- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

The Bull Case For Walmart (WMT) Could Change Following ChatGPT-Enabled AI Shopping Rollout – Learn Why

Reviewed by Sasha Jovanovic

- Walmart recently announced a partnership with OpenAI that enables customers to shop directly through ChatGPT using Instant Checkout, streamlining everything from meal planning to restocking essentials with a conversational interface.

- This move highlights Walmart's broader strategy to integrate AI across all aspects of its business, from customer experience to workforce training, positioning it at the forefront of tech-enabled retail transformation.

- We'll explore how Walmart's launch of AI-powered, ChatGPT-driven shopping could accelerate its omni-channel and operational efficiency objectives within its investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Walmart Investment Narrative Recap

To own Walmart stock, you need to believe in its ability to leverage technology and scale to sustain leadership in omni-channel retail, deliver profit growth, and improve operating efficiency against rising costs and intensifying competition. The newly announced OpenAI partnership, enabling ChatGPT-powered shopping and Instant Checkout, fits Walmart’s push for digital transformation, yet its immediate impact on the most important short-term catalyst, operating margin, and the key risk of e-commerce profitability is not expected to be material in the short run.

The recently announced supply chain collaboration with Wiliot, which brings ambient IoT technology into Walmart’s logistics, ties directly into the company’s core efficiency and cost-reduction goals. Enhanced supply chain automation and real-time inventory management offer visible ways Walmart can potentially address margin pressures from delivery and logistics as it pursues more digital growth opportunities.

However, against these advancements, investors should also be aware that margin erosion from persistently high logistics costs and tough grocery competition remains a risk that...

Read the full narrative on Walmart (it's free!)

Walmart's outlook anticipates $789.9 billion in revenue and $27.4 billion in earnings by 2028. This is based on projected annual revenue growth of 4.5% and an increase in earnings of $6.1 billion from the current $21.3 billion.

Uncover how Walmart's forecasts yield a $112.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

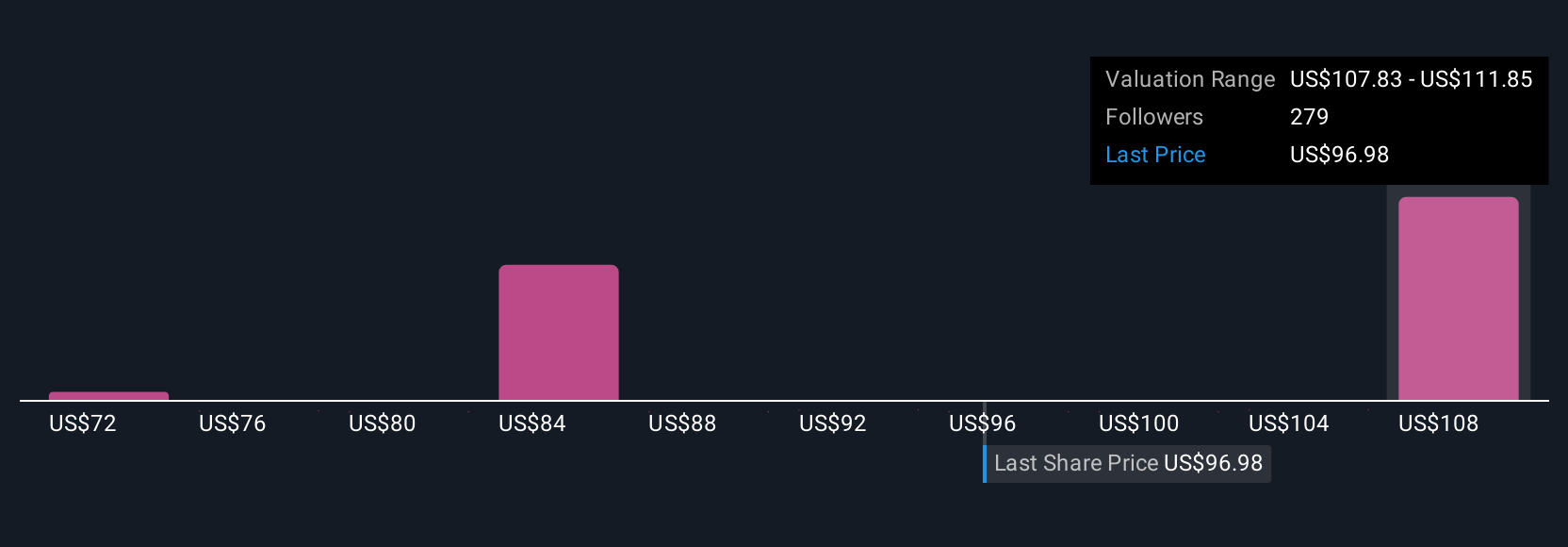

Twenty-five members of the Simply Wall St Community value Walmart’s shares between US$71.70 and US$112.00, underscoring widely differing outlooks. With e-commerce expansion driving both optimism and concern over profitability, it’s worth comparing these views before deciding your next move.

Explore 25 other fair value estimates on Walmart - why the stock might be worth as much as $112.00!

Build Your Own Walmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Walmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walmart's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives