- United States

- /

- Food and Staples Retail

- /

- NYSE:USFD

Operational Efficiency Investments Might Change The Case For Investing In US Foods Holding (USFD)

Reviewed by Sasha Jovanovic

- Earlier this month, Lecap Asset Management Ltd. established a new position in US Foods Holding Corp. by acquiring 15,512 shares, totaling approximately US$1,195,000, amid growing optimism about the company’s operational improvements and potential collaborations.

- Investors have taken particular interest in US Foods Holding’s accelerating independent case volume, margin expansion initiatives such as vendor management and small-truck delivery, and ongoing investments in digital platforms and supply chain automation.

- We’ll explore how US Foods Holding’s focus on margin growth through operational efficiencies influences its current investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

US Foods Holding Investment Narrative Recap

Shareholders in US Foods Holding typically believe in the company’s ability to expand margins through operational efficiencies, automation, and emerging opportunities in independent case volume. The recent move by Lecap Asset Management Ltd. underscores continued confidence, but the most important short-term catalyst, potential collaboration with Performance Food Group, remains open-ended, while the risk of industry-wide softness in dining out trends has not meaningfully changed as a result of this activity.

Among recent announcements, the clean team agreement with Performance Food Group stands out most for its potential to reshape industry dynamics. This step, although only a preliminary information-sharing arrangement, supports the narrative that M&A activity is a key short-term catalyst for US Foods Holding’s investment story.

In contrast, investors should also be aware of ongoing macroeconomic headwinds and the risk that a prolonged downturn in “food away from home” spending could...

Read the full narrative on US Foods Holding (it's free!)

US Foods Holding's outlook projects $45.1 billion in revenue and $1.1 billion in earnings by 2028. This scenario is based on a 5.3% annual revenue growth rate and an increase in earnings of $547 million from the current $553 million.

Uncover how US Foods Holding's forecasts yield a $91.33 fair value, a 20% upside to its current price.

Exploring Other Perspectives

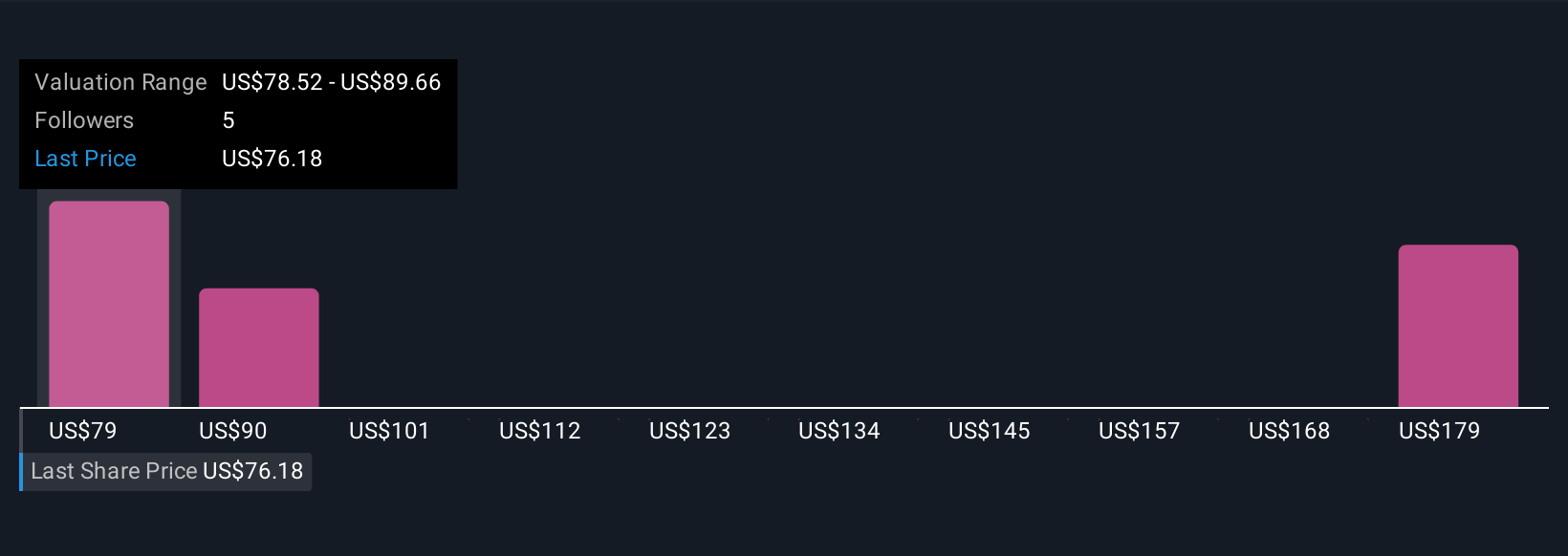

Across seven recent fair value estimates from the Simply Wall St Community, opinions ranged from US$78.52 to US$190.29 per share. While many anticipate margin expansion, persistent industry softness may challenge the company’s future results, underscoring why you may want to review multiple viewpoints before making up your mind.

Explore 7 other fair value estimates on US Foods Holding - why the stock might be worth just $78.52!

Build Your Own US Foods Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your US Foods Holding research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free US Foods Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate US Foods Holding's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USFD

US Foods Holding

Engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives