- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

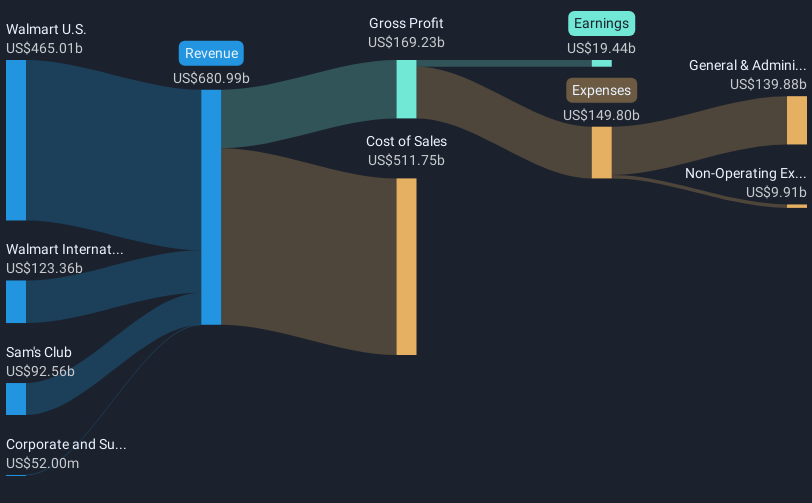

Walmart (NYSE:WMT) Reports US$681 Billion Revenue And 13% Increase In Annual Dividend

Reviewed by Simply Wall St

Walmart (NYSE:WMT) recently announced its yearly financial results, highlighting a significant rise in sales, revenue, and net income, accompanied by a 13% dividend increase. This news initially supported the company's stock price, contributing to a 17.66% rise last quarter. However, the shares experienced volatility following a guidance outlook that failed to meet investor expectations, leading to a sharp 6% decline on February 20th. This decline occurred against a backdrop of broader stock market fluctuations, with indices like the Dow Jones and S&P 500 experiencing declines amid concerns about future economic policies and interest rates. The company's new partnerships, such as the collaboration with California Water Service, and its business expansions, including a new Home Office campus, emphasize its ongoing strategic initiatives. Despite recent challenges, Walmart's stock continues to reflect resilience over the past year, indicating investor confidence amid new growth opportunities and enhancements.

Click here and access our complete analysis report to understand the dynamics of Walmart.

Over the past five years, Walmart's shares have delivered a remarkable total return of 195.56%. This performance highlights the retailer's successful navigation of industry challenges, contrasting sharply with broader market trends. Key factors have influenced this robust performance, including consistent earnings growth, driven by a surge in last year's earnings of 20.8%, significantly outpacing the Consumer Retailing industry. The company's high Return on Equity at 21.6% further underscores its financial strength, while expansion initiatives, such as the unveiling of a new Home Office campus in Arkansas, signal a commitment to long-term growth.

Additionally, Walmart's strategic share repurchases, with 13.2 million shares bought back at a cost of US$955.44 million, have likely played a role in enhancing shareholder value. While the company's valuation may appear high compared to industry averages, its performance has surpassed those benchmarks. Recent events, including Walmart's guidance of a 4.8% to 5.1% increase in consolidated net sales for FY 2026, continue to bolster investor confidence in the company's growth trajectory.

- Understand the fair market value of Walmart with insights from our valuation analysis—click here to learn more.

- Understand the uncertainties surrounding Walmart's market positioning with our detailed risk analysis report.

- Have a stake in Walmart? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail, wholesale, other units, and eCommerce worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives