- United States

- /

- Food and Staples Retail

- /

- NYSE:UNFI

Should You Be Pleased About The CEO Pay At United Natural Foods, Inc.'s (NYSE:UNFI)

Steve Spinner has been the CEO of United Natural Foods, Inc. (NYSE:UNFI) since 2008. First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for United Natural Foods

How Does Steve Spinner's Compensation Compare With Similar Sized Companies?

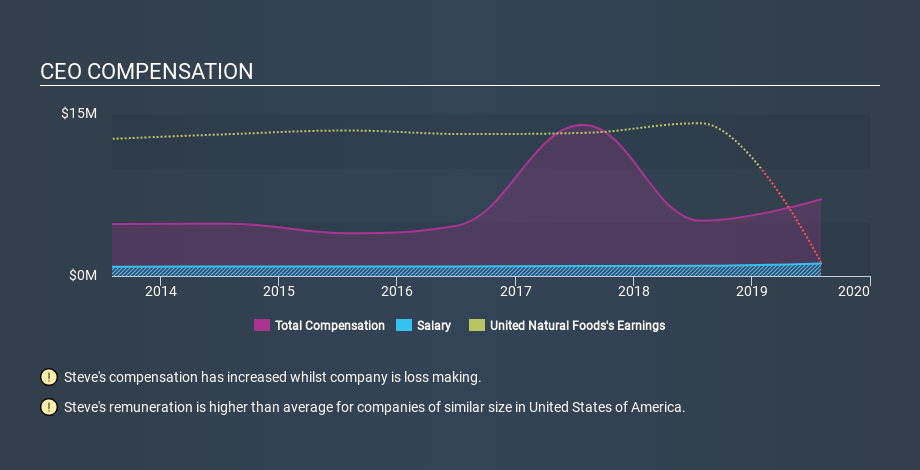

At the time of writing, our data says that United Natural Foods, Inc. has a market cap of US$465m, and reported total annual CEO compensation of US$7.1m for the year to August 2019. We note that's an increase of 39% above last year. While we always look at total compensation first, we note that the salary component is less, at US$1.2m. We note that more than half of the total compensation is not the salary; and performance requirements may apply to this non-salary portion. When we examined a selection of companies with market caps ranging from US$200m to US$800m, we found the median CEO total compensation was US$1.7m.

Thus we can conclude that Steve Spinner receives more in total compensation than the median of a group of companies in the same market, and of similar size to United Natural Foods, Inc.. However, this doesn't necessarily mean the pay is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business.

You can see, below, how CEO compensation at United Natural Foods has changed over time.

Is United Natural Foods, Inc. Growing?

Over the last three years United Natural Foods, Inc. has shrunk its earnings per share by an average of 82% per year (measured with a line of best fit). It achieved revenue growth of 109% over the last year.

The reduction in earnings per share, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metric are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Shareholders might be interested in this free visualization of analyst forecasts.

Has United Natural Foods, Inc. Been A Good Investment?

Given the total loss of 81% over three years, many shareholders in United Natural Foods, Inc. are probably rather dissatisfied, to say the least. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

We compared total CEO remuneration at United Natural Foods, Inc. with the amount paid at companies with a similar market capitalization. We found that it pays well over the median amount paid in the benchmark group.

The growth in the business has been uninspiring, but the shareholder returns have arguably been worse, over the last three years. This doesn't look great when you consider CEO remuneration is up on last year. Although we'd stop short of calling it inappropriate, we think the CEO compensation is probably more on the generous side of things. Whatever your view on compensation, you might want to check if insiders are buying or selling United Natural Foods shares (free trial).

If you want to buy a stock that is better than United Natural Foods, this free list of high return, low debt companies is a great place to look.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:UNFI

United Natural Foods

Distributes natural, organic, specialty, produce, and conventional grocery and non-food products in the United States and Canada.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives