- United States

- /

- Food and Staples Retail

- /

- NYSE:USFD

US Foods (USFD) Valuation Check After 14% Year-to-Date Share Price Gain

Reviewed by Simply Wall St

US Foods Holding (USFD) has been quietly grinding higher this year, and with the stock up about 14 % year to date, investors are starting to revisit its long term setup.

See our latest analysis for US Foods Holding.

The recent 4.48% one-month share price return, despite some short-term volatility, fits neatly with a 14.26% year-to-date share price gain and strong multi-year total shareholder returns. This suggests underlying momentum is still intact rather than fading.

If US Foods has you rethinking your watchlist, it could be worth widening the lens and exploring fast growing stocks with high insider ownership as potential next wave leaders.

With earnings growing faster than sales and the share price still trading at a hefty discount to analyst targets and estimated intrinsic value, is US Foods a quietly undervalued compounder, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 16.7% Undervalued

With the most followed fair value sitting above the last close of $77, the narrative frames US Foods as a longer term compounding story in motion.

The company's strong focus on private label and value added offerings, with penetration now exceeding 53% among independent restaurants, enhances gross margins and provides insulation from input cost pressures, driving steady EPS accretion.

Curious how steady margin lift, moderating valuation multiples, and richer earnings combine into that upside case? The narrative connects those dots in surprising ways.

Result: Fair Value of $92.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industry softness and execution risks around larger M&A moves could derail the margin expansion and growth assumptions that underpin this upside narrative.

Find out about the key risks to this US Foods Holding narrative.

Another Lens on Valuation

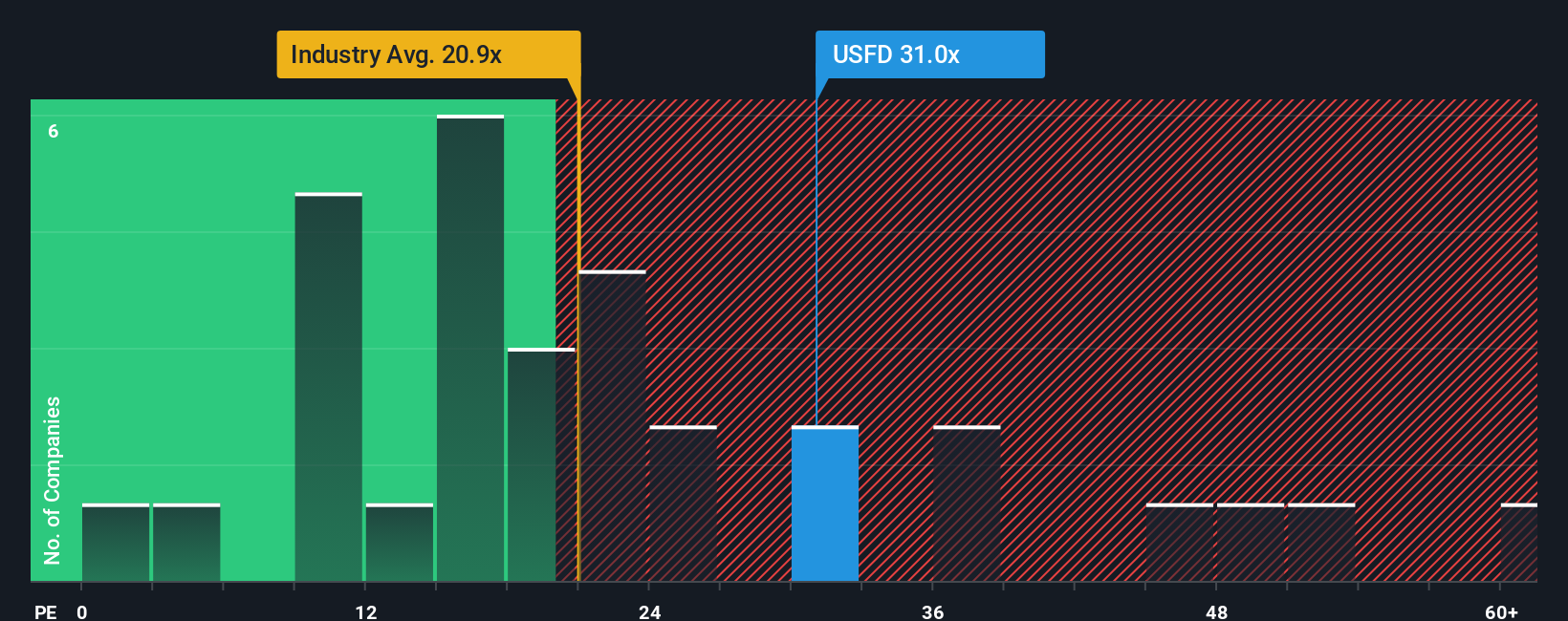

On earnings, the story looks very different. US Foods trades on a P/E of about 30.8 times, above both US consumer retail peers at 30.5 times and a fair ratio of 28.6 times, which hints at limited margin for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own US Foods Holding Narrative

If you see the story playing out differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your US Foods Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next smart move by scanning focused shortlists of opportunities that other investors might be overlooking right now.

- Target higher income potential by reviewing these 14 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow without stretching too far out on the risk curve.

- Capitalize on structural growth trends by evaluating these 25 AI penny stocks positioned at the center of accelerating adoption in automation, analytics, and intelligent software.

- Position yourself for valuation rerates by screening these 927 undervalued stocks based on cash flows where current prices may not yet reflect their long term cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USFD

US Foods Holding

Engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026