- United States

- /

- Hospitality

- /

- NasdaqGS:CAKE

Cheesecake Factory (CAKE): Exploring Valuation After Recent Share Gains and Analyst Upgrades

Reviewed by Simply Wall St

Cheesecake Factory (CAKE) has continued to attract investor attention with steady share performance over the past month. The stock edged up about 2% in the last week, maintaining a positive trend this year.

See our latest analysis for Cheesecake Factory.

Momentum is starting to build for Cheesecake Factory, with a 14.2% year-to-date share price return. This reflects renewed confidence after a rocky stretch earlier this year. Long-term investors have enjoyed a 34.5% total shareholder return over the past year, which reinforces the stock’s underlying resilience against broader market swings.

If you're interested in what else could surprise the market, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with the stock’s solid run and recent analyst upgrades, investors need to ask: is Cheesecake Factory still trading at a compelling value, or is the market already baking in all of its upside potential?

Most Popular Narrative: 25% Undervalued

According to Zwfis, Cheesecake Factory’s estimated fair value of $73.83 stands well above the recent close of $55.40, suggesting considerable upside. The valuation reflects the brand’s momentum and a new long-term outlook, setting the stage for further debate about the company’s next expansion phase.

The potential that CAKE holds over the next 10 years makes me very eager to continue to buy into this company. As I see them as a potential growth company, they also hold in my opinion as a Value/Dividend company as well, which makes them even more attractive.

Curious about what drives this bullish stance? The narrative leans into bold projections around future store openings, margin improvements, and an annual return forecast that is higher than many expect. Find out what is fueling this optimism and the key figures that could shift Wall Street’s perspective by reading the full outlook.

Result: Fair Value of $73.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected shifts in consumer spending or cost pressures could challenge these optimistic projections and change the current growth narrative for Cheesecake Factory.

Find out about the key risks to this Cheesecake Factory narrative.

Another View: Discounted Cash Flow Tells a Different Story

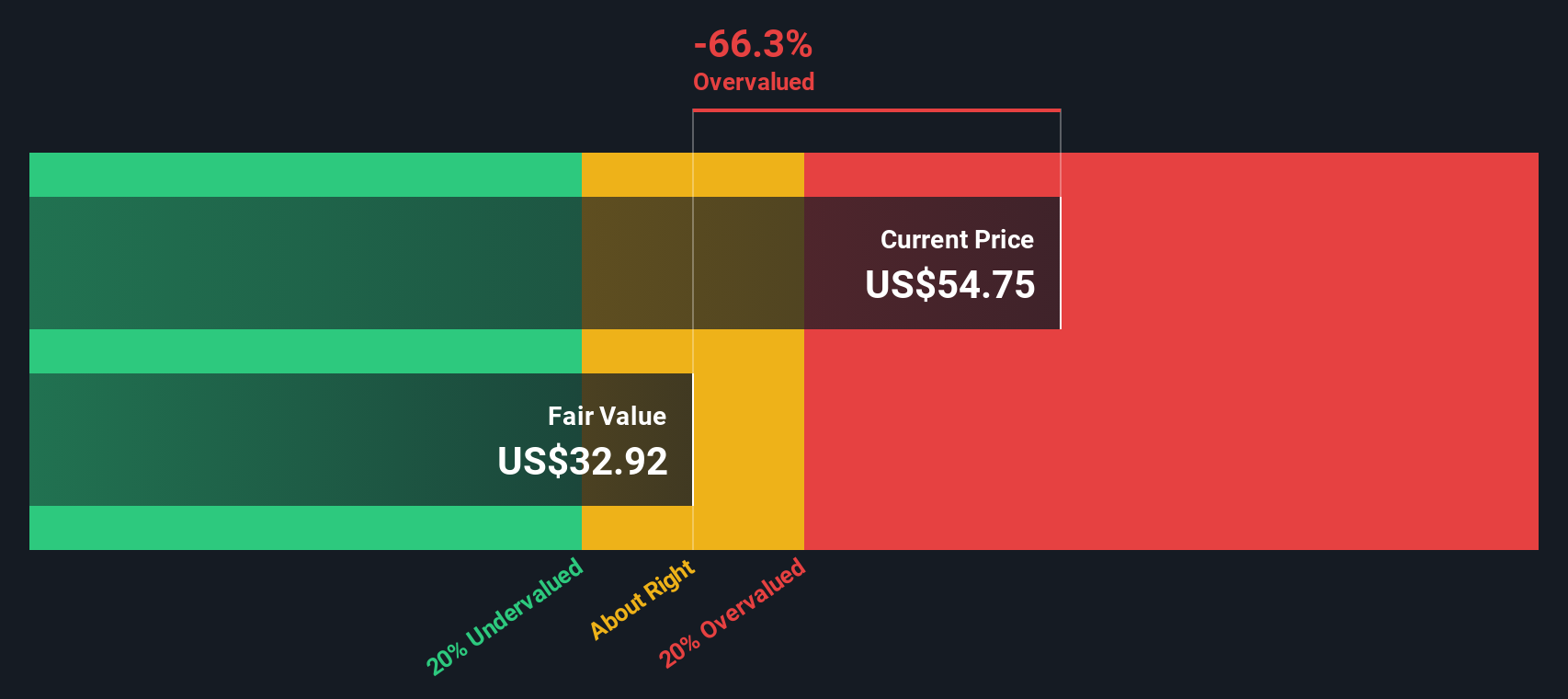

Looking at Cheesecake Factory through the lens of our DCF model brings a more cautious outlook. The SWS DCF model suggests the current share price is actually sitting above its intrinsic value, which points to potential overvaluation even though other metrics might suggest otherwise. Which story will the market believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cheesecake Factory for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cheesecake Factory Narrative

If you see things differently or would rather rely on your personal research, you have the tools to craft your own perspective in just minutes. Do it your way

A great starting point for your Cheesecake Factory research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one opportunity when other smart picks are just a step away. Use these handpicked lists and make your next investment move confidently:

- Capture the biggest yields in the market by uncovering these 17 dividend stocks with yields > 3% offering attractive income streams that stand out from the crowd.

- Get ahead of the curve with early movers in artificial intelligence by tapping into these 24 AI penny stocks poised for explosive growth.

- Secure your spot among those who spot rare market value by targeting these 880 undervalued stocks based on cash flows trading at discounts based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAKE

Cheesecake Factory

Operates and licenses restaurants in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives