- United States

- /

- Hospitality

- /

- NasdaqGS:CAKE

Is Cheesecake Factory Still Attractive After Its 74.6% Three Year Share Price Surge?

Reviewed by Bailey Pemberton

- Investors may be wondering if Cheesecake Factory at around $51.66 is still a treat for value focused investors, or if most of the upside has already been served.

- The stock has climbed 3.6% over the last week and 17.3% in the past month, adding to a 9.0% gain over the last year and a 74.6% return over three years.

- Recent headlines have focused on the company expanding its restaurant footprint and leaning into off premise and digital channels, which investors often read as a signal of confidence in future demand. At the same time, analysts and commentators have been revisiting the casual dining space overall, weighing consumer spending resilience against cost pressures and competitive dynamics.

- On our framework, Cheesecake Factory scores a 3/6 valuation check, suggesting pockets of undervaluation but not across the board. Next, we will break down what different valuation approaches indicate about that number, before finishing with a more intuitive way to understand what the market is really pricing in.

Approach 1: Cheesecake Factory Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to todays dollars. For Cheesecake Factory, the model uses a 2 Stage Free Cash Flow to Equity approach based on cash flow projections.

The company generated around $157.1 Million in free cash flow over the last twelve months, and analysts expect this to moderate to about $151.7 Million by 2026 and $133 Million by 2027. Beyond those years, Simply Wall St extrapolates the trend, with free cash flow gradually easing to roughly $137.2 Million by 2035.

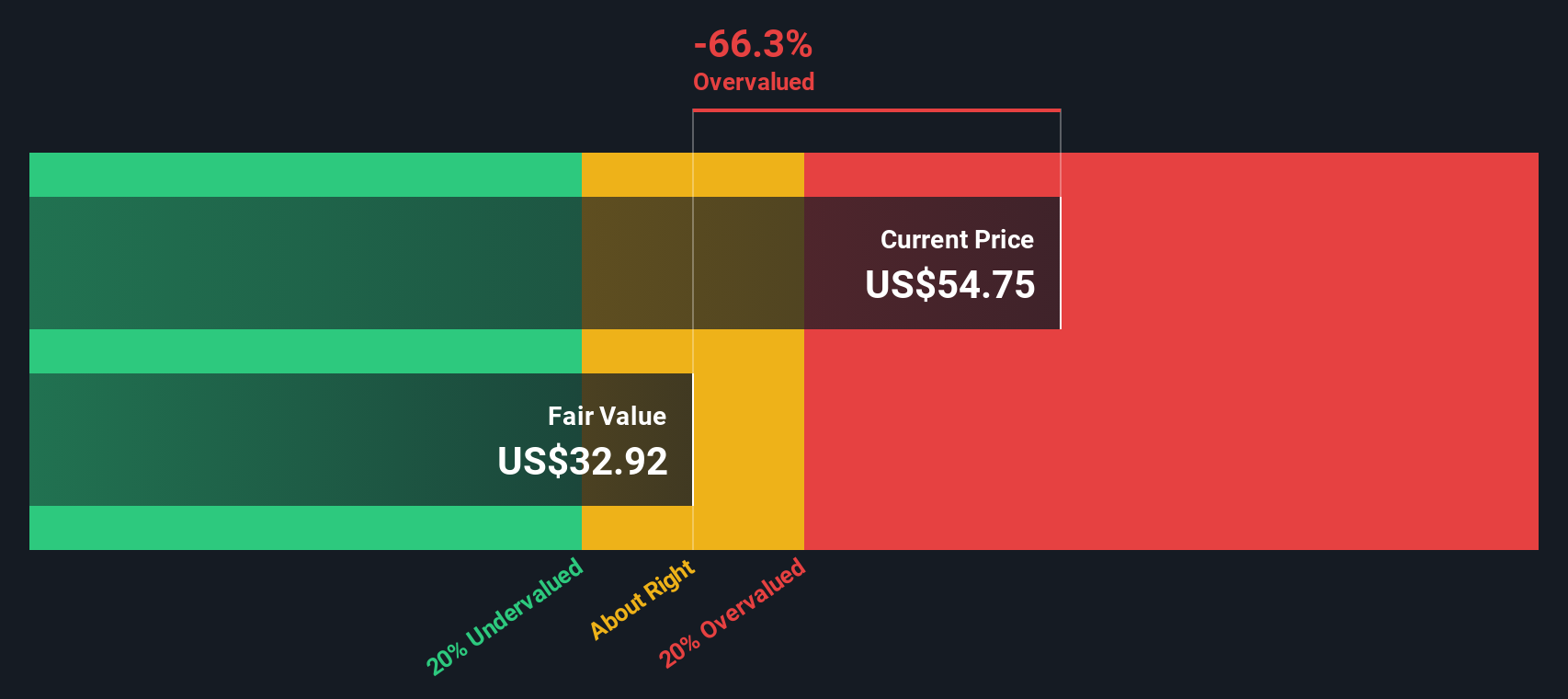

When all these projected cash flows are discounted back to today and combined with a terminal value, the model arrives at an intrinsic value of about $29.90 per share. Against a recent share price near $51.66, the DCF suggests the stock is roughly 72.8% overvalued on this methodology.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cheesecake Factory may be overvalued by 72.8%. Discover 918 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cheesecake Factory Price vs Earnings

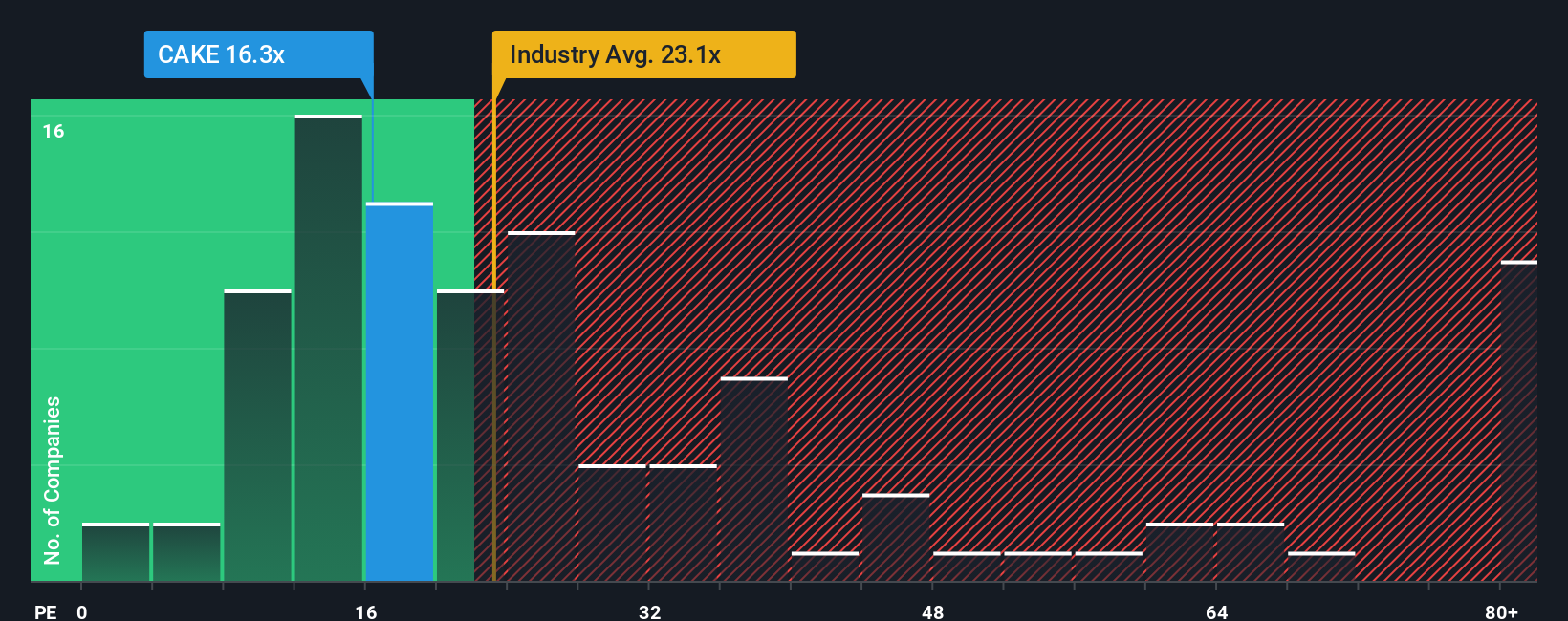

For profitable companies like Cheesecake Factory, the price to earnings ratio is often the most intuitive way to judge valuation, because it links what investors are paying directly to the profits the business is generating today. A higher or lower PE usually reflects how the market is weighing the company’s growth prospects and risk profile, with faster growing, lower risk businesses typically deserving a higher “normal” multiple, and slower or riskier names sitting on lower ones.

Cheesecake Factory currently trades on about 16.0x earnings, which is below both the broader Hospitality industry average of roughly 23.5x and the peer group average of around 33.1x. Simply Wall St’s Fair Ratio framework estimates that, given Cheesecake Factory’s earnings growth outlook, margins, scale and risk factors, a more appropriate PE multiple would be closer to 18.6x. This Fair Ratio is more informative than a simple peer or industry comparison because it explicitly adjusts for the company’s own growth, profitability, risk profile, industry and market capitalization, rather than assuming all restaurant stocks deserve the same multiple.

With the Fair Ratio of 18.6x sitting above the current 16.0x, the PE view suggests Cheesecake Factory is trading at a discount to what its fundamentals might justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cheesecake Factory Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce Narratives, a simple way for you to attach a clear story to your numbers by spelling out what you think will happen to Cheesecake Factory’s future revenue, earnings, and margins, linking that story to a financial forecast and then to a fair value that you can easily compare with today’s share price to decide whether to buy, hold, or sell.

On Simply Wall St’s Community page, Narratives are an accessible tool used by millions of investors. They continually update when new information such as earnings, news, or guidance comes in, so your fair value does not stay static while the world changes around the company.

For example, one Cheesecake Factory Narrative might assume strong multi brand expansion, improving margins and a fair value near $74 per share. Another more cautious Narrative could assume slower growth, lower profitability and a fair value closer to $59 per share, showing how two investors looking at the same business can reasonably arrive at very different, but clearly explained, price tags.

Do you think there's more to the story for Cheesecake Factory? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAKE

Cheesecake Factory

Operates and licenses restaurants in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion