screener (2090 results) to focus on those with proven, stable growth records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHDN

Churchill Downs

Operates live and historical racing entertainment venues, online wagering businesses, and regional casino gaming properties in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion