- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart's (NYSE: WMT) Insider are Slowing Down, But Institutions aren't Done Yet

After a superb performance earlier this year, Walmart Inc. ( NYSE: WMT ) experienced one of the deepest sell-offs recently, owing to an underwhelming earnings report.

While already substantial, we'll explore arguments for the potential continuation of the downslide.

Q1 Earnings Report

- Non-GAAP EPS: US$1.30 (miss by US$0.18)

- Revenue: US$141.6b (beat by US$3.55b)

- Revenue growth: +2.4% Y/Y

Other highlights

- U.S. comparable sales: +3%

- E-commerce growth: +1%

- Q2 guidance: flat EPS

- FY 2022 outlook: EPS decrease 1%

So far, it seems that the market is spooked by the miss and negative guidance on EPS. However, we must remember that multiple factors negatively influence the company's bottom line, like supply chain issues, inflationary pressures on consumers' spending, higher freight costs due to rising energy prices, and hiring issues.

For example, the company recently announced a College2Career program to fast-track recent college graduates into store manager positions with a US$65,000 per year starting salary and compensation reaching US$200,000 within 2 years. Even so, they're not sure whether they'll have enough store managers in the following years.

Interestingly, Saudi Arabia's sovereign wealth fund reduced its share in Walmart by 52,3%, taking it down to around 790,000 shares, while Gates Foundation Trust reduced its stake by 56.3% to 3.02m shares. In light of those events, it is insightful to check other significant transactions, especially those by the insiders.

View our latest analysis for Walmart

The Last 12 Months Of Insider Transactions At Walmart

The Executive VP & CFO, M. Biggs, made the biggest insider sale in 12 months. That single transaction was for US$4.8m worth of shares at US$151 each.That means that an insider was selling shares at around the current price of US$148.

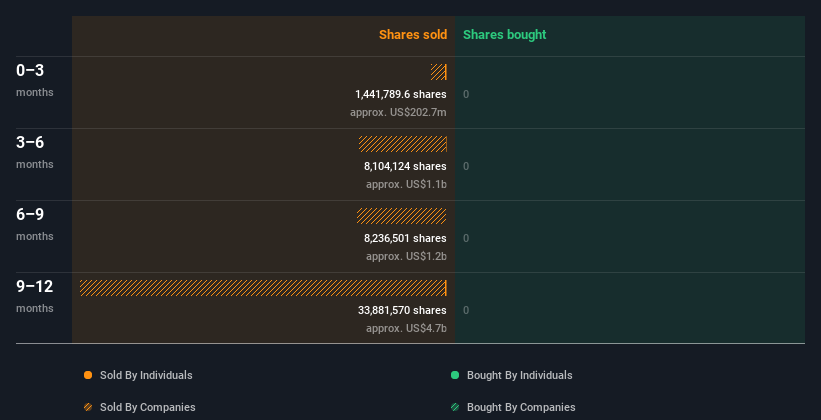

Insiders in Walmart didn't buy any shares in the last year.You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below.If you want to know exactly who sold, how much, and when, simply click on the graph below!

If you're looking for the opposite, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership and Transactions at Walmart

Many investors like to check how much of a company is owned by insiders.High insider ownership often makes company leadership more mindful of shareholder interests.Walmart insiders own about US$3.7b worth of shares (which is 0.9% of the company).Most shareholders would be happy to see this sort of insider ownership since it suggests that management incentives are well aligned with other shareholders.

The last three months saw significant insider selling at Walmart.Specifically, insiders ditched US$14m worth of shares in that time, and we didn't record any purchases whatsoever.Overall this makes us a bit cautious, but it's not the be-all and end-all.

So What Does This Data Suggest About Walmart?

Walmart had some disappointing results in the last few months, growing below the anticipated rate. Although it operates in an inflation-resilient sector, it doesn't mean that such a large business can quickly adjust.

Despite this selloff, we have to point out that the stock trades at a reasonably high price-to-earnings multiple of almost 30x. Even with our data suggesting that insider sales have slowed down, the most recent institutional sale in multiple millions of shares doesn't make us want to jump in, but it certainly puts Walmart on our watchlist .

While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. In terms of investment risks, we've identified 2 warning signs with Walmart , and understanding these should be part of your investment process.

If you would prefer to check out another company, one with potentially superior financials, then do not miss this free list of interesting companies, that have HIGH returns on equity and low debt.

For this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives