- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (WMT) Valuation in Focus After Strong Q2 Growth and New AI Marketplace Initiatives

Reviewed by Simply Wall St

If you have been watching Walmart (WMT) lately, you are not alone. Investors are taking notice after the company’s revenue and net income saw steady gains last quarter. Walmart’s strong comparable sales in both the U.S. and international markets, coupled with a surge in eCommerce and expanding pickup and delivery services, are sending a message to the market that this retail giant is managing to grow even as the industry faces shifting consumer habits. The recent introduction of AI-powered marketplace tools and new seller incentives shows Walmart is not just focused on the present, but actively building for a future where online and offline shopping experiences merge.

The momentum is visible in the numbers. Over the past year, Walmart shares have returned 27%, far outpacing many peers and the general market. While there was some pullback in the past month, the longer-term uptrend is hard to ignore, especially as sales and earnings announcements continue to reflect the company’s ability to adapt and thrive. This year alone, Walmart’s stock has advanced 8%, bolstered by its push into omnichannel retail and innovative seller programs.

So the big question now is, with all this growth and strategic investment, is Walmart’s stock trading at an attractive entry point, or is the market already pricing in the next chapter of its expansion?

Most Popular Narrative: 29.9% Overvalued

The prominent narrative views Walmart’s current share price as significantly higher than its calculated fair value. The argument rests on Walmart’s global reach, its operational scale, and its ability to adapt margins and grow dividends; yet the present valuation is seen as rich relative to future cash flows.

Using modern solutions like AI, Walmart can magnify these economies of scale advantages. A successful expansion to lucrative markets like India will provide the company with further growth.

Ready to be surprised by the financial blueprint behind this bold valuation call? The backbone of this outlook is a cocktail of annual profit and revenue growth, improvements to operating margins, and plans for international expansion that could reshape Walmart’s global role. Discover what happens when strategic assumptions about margins, sales momentum and capital discipline meet expectations for future profit multiples, and see why this narrative pegs fair value far below the stock’s current price.

Result: Fair Value of $74.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected retail theft or shifting consumer habits, such as the rise of weight-loss drugs, could challenge Walmart’s ambitious growth narrative.

Find out about the key risks to this Walmart narrative.Another View: What Does the SWS DCF Model Say?

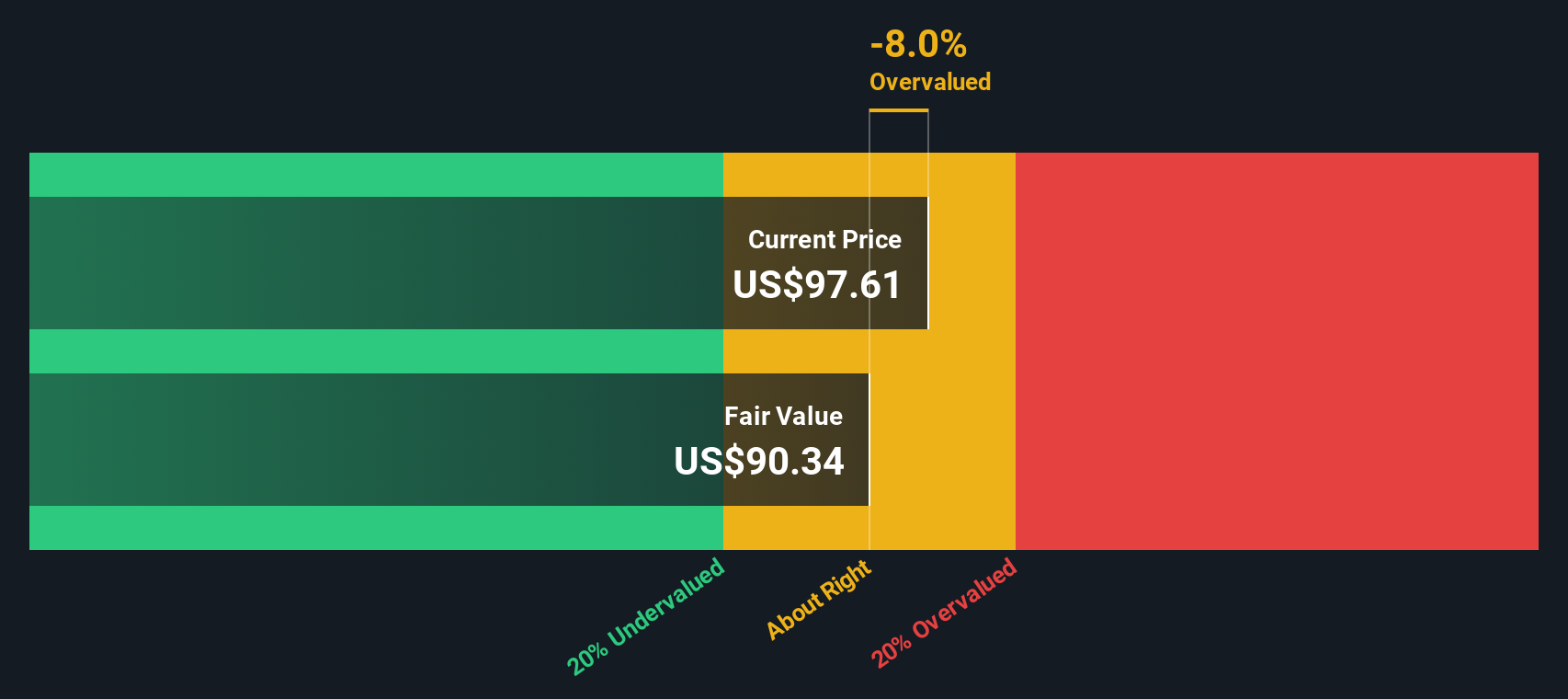

While some believe Walmart is priced above its fair value, our DCF model comes to a similar conclusion. This approach examines expected cash flows and fundamentals more closely. But does this reinforce the cautious outlook, or is there more to discover?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Walmart for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Walmart Narrative

If your take on Walmart’s outlook differs or you want to put your own perspective to the test, it only takes a few minutes to build a custom scenario. Do it your way

A great starting point for your Walmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Ideas?

Stay ahead of the market and enhance your research by discovering unique stock picks tailored to today’s trends and tomorrow’s breakthroughs. Don’t miss opportunities that may be just beyond your current watchlist.

- Unlock potential with undervalued stocks based on cash flows to identify companies that could be trading below their true worth based on strong fundamentals and robust cash flows.

- Find your edge with healthcare AI stocks by focusing on healthcare innovators driving the next wave of AI-powered medical advances and digital transformation.

- Boost your returns and stabilize your income with dividend stocks with yields > 3%, connecting you to stocks that offer high dividend yields to help support your financial future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives