The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Ark Restaurants Corp. (NASDAQ:ARKR) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Ark Restaurants

How Much Debt Does Ark Restaurants Carry?

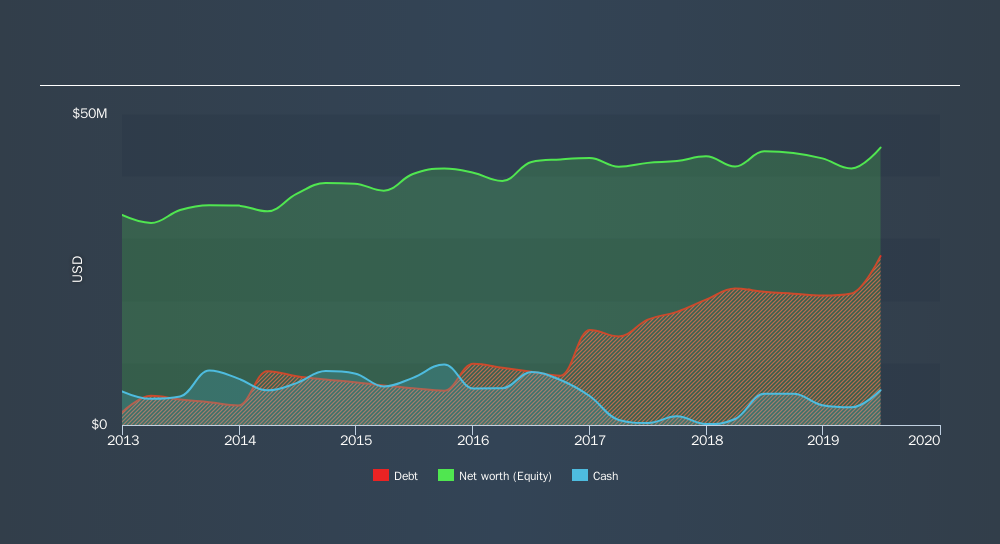

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Ark Restaurants had US$27.2m of debt, an increase on US$21.4m, over one year. On the flip side, it has US$5.58m in cash leading to net debt of about US$21.6m.

How Strong Is Ark Restaurants's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Ark Restaurants had liabilities of US$17.8m due within 12 months and liabilities of US$27.4m due beyond that. On the other hand, it had cash of US$5.58m and US$4.15m worth of receivables due within a year. So it has liabilities totalling US$35.5m more than its cash and near-term receivables, combined.

Ark Restaurants has a market capitalization of US$70.0m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Ark Restaurants has net debt worth 1.8 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 5.5 times the interest expense. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Also relevant is that Ark Restaurants has grown its EBIT by a very respectable 23% in the last year, thus enhancing its ability to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But it is Ark Restaurants's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Ark Restaurants recorded free cash flow of 30% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On our analysis Ark Restaurants's EBIT growth rate should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. For example, its conversion of EBIT to free cash flow makes us a little nervous about its debt. When we consider all the factors mentioned above, we do feel a bit cautious about Ark Restaurants's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Ark Restaurants's dividend history, without delay!

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:ARKR

Ark Restaurants

Through its subsidiaries, owns and operates restaurants and bars in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives