- United States

- /

- Food and Staples Retail

- /

- NYSE:WMK

Cognira’s PromoAI Partnership Could Be a Game Changer for Weis Markets (WMK)

Reviewed by Sasha Jovanovic

- Cognira announced that Weis Markets has selected its PromoAI platform to optimize promotion planning and analysis across more than 200 stores and digital channels.

- This technology partnership reflects Weis Markets' push to harness enterprise AI for more effective, data-driven promotional strategies and customer engagement initiatives.

- We'll explore how Weis Markets' investment in AI-powered promotions could influence its competitive position and long-term planning.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Weis Markets' Investment Narrative?

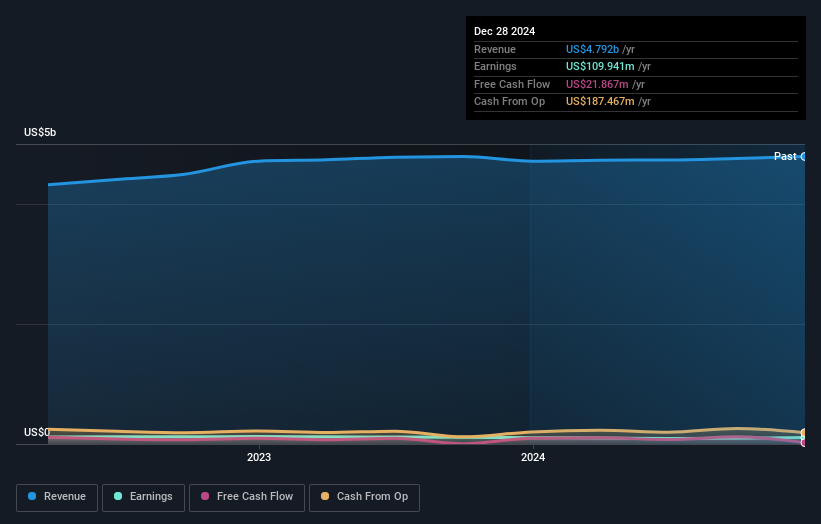

For investors considering Weis Markets, the key story has revolved around stable earnings, prudent expansion, and consistent dividends, balanced against concerns like low return on equity and a modest profit margin. The latest move to adopt Cognira’s PromoAI platform signals a new focus on harnessing AI for improved promotional efficiency and customer engagement across physical and digital channels. While it’s too early to gauge a material impact on near-term financials, this step could enhance competitiveness if execution aligns with broader digital retail trends. Catalysts like new store openings and experienced management remain in place, but the risk profile may shift as the company takes on technology integration, especially in an industry where incremental margins are thin. Investors should watch closely to see if early AI investments translate into measurable operational gains in the quarters ahead.

Yet, questions around return on equity and dividend coverage remain risks worth knowing about.

Weis Markets' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Weis Markets - why the stock might be worth less than half the current price!

Build Your Own Weis Markets Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weis Markets research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Weis Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weis Markets' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weis Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMK

Weis Markets

Engages in the retail sale of food through a chain of supermarkets in Pennsylvania.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives