- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (NYSE:WMT) Expands With Cloud Haircare In Over 1,000 US Locations

Reviewed by Simply Wall St

The recent expansion of Cloud Haircare into Walmart (NYSE:WMT) locations across the United States aims to make premium haircare more accessible to consumers. Despite this expansion, the company's shares experienced a 1% decline over the past week. Contributing to this slight downturn, broader market uncertainties surrounding President Trump's announced tariffs on auto imports have influenced investor sentiment, reflected in the general market movement. While the Cloud Haircare announcement underscores Walmart's ongoing commitment to diversifying product offerings, these market tensions may have tempered investor enthusiasm towards retail stocks, including Walmart, during this period.

Buy, Hold or Sell Walmart? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

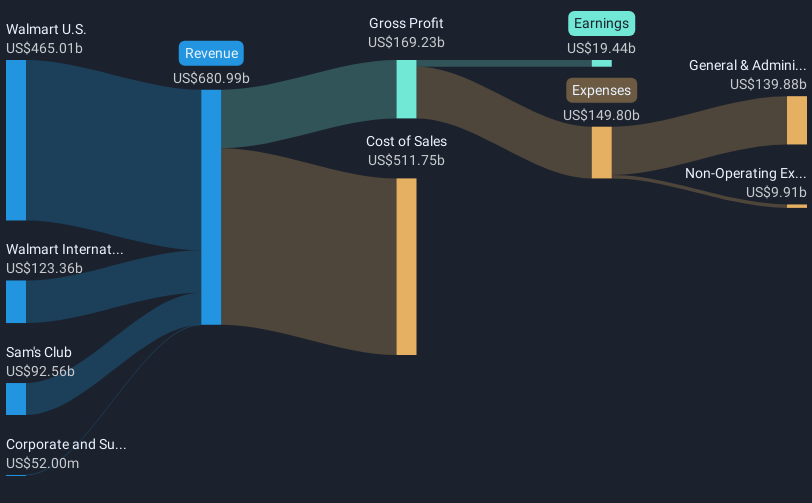

Over the past five years, Walmart's total shareholder return stood at 140.99%. This impressive performance was underpinned by significant earnings and revenue growth, showcasing robust financial health. Notably, Walmart's earnings growth rate over the past year reached 25.3%, surpassing the US Consumer Retailing industry’s return of 21%. This difference illustrates Walmart’s ability to outpace its peers despite market challenges.

Key drivers included strategic expansions and product launches, such as the launch of the Pets Table with high-quality dog food and a significant settlement of opioid litigation in December 2024. These initiatives, coupled with increased operational efficiencies from supply chain automation investments, anchored the company’s growth trajectory. The recent completion of a substantial share buyback and a 13% dividend increase reflect Walmart's dedication to returning value to shareholders. Overall, these efforts indicate a diversified and adaptive approach to sustaining long-term shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives