- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Should Airbnb Co-Founder’s White House Appointment Shape Investor Views on ABNB’s Design-Led Ambitions?

Reviewed by Simply Wall St

- In August 2025, President Donald Trump appointed Airbnb co-founder Joe Gebbia as the nation’s first Chief Design Officer, placing him at the helm of the new National Design Studio to modernize federal digital services and locations under the "America by Design" executive order.

- This move highlights the federal government’s recognition of design leadership from the private sector, directly elevating Airbnb’s reputation in technology and user experience innovation.

- We'll examine how Gebbia’s new government role spotlights Airbnb’s design credibility and could influence its long-term investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Airbnb Investment Narrative Recap

To own Airbnb, you need conviction in the company's ability to capture ongoing travel and experience trends, especially the shift toward longer stays and unique accommodations, while combating slowing growth in mature markets and mounting regulatory scrutiny. Joe Gebbia’s appointment as Chief Design Officer signals continued recognition of Airbnb’s design prowess but isn't likely to meaningfully affect key near-term drivers like bookings momentum or regulatory pressures facing short-term rentals in major cities.

The most relevant company announcement alongside this government news is Airbnb's ongoing share repurchase program, with US$4,468.23 million in shares bought back so far. While buybacks can boost per-share metrics and signal management’s confidence, they don’t address Airbnb’s most immediate business risks or unlock new revenue, meaning the core catalysts and challenges for the business remain unchanged in the short term.

On the other hand, investors should be aware that... heightened political scrutiny and regulatory action can quickly shift the risk profile for Airbnb’s business.

Read the full narrative on Airbnb (it's free!)

Airbnb's outlook anticipates $15.4 billion in revenue and $3.7 billion in earnings by 2028. This scenario assumes a 10.1% annual revenue growth rate and a $1.1 billion increase in earnings from the current $2.6 billion.

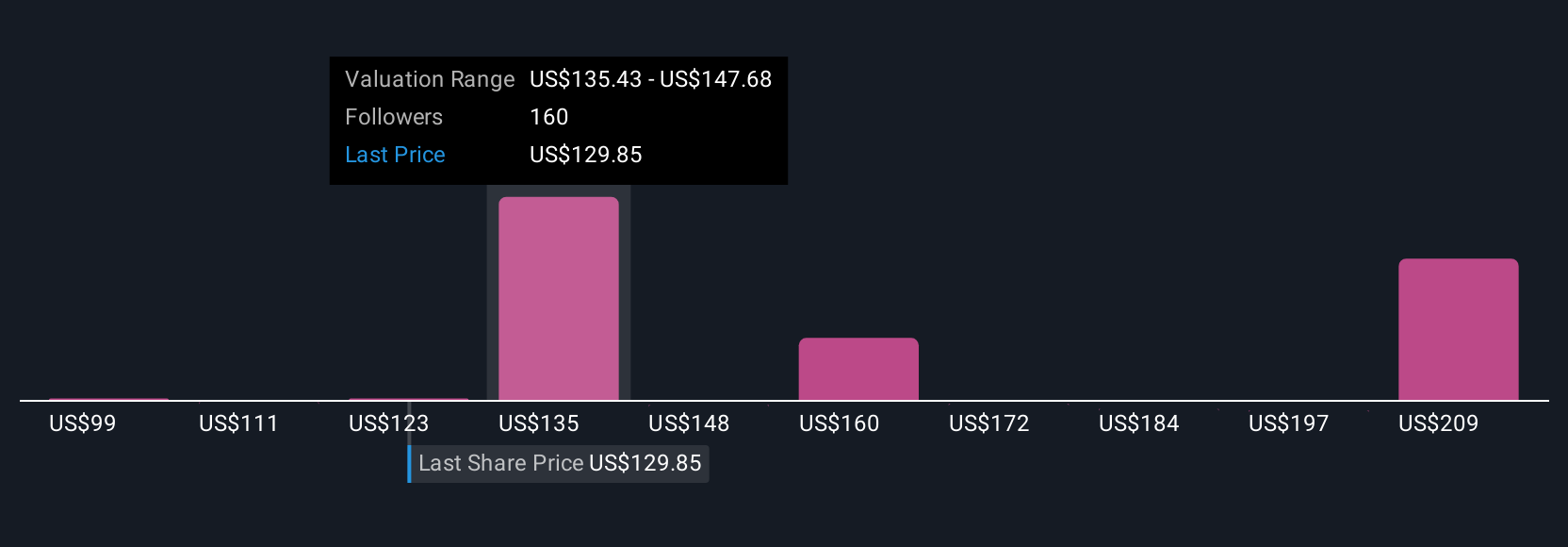

Uncover how Airbnb's forecasts yield a $140.40 fair value, a 8% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts were expecting Airbnb's international revenues to grow quicker than consensus, projecting US$16.4 billion in revenue and US$4.2 billion in earnings by 2028. If you believe Airbnb will accelerate global expansion and Experiences adoption even faster, despite new risks spotlighted by recent headlines, consider that expert opinions really do vary. Explore what might change these forecasts as you read further.

Explore 31 other fair value estimates on Airbnb - why the stock might be worth 23% less than the current price!

Build Your Own Airbnb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbnb research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Airbnb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbnb's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives