- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Too Much Hassle for a Small Profit - The Business Logic Behind Walmart's (NYSE:WMT) New Tobacco Policy

A story broke today that Walmart (NYSE:WMT) is going to stop selling tobacco products in certain stores. The company seems to be experimenting with phasing out tobacco products and is taking it one step at a time. Today, we will re-cap Walmart's fundamentals and analyze what the change in strategy might mean for the company.

The Key Takeaways from our analysis are:

- Phasing out tobacco products in some stores might have sound business logic

- The company's earnings seem to be expensive compared to the market and industry

- Walmart is in mature growth, but delivering value through implementing efficiencies

While at first glance it may seem that WMT is moving because of health reasons, the decision might have sound business logic. Even though tobacco products may account for a part of WMT's US$572.75b top line, it is arguably a small margin product. Investors may even expect that the 2.4% profit margin improves as a result of the decision.

Tobacco products are strictly regulated in the U.S. - this means that they need to be locked in a container and can only be sold from an employee (as opposed to products that can be sold at a self-checkout counter). The extra time that it takes for employees to unlock, find and sell the products will now be freed up, and efficiency in operations may improve.

The company is also focused on redesigning stores and implementing more self-checkout counters, which should streamline the shopping experience and relieve bottlenecks.

The possible drawbacks of this move might be that the company risks alienating part of their consumer base. Shoppers might choose to opt for different retailers where they can get the products. That is why this logic makes more sense in regions where Walmart is a stronger brand and customers can get just their tobacco products at a smaller store nearby.

Now, let's re-cap Walmart's fundamentals.

See our latest analysis for Walmart

The company grew revenues 2.4% from the last 12 months, slightly less than the 3-year median growth rate of 3.7%. This is not surprising as the company is in a mature growth phase.

Walmart is making US$11b in free cash flows and US$13.67b in earnings. This sets WMT's price to earnings (P/E) ratio to 28.9x - which is a little high compared to how the market currently values earnings at 16.6x.

Walmart is also delivering a good return on invested capital of 16.5% which increased 1% from 3 years ago. For a company like this, driving higher returns is a step in the right direction. We can also see if the company is creating value for shareholders by comparing the returns on capital to the cost of capital. In the case of Walmart, it seems to be creating value for investors every time it grows, since the company has a cost of capital at 7.24% which is less than the mentioned 16.5% return!

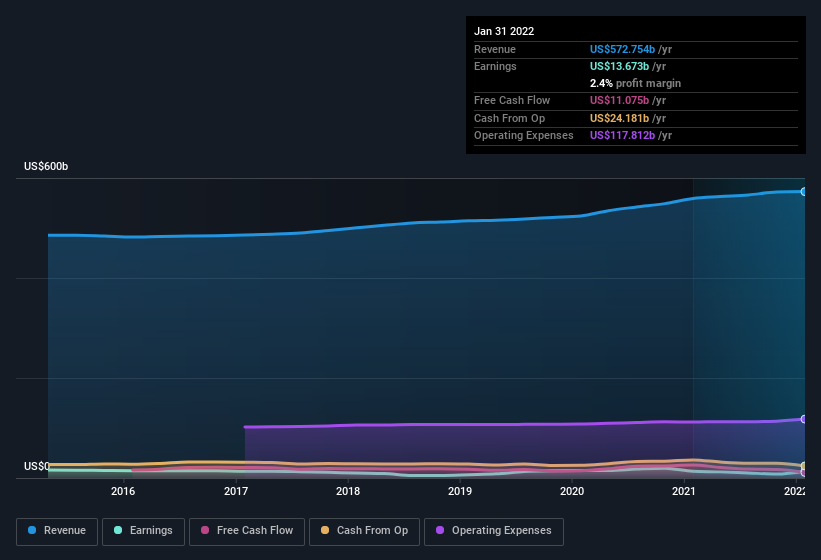

You can view Walmart's performance in the chart below:

Checking Unusual Items

Looking back, our data indicates that Walmart's profit was reduced by US$5.3b, due to unusual items.

It's never great to see unusual items costing the company profits, but on the upside, things might revert to normal, which is what investors tend to focus on.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Next Steps

Today, we've zoomed in on the fundamentals and Walmart's latest strategic move. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

It's also good to keep a tab on risks, and we found 2 warning signs for Walmart that you'll want to know about.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives