- United States

- /

- Food and Staples Retail

- /

- NYSE:UNFI

United Natural Foods (UNFI) Narrows Q1 Losses, Testing Bullish Turnaround Narratives

Reviewed by Simply Wall St

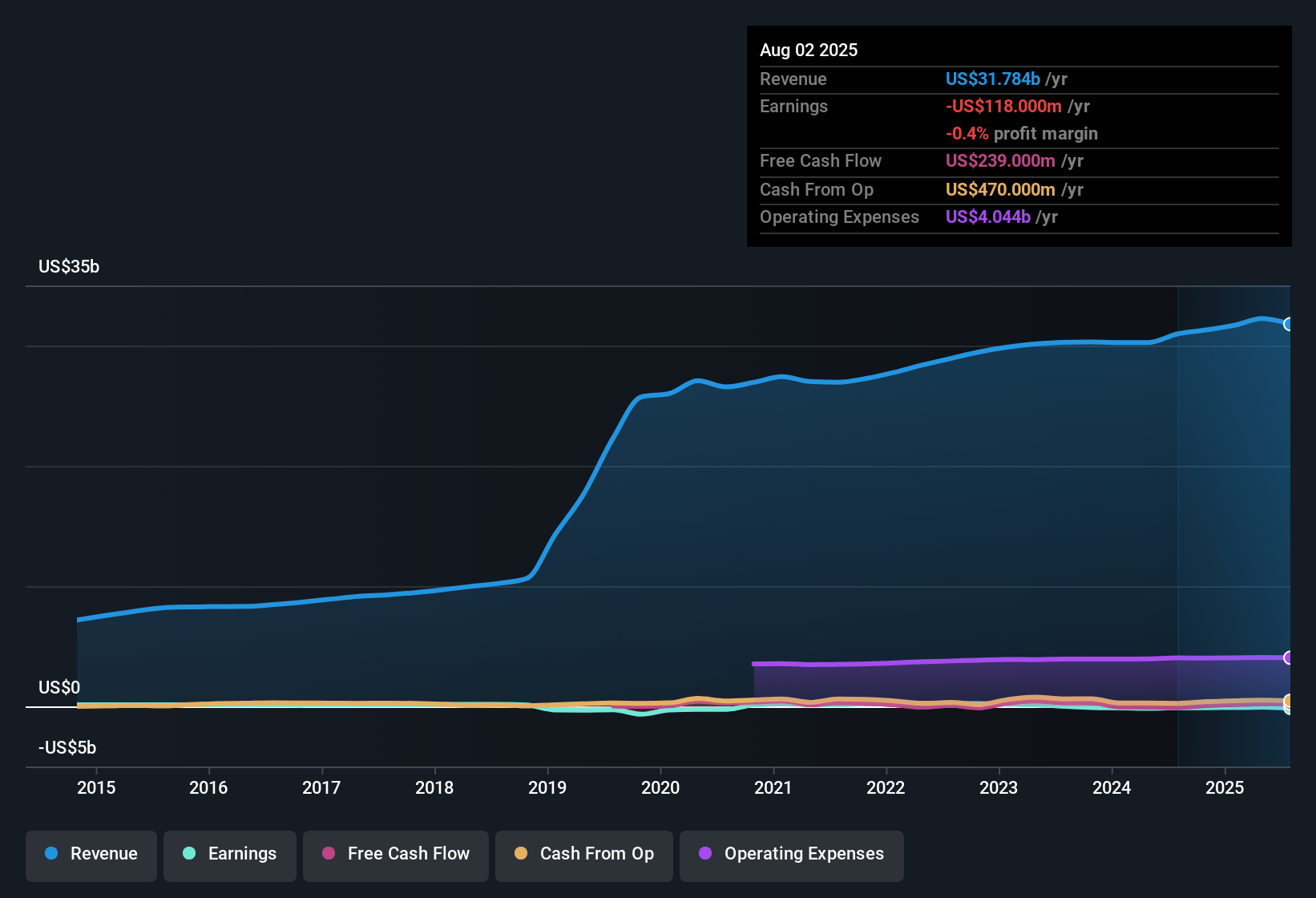

United Natural Foods (UNFI) opened fiscal Q1 2026 with revenue of about $7.8 billion and a basic EPS loss of roughly $0.07, alongside a trailing 12 month EPS of around negative $1.67 and net income of negative $101 million, keeping the bottom line in the red despite steady sales. The company has seen quarterly revenue move from $7.9 billion in Q1 2025 to $7.8 billion in Q1 2026, while basic EPS losses narrowed from about $0.35 a year ago and sat against a trailing 12 month revenue base of roughly $31.8 billion, putting the focus squarely on how quickly margins can recover from current loss levels.

See our full analysis for United Natural Foods.With the latest numbers on the table, the next step is to compare these margin trends with the prevailing narratives around UNFI to see which stories hold up and which ones the earnings season just put under pressure.

See what the community is saying about United Natural Foods

Losses Narrow To $4 Million

- Net loss improved to about $4 million in Q1 2026 versus $21 million in Q1 2025 and $87 million in Q4 2025, even though revenue held in a tight band around $7.8 billion to $8.2 billion over these periods.

- Analysts’ consensus narrative leans bullish on operational fixes, and this step down in losses gives them some numerical backing

- The trailing 12 month net loss of roughly $101 million is still large, but it is lower than the $118 million recorded one quarter earlier, which lines up with expectations for gradual earnings repair.

- However, consensus also talks about stronger cash flow and margin power, and that is not visible yet in the modest 1.9 percent revenue growth over the last year compared with 10.5 percent for the wider US market.

Forecasts Point To Profit Rebound

- From a trailing 12 month basic EPS loss of about $1.67, forecasts imply roughly 86.7 percent annual earnings growth and a swing to about $107.8 million of profit by around 2028.

- Bulls argue that technology investments and network optimization will unlock this earnings jump, and the current numbers partly support that case

- Quarterly basic EPS has already moved from a loss of roughly $0.35 in Q1 2025 and $1.44 in Q4 2025 to about $0.07 in Q1 2026, which fits a story of early efficiency gains.

- At the same time, trailing revenue of about $31.8 billion is only growing at 1.9 percent per year, so the bullish view depends heavily on margin improvement rather than faster top line growth.

Deep Valuation Discount With Debt Strain

- At a share price of $35.95, UNFI trades at about 0.1 times sales versus 0.4 times for the industry and 0.7 times for peers, while also sitting roughly 72 percent below a DCF fair value estimate of $127.91.

- Bears focus on financial strain and competition, and the data still gives that cautious view real weight

- Trailing losses have grown at about 55.3 percent per year over the last five years and interest payments are flagged as not well covered by earnings, so leverage pressure remains despite the recent quarterly improvement.

- With revenue only growing 1.9 percent annually compared with 10.5 percent for the broader US market, concerns about slower structural growth and margin squeeze from powerful retailers and integrated rivals are not yet contradicted by the reported numbers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for United Natural Foods on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers a different way? Turn that angle into a clear narrative in just a few minutes with Do it your way built around your own view.

A great starting point for your United Natural Foods research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternative Ideas

United Natural Foods’ narrow margins, persistent net losses, weak interest coverage, and slow 1.9 percent revenue growth all highlight real financial strain and execution risk.

If those pressure points concern you, use our solid balance sheet and fundamentals stocks screener (1942 results) to quickly focus on businesses with stronger finances, healthier leverage, and balance sheets designed to withstand tougher conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNFI

United Natural Foods

Engages in the distribution of natural, organic, specialty, produce, and conventional grocery and non-food products in the United States and Canada.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026