- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Airbnb (NasdaqGS:ABNB) Reports $154 Million Net Income Decline in Q1 2025 Earnings

Reviewed by Simply Wall St

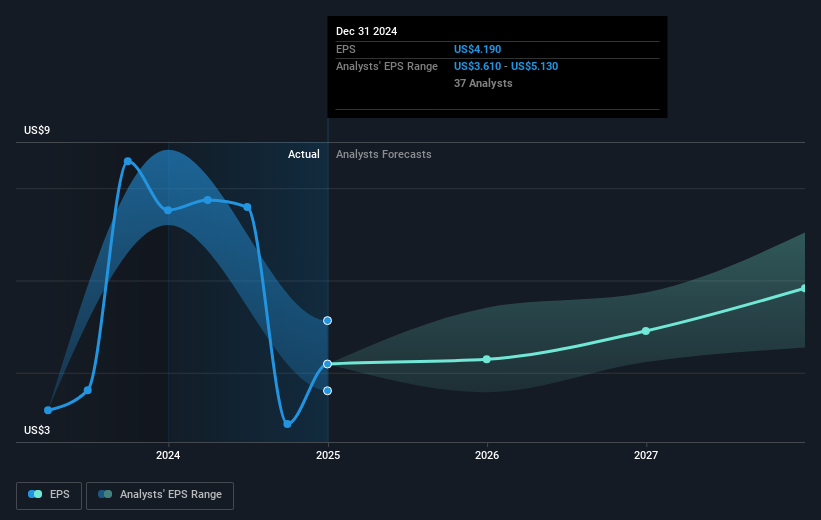

Airbnb (NasdaqGS:ABNB) recently announced its Q1 2025 earnings, demonstrating a sales increase to $2,272 million, though net income declined to $154 million from the previous year. Alongside this, the company provided optimistic guidance for Q2 2025, expecting revenue growth of up to 11%, aided by Easter holiday timing. Additionally, Airbnb's execution of its share buyback program, involving 6 million shares repurchased last quarter, underscores its commitment to shareholder value. These elements add depth to the company's 20% share price increase over the past month, outperforming the broader market's 4% rise during the same timeframe.

Be aware that Airbnb is showing 1 risk in our investment analysis.

Airbnb's recent Q1 2025 earnings reflect a mixed financial scenario, with sales climbing to US$11.23 billion while net income decreased to US$154 million. The company's committed execution of its share buyback program signals a focus on shareholder returns. Over the past month, Airbnb's share price has surged by 20%, and this upward movement aligns with the company's optimistic forecast for Q2 revenue growth between 9% and 11% due to favorable timing of the Easter holiday. However, despite Airbnb's significant one-month market outperformance of 16%, its three-year total return, including share price appreciation and dividends, stands at 17.49%. This long-term performance highlights a moderate growth over the duration when contextualized with market or industry trends. Over the past year, Airbnb's shares underperformed compared to the US Hospitality industry and broad market, which saw increases of 12.2% and 11.6% respectively.

The recent developments could bolster revenue and earnings forecasts, given the expected benefits from enhanced seasonal demand and operational improvements. On the guidance front, analysts project a revenue growth trajectory of approximately 9% annually, deemed slightly ahead of the broader US market's growth expectation of 8.4%. In terms of earnings, while net earnings growth is anticipated, it remains below the projected pace of US market earnings expansion. The current stock price of US$121.67 reflects a slight discount to the consensus price target of US$139.06. However, it remains 34.7% below the more bullish price target of US$186.39, highlighting investor sentiment that may hinge on Airbnb meeting or exceeding growth expectations while navigating continued regulatory and market competition challenges.

Assess Airbnb's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives