- United States

- /

- Hospitality

- /

- NasdaqGS:BKNG

Assessing Booking Holdings After Stock Dip and Ryanair Lawsuit Resolution in 2025

Reviewed by Bailey Pemberton

If you are a Booking Holdings shareholder, or just eyeing the stock with some curiosity, you may be wondering if recent volatility is a sign to buckle up or an opportunity to get in. After all, it is not every day you see a company with Booking’s size dip by 9.5% over the last month, while at the same time, its three- and five-year gains are more than 180%. Year to date, it is essentially flat, hanging just above the line at 0.5%, and last week alone saw a 4.6% drop. What is driving these moves?

Some of the recent turbulence has centered around headline-grabbing stories, such as Booking’s legal dispute with Ryanair finally heading towards resolution. While that saga may have added some uncertainty, long-term optimism does not appear to have disappeared. Instead, these bumps may present value opportunities for those willing to look past the noise.

Speaking of value, Booking Holdings currently has a value score of 4 out of 6 based on a set of undervaluation checks. This means the company passes four different measures that suggest it is attractively priced right now, which may be worth considering for anyone reassessing their portfolio.

But what exactly goes into that score, and what can investors really learn from the standard menu of valuation methods? Let us take a closer look at how Booking stacks up. There is also a clearer way to judge valuation that will be discussed at the end.

Approach 1: Booking Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting those predictions back to today’s value. For Booking Holdings, this approach relies on its ability to generate significant free cash flow now and in the years ahead.

Currently, Booking Holdings delivers a robust trailing twelve months Free Cash Flow of $9.15 billion. According to analyst projections, that number is expected to trend upwards each year, reaching $12.53 billion by 2029. Beyond the analyst horizon, Simply Wall St extrapolates Booking’s free cash flow to climb steadily over a ten-year span, potentially exceeding $16 billion by 2035.

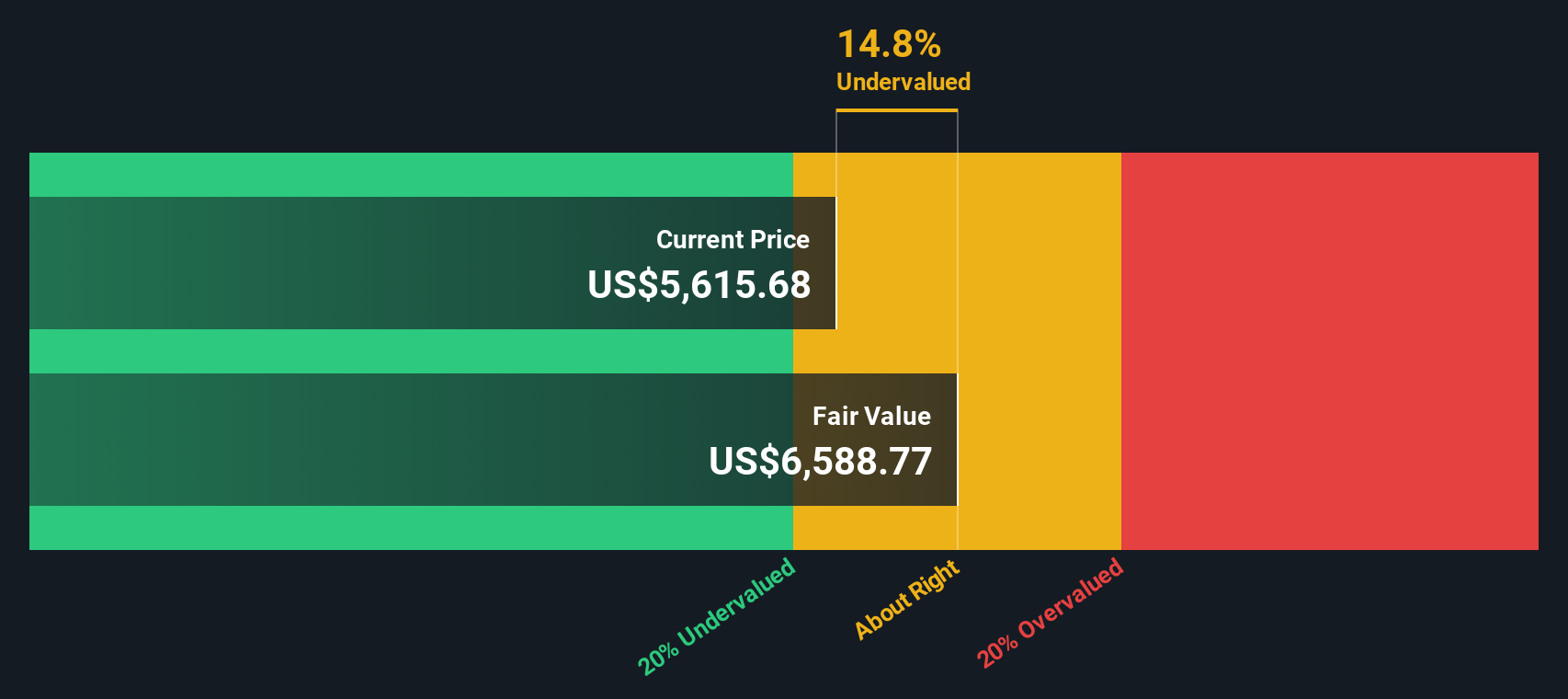

After discounting all these future cash flows back to present value, the model estimates Booking Holdings' intrinsic value at $6,846 per share. Compared to the recent market price, this implies the stock is trading at a 27.7 percent discount. This suggests that investors are currently undervaluing its cash-generating potential and long-term growth prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Booking Holdings is undervalued by 27.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Booking Holdings Price vs Earnings

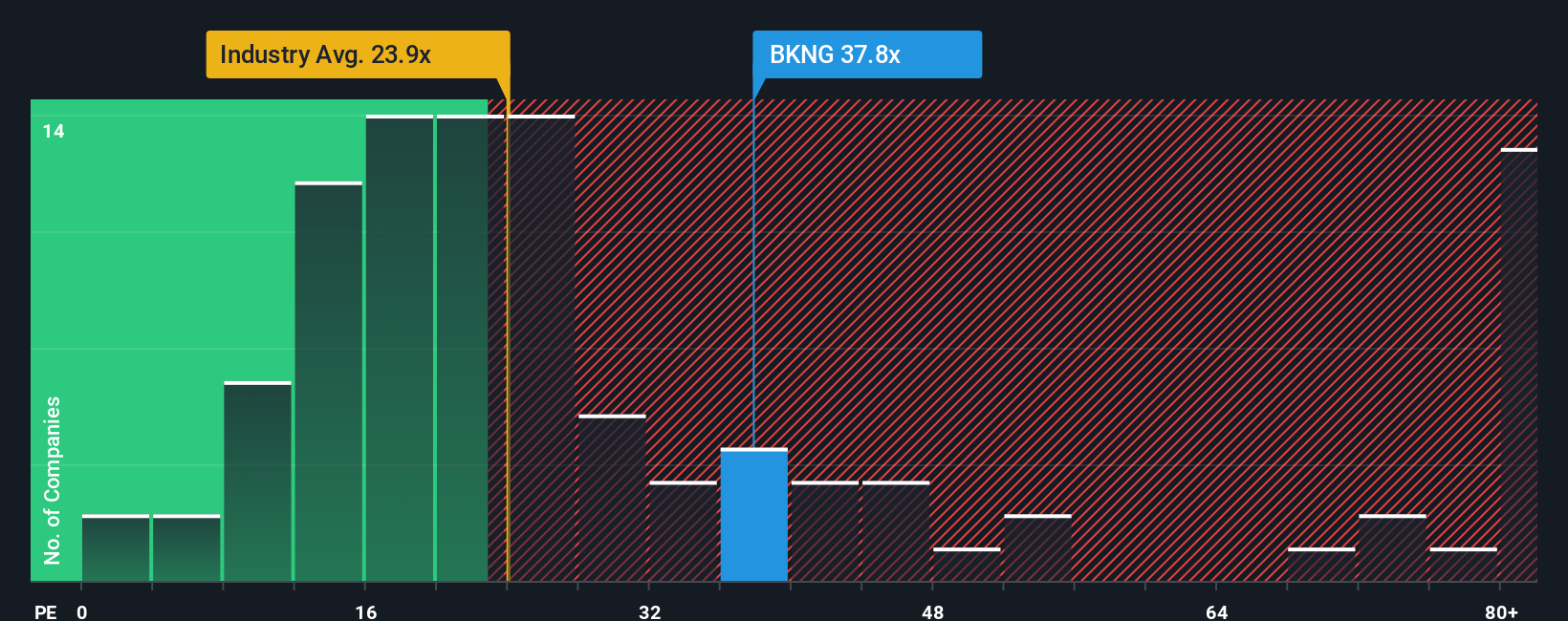

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Booking Holdings because it links a company's share price to its underlying earnings. For businesses consistently generating profits, the PE ratio gives investors a quick way to gauge how much the market is willing to pay for each dollar of earnings.

Growth expectations and perceived risk play a major role in shaping what constitutes a “normal” or fair PE ratio for any stock. Companies expected to grow earnings faster typically see higher PE ratios, whereas higher perceived risks or uncertain outlooks tend to push valuations down. Comparing a company’s PE ratio against benchmarks can offer valuable context.

As of now, Booking Holdings trades at a PE ratio of 33.3x. This is a premium over the Hospitality industry average of 23.4x and also ahead of the peer average at 29.4x. However, these benchmarks may not fully account for Booking’s specific strengths, growth trajectory, or risks.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, at 38.8x for Booking Holdings, incorporates a range of factors, including earnings growth, profit margins, market cap, risks, and industry dynamics. This results in a more tailored view than a simple comparison with industry or peers. It aims to answer what a reasonable multiple is for this particular business at this point in time.

When comparing the Fair Ratio (38.8x) to Booking’s actual PE of 33.3x, the numbers are close but still indicate some headroom. This suggests the stock is modestly undervalued according to this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Booking Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story and perspective about a company, combining your own beliefs and insights with the numbers, such as your assumptions about future revenue, profit margins, and what the business is really worth.

Narratives take you beyond simple ratios by linking your story to a financial forecast and then determining a fair value. This turns what can feel like guesswork into a structured and intuitive process. On Simply Wall St's Community page, millions of investors use Narratives as an easy, accessible tool to decide when a stock is overvalued or undervalued, comparing their calculated Fair Value to the current Price in real time.

Because Narratives update dynamically when new earnings, news, or company updates come in, they make it easy to stay informed and adjust your position. For example, some Booking Holdings Narratives currently project a bullish fair value as high as $7,218 per share (based on strong AI integration and partnership growth), while more cautious perspectives estimate a fair value closer to $5,200 (highlighting rising costs and geopolitical risks).

Do you think there's more to the story for Booking Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booking Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKNG

Booking Holdings

Provides online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives